One of the largest AMCs in India, DSP has been helping investors make sound investment decisions responsibly and unemotionally for over 25 years. DSP is backed by the DSP Group, an almost 160-year-old Indian financial giant.

The family behind DSP has been very influential in the growth and professionalization of capital markets and the money management business in India over the last one-and-a-half centuries. Let us talk about the consumer product – DSP Value Fund.

About the DSP Value Fund

Investment Objective:

The primary investment objective of the scheme is to seek to generate consistent returns by investing in equity and equity-related or fixed-income securities which are currently undervalued.

Investment Process

- This fund is designed on fundamental value-investing principles & forms its portfolio through a carefully constructed framework.

- It aims to invest in ‘good’ Indian & international companies at ‘good’, reasonable prices.

- It aims to allocate up to 35% to global ‘value’ stocks via internationally renowned value managers like Berkshire Hathaway, Lindsell Train, Harding Loevner, Veritas, etc.

Portfolio Composition

The portfolio holds major large-cap stocks and global funds exposure at 36% and 26%, respectively. Significant sectoral exposure (apart from the mutual funds) is to Pharmaceuticals & Biotechnology, which account for roughly 10% of the portfolio.

Source: DSP MF

Top 5 Holdings of DSP Value Fund

| Name | Weightage % |

| Veritas Global Focus Fund | 7.06 |

| Berkshire Hathaway Inc – Class B | 6.87 |

| Harding Loevner Global Equity Fund | 5.55 |

| Lindsell Train Global Equity Fund | 5.39 |

| WCM GLOBAL EQUITY FUND | 5.15 |

Source: DSP MF

Performance

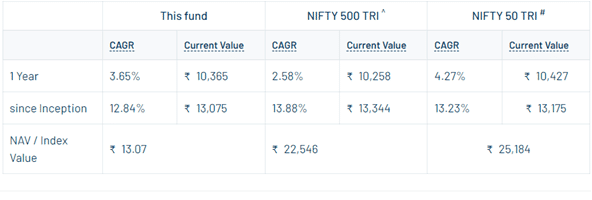

If you had invested 10,000 at the fund’s inception, it would now be valued at Rs 13,075.

Source: DSP MF

The fund was launched on 10th Dec. 2020. Since it has been only two years, investors must stay invested longer to see the fund outperform the index.

Fund manager

- Aparna Karnik has been managing this fund since May 2022. Aparna Karnik is Head-Quantitative Investments and Analytics (QIA). Aparna has 17 years of experience in investment, credit and operations risk management. Before joining DSP, she worked with CRISIL Ratings in their Structured Finance Division, Large Corporates Group.

- She holds a Masters’s in Management Studies from Jamnalal Bajaj Institute of Management Studies.

- Prateek Nigudkar has been managing this fund since May 2022. Prateek Nigudkar is a Quantitative researcher at DSP Investment Managers Pvt. Ltd. (DSPIM). Before joining DSPIM, Prateek headed a team of Quantitative analysts in the Equity Smart-Beta team for State Street Global Advisors (SSGA) in India. Prateek holds a Master’s in Quantitative Finance from the University of Washington and is FRM certified. He has also cleared all three levels of the CFA examination from the CFA Institute.

- Jay Kothari has been managing this fund since December 2020. Jay Kothari, Vice President & Product Strategist -Jay has been with DSP Investment Managers since May 2005 and has been with the Investment function since January 2011. Before joining DSPIM, Jay worked for Standard Chartered Bank for a year in the Priority Banking division. Jay completed his Bachelor of Management Studies (Finance & International Finance) from Mumbai University and an MBA in Finance from Mumbai University.

Who should invest in DSP Small Cap Fund?

Consider this fund if you

- Are a first-timer or a relatively new equity market investor?

- Have the patience & mental resilience to remain invested for a decade or more.

- Recognize market falls as good opportunities to invest even more.

- Accept that equity investing means exposure to risk.

- Do not chase the highest possible returns at all times.

Why invest in this Fund?

- Offers the potential to earn relatively risk-free, stable returns higher than those from pure fixed-income investments.

- Get the benefit of equity taxation despite the low-risk orientation.

Time Horizon

- One should look at investing for at least ten years or even more.

- Investment through Systematic Investment Plan (SIP) may help in tackling the volatility of the broader equity market.

Conclusion

The DSP Value Fund is a good option for those who believe in the principles of value investing. Investors investing in this fund should remain invested long to reap the benefits of compounding.

Disclaimer: This is not recommendation advice. All information in this blog is for educational purposes only.