UTI is one of the pioneers of the Indian Mutual Fund Industry. With over Rs 2.72 lakh crore average AUM (excluding domestic fund of fund) for quarter ended December 2023, the AMC is among the most trusted names in the mutual fund space. The UTI Mutual Fund offers products across asset classes. Let us talk about the – UTI Conservative Hybrid Fund.

About UTI Conservative Hybrid Fund

Investment objective – The scheme’s primary objective is to invest predominantly in debt and money market instruments and part of the portfolio into equity/equity-related securities with a view to generating income and aim for capital appreciation.

Note: There is no assurance or guarantee that the investment objective of the scheme would be achieved.

Investment Process

The Fund aims to earn accrual income by investing approximately 75% of its assets in debt instruments. It follows tactical allocation to invest among corporate debt, government securities (G-Sec), and state development loans (SDLs), guided by the fixed-income strategy of the fund manager.

Source: UTI MF

Portfolio Composition

As a hybrid fund, the funds are allocated to equity, long-term debts, government securities, Cash and Cash Equivalents. As of 29th Feb 2024:

- 72.63% of the portfolio is allocated to debt

- 24.36% of the portfolio is allocated to equity,

- 3.01% of the portfolio is allocated to cash and cash equivalents.

Equity Allocation

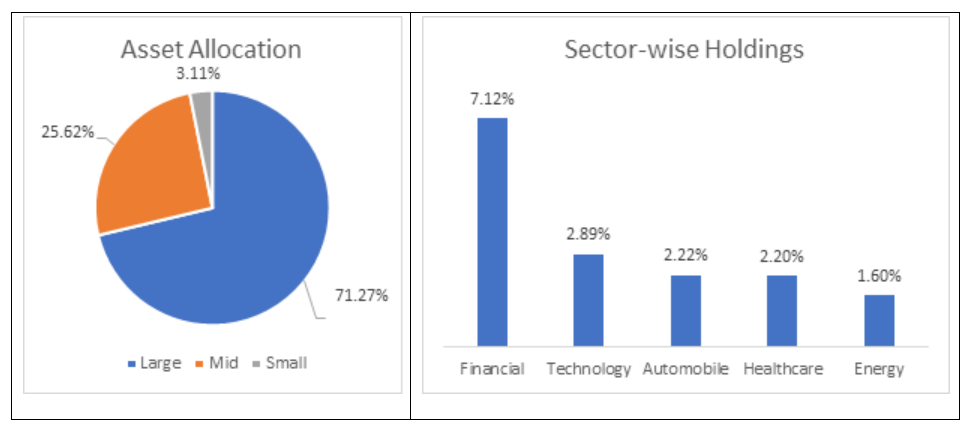

The equity fund allocated 71.27% to large-cap funds, 25.62% to mid-cap, and 3.11% go into small-cap.

Source: Value Research

Top 5 Equity Holdings for UTI Conservative Hybrid Fund

| Name | Sector | % |

| HDFC Bank Ltd. | Banking | 2.18 |

| ICICI Bank Ltd | Banking | 1.40 |

| Infosys Ltd | IT | 1.33 |

| Axis Bank Ltd | Banking | 1.06 |

| Bharti Airtel | Communication | 0.96 |

Source: Value Research

Debt Allocation:

Top 5 Debt Holdings for UTI Conservative Hybrid Fund

| Name | Sector | % |

| GOI Sec 7.18 14/08/2033 | GOI Securities | 12.82 |

| NABARD SR 23I Debenture 7.62 | Debenture | 6.33 |

| PFC Ltd SR 223 Debenture 7.64 | Debenture | 4.79 |

| HDFC Bank Ltd SR AB002 Debenture 7.97 | Debenture | 3.22 |

| REC Ltd SR 220-B FRB 7.69 | Floating Rate Bond | 3.20 |

Source: Value Research

Performance Since Inception

| Period | UTI Conservative Hybrid Fund (%) | Nifty 50 Hybrid Composite Debt 15:85 Index (%) | CRISIL 10 Year Gilt Index (%) |

| 1 year | 13.68 | 11.49 | 9.42 |

| 3 years | 9.80 | 7.46 | 4.36 |

| 5 years | 8.39 | 9.30 | 6.21 |

| Since Inception | 9.32 | 8.44 | 5.61 |

Source: UTIMF

Fund Manager

Mr. Jaydeep Bhowal holds CA degree from ICAI and also PGDFM from Welingkar Institute of Management, Mumbai. He is the vice president began his career with UTI in November 2009. He has more than 10 years of experience and had been involved in various roles at UTI.

Who Should Invest?

- Investors with lower risk appetite, seeking alternative to traditional investment options like FDs.

- Investors seeking moderate participation in equity with relatively lower overall portfolio risk.

Why Invest?

- Around 75% of the portfolio invested in debt securities with tactical allocation to corporate debt, G sec and SDLs based on overall fixed income strategy of fund house.

- Fund manages the bond duration dynamically with investment across various maturities.

- It focuses on high quality corporate debt securities to minimize the risk.

- Portfolio diversification with distinct asset classes of equity & debt.

Time horizon

- Investors with a time horizon of three years and above.

- Investment through Systematic Investment Plan (SIP) may help in tackling the volatility of the broader equity market.

Click here to start investing for your child’s college!

Conclusion

The equity portion of the fund’s portfolio is managed actively with a bottom-up stock-picking approach, while the debt portion is managed with a focus on credit quality and liquidity. The fund has consistently performed with a CAGR of 9.32% since inception, while having moderate risk. Investors with low risk appetite can consider this as an alternative to traditional fixed deposits for long term capital appreciation.

Disclaimer: This is not recommendation advice. All information in this blog is for educational purposes only.