One of the largest AMCs in India, DSP has been helping investors make sound investment decisions responsibly and unemotionally for over 25 years.

DSP is backed by the DSP Group, an almost 160-year-old Indian financial giant. The family behind DSP has been very influential in the growth and professionalization of capital markets and the money management business in India over the last one-and-a-half centuries.

Let us talk about the flagship product – DSP Nifty 50 Index Fund.

About DSP Nifty 50 Index Fund

– Investment objective

To invest in companies that are constituents of the NIFTY 50 Index (underlying Index) in the same proportion as in the index and seek to generate returns that are commensurate (before fees and expenses) with the performance of the underlying Index, “subject to tracking error”.

– Investment process

The portfolio of this index fund replicates the Nifty 50 TR Index – same stocks, same weights. The portfolio is rebalanced semi-annually to adjust for any stock additions or subtractions to the Index.

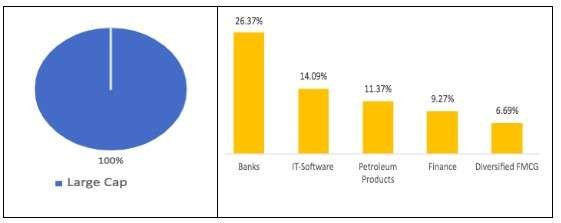

– Portfolio composition

The entire portfolio exposure of 100% is only in large-cap stocks replicating the Nifty 50 Index. The top 5 sectors hold nearly 67% of the portfolio, with major exposure to the banking sector.

Source: dspim.com

Top 5 holdings

| Name | Sector | Weightage % |

| Reliance Industries Ltd. | Conglomerate | 11.01 |

| HDFC Bank Ltd. | Bank | 8.25 |

| ICICI Bank Ltd. | Bank | 7.93 |

| Infosys Ltd. | Information Technology | 7.05 |

| Housing Development Finance Corporation Ltd. | Financial Services | 5.61 |

Source: ICICI Pru AMC

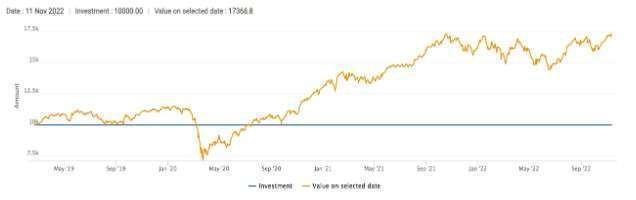

Performance over 3 years

If you would have invested 10,000 at the inception of the DSP Nifty 50 Index Fund, it would be now valued at Rs. 17,368. The DSP Nifty 50 Index Fund has outperformed the benchmark in all time horizons.

Source: Moneycontrol

The fund has given consistent returns and has outperformed the benchmark over the period of more than 3 years by generating a CAGR (Compounded Annual Growth Rate) of 15.98%.

Fund managers

- Anil Ghelani: Total work experience of 22 years. Managing the scheme since June 2019. He was also the CIO of DSP Mutual Fund.

- Diipesh Shah: Total work experience of 20 years. Managing the scheme since November 2020.

Who should invest in DSP Nifty 50 Index Fund?

Investors looking for

- Aim to build wealth by investing conveniently in the top 50 Indian companies.

- Relatively low-cost funds, with a comparatively lower expense ratio than active large-cap funds.

Why invest in DSP Nifty 50 Index Fund?

- This fund can help you beat the impact of rising prices over the long term.

- It has no sector or stock concentration.

Horizon

- One should look at investing for a minimum of 5 years or more.

- Investment through a Systematic Investment Plan (SIP) may help in tackling the volatility of the broader equity market.

Conclusion

This DSP Nifty 50 Index Fund offers an affordable way to buy the top 50 Indian stocks. Since the fund only replicates an index & does not have an ‘active’ fund manager, it carries no human decision-making bias.

Disclaimer

This is not recommendation advice. All information in this blog is for educational purposes only.