Incorporated on December 10, 1999, HDFC Asset Management Company Ltd. is among India’s most popular fund houses.

HDFC Mutual Fund launched its first scheme in July 2000, and ever since it has been ambitious about offering a stable performance of funds across all the variants of schemes it offers.

The HDFC Mutual Fund is managed by HDFC Asset Management Company (HDFC AMC) Limited. Let us talk about the consumer product – HDFC Mid-Cap Opportunities Fund

HDFC Mid-Cap Opportunities Fund

Investment Objective

The primary objective is to provide long-term capital appreciation/income by investing predominantly in mid-cap companies.

Investment Process

- To follow a stock-specific approach

- Construct the portfolio on a bottom-up basis

- Focus on good quality companies at acceptable valuations

- Long-term orientation (resulting in low portfolio turnover)

- Stick to the circle of competence

Portfolio Composition

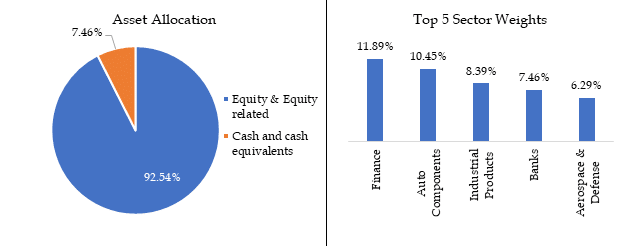

The fund had invested 92.54% of its assets in equity & equity-related stocks, and significant sectoral exposure is to Finance, which accounts for roughly 11.89% of the portfolio.

Source: HDFC MF

Top 5 Holdings

| Name | Weightage % |

| Indian Hotels Company Ltd. | 4.39 |

| Cholamandalam Investment & Finance Co. Ltd. | 3.66 |

| Max Healthcare Institute Ltd. | 3.65 |

| Tata Communications Ltd. | 3.58 |

| Apollo Tyres Ltd. | 3.30 |

Source: HDFC MF

Performance

| This Fund | S&P BSE 150 MidCap TRI | Equity: Mid Cap | |

| 1 Year | 34.64% | 24.82% | 23.13% |

| 3 Years | 36.45% | 33.34% | 31.71% |

| 5 Years | 18.04% | 16.83% | 17.05% |

| 10 Years | 22.38% | 20.17% | 21.05% |

Source: Value Research

Fund Manager

- Mr. Chirag Setalvad (Since June 28, 2014) has over 25 years of experience, of which 18 years in Fund Management and Equity Research and three years in Investment Banking. Before HDFC, he worked at New Vernon Advisory Services and started his career at ING Barings in India.

Who Should Invest in HDFC Mid-Cap Opportunities Fund?

Investors looking to generate higher returns by taking exposure to mid-cap equities can consider this fund. However, investors need to understand the aggressive risk exposure of this fund.

Why Invest in this Fund?

- Opportunity to invest in a portfolio of predominantly mid-sized companies.

- Aims to provide diversification to an investor’s overall equity mutual fund portfolio.

- Experienced fund management and research teams with a track record of managing equity assets across market cycles.

- Emphasis on risk management – portfolio diversification across stocks and sectors; focus on good quality businesses.

- One of the largest funds in the mid-cap category with a track record of more than 15 years.

Time Horizon

- One should look at investing for at least three years or even more.

- Investment through Systematic Investment Plan (SIP) may help in tackling the volatility of the broader equity market.

Conclusion

The HDFC Mid-Cap Opportunities Fund has a proven track record of over 15 years, with an Asset Under Management of ₹77,967.21 Cr as of January 22, 2025

The fund has consistently outperformed both the benchmarks and the category average also.

Therefore, investors looking to generate wealth over the long term can consider this fund with an understanding of high risk.

Disclaimer

This is not recommendation advice. All information in this blog is for educational purposes only.