Before going to the types of asset classes, let’s understand what is an asset class. A resource with economic value that an individual, business, or country holds or controls with the hope of future gain is an asset.

An asset can produce cash flow, cut expenses, or increase sales in the future. Asset classes are groups of investments with comparable characteristics governed by the same laws and regulations.

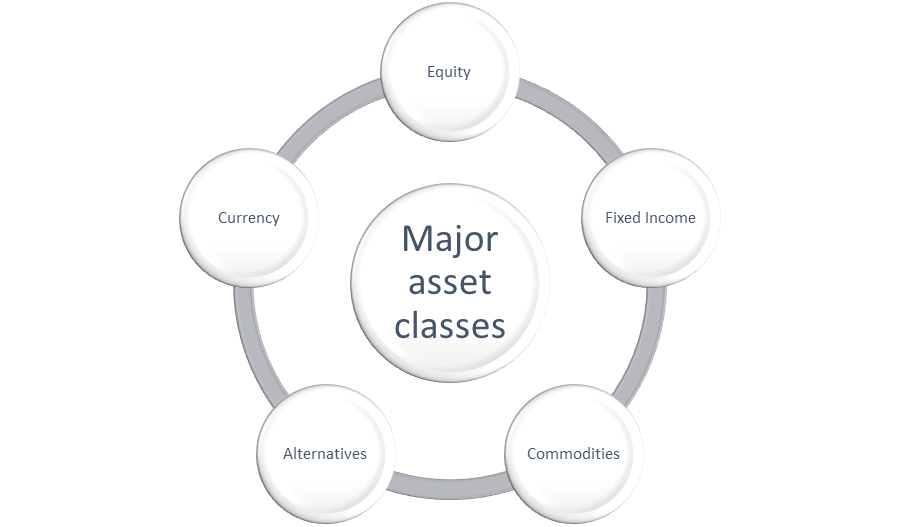

As a result, asset classes consist of instruments that often act similarly in the marketplace. The significant types of asset classes are as follows

Types of an asset class

1. Equity

Talking in brevity, equity also called a stock, is fractional ownership of a company. The ownership interest in a corporation represented by securities or stock is equity.

Common and preferred stock are two types of equity shares that an investor can possess in a company. The original business owner shares ownership with others, known as shareholders, in the form of equity ownership in the company.

The monetary value might represent the equity of each share that they could receive if they sold it. This value fluctuates as a result of market dynamics during the trading day.

By multiplying the equity value of a single share by the total number of shares an investor owns, they can calculate their entire equity interest in a company.

A person invests in equity to get ownership in a firm and get the right to vote on critical decisions. However, the core reason for investing in equities is that the investor will make money by selling away the equities at a premium compared to the buying price.

2. Fixed Income

Fixed-income assets and securities offer investors a steady flow of cash, usually in the form of fixed interest or dividends.

Investors in many fixed-income instruments obtain the initial amount they invested and the interest earned at maturity. Fixed income is an investment type that emphasizes capital and income safeguarding.

Government bonds, corporate bonds, CDs, and money market funds are specific investments. Fixed income can provide a consistent stream of income with less risk.

Fixed-income investing is less volatile than equity investing because when an investor lends a loan to a firm, the corporation pledges to repay the entire debt at the end of the term (plus interest).

There is no such guarantee with stock investment, as it could lose all of its value. Fixed income is popular among investors because of its stability, capital preservation, and consistent income stream.

3. Commodities

Raw resources or agricultural goods that can be bought and traded are commodities. They are one of the most important investing asset classes.

A futures market is where commodity trading is done. The people who make the goods and those who buy them haggle for payment in this market. These contracts also include a future delivery date for the products. Commodity pools are also available to individual investors.

It is a method of diversifying your holdings. These pools are much like mutual funds or exchange-traded products (ETPs). Traditional mutual funds and exchange-traded funds are not the same as these.

The assets themselves do not belong to the investor. Instead, the investor purchases the right to buy or sell an asset in the future for a certain period. This asset class can be precarious.

Commodities are appreciated as an asset class because of their low connection to stock and fixed-income markets, in other words, for their diversification benefits.

4. Alternatives

Alternative assets are investments that are not part of the standard asset classes that most investors are familiar with, such as stocks, bonds, or cash.

These investments may be less liquid than their traditional counterparts because of their alternative nature, and they may require a longer investment time before any substantial benefit is received.

Alternative investments are difficult to understand and are not well-regulated. As a result, institutional investors and high-net-worth individuals hold the majority of alternative asset assets.

In comparison to public markets, private markets are famously opaque due to their lack of oversight. Private corporations, for example, are not required to disclose earnings or financial information or to report to shareholders; therefore, information on these types of assets might be difficult to come by.

Some alternative asset classes are Private equities, venture capital, hedge funds, private debt, real estate, infrastructure, and natural resources.

5. Currency

A wager on the direction of a currency is known as currency investing. Investors can now make directional bets on currencies like the euro, Australian dollar, yen, US dollar, and even currencies from emerging markets like the Indian rupee or Chinese yuan in ETF format.

Currency investing is a rare recommendation as a long-term investment. On the other hand, professionals and short-term traders frequently use currency funds to hedge current currency risk.

A proper mix of the above asset classes based on investor goals and risk profiles can generate handsome returns for the investor.

FAQs

What are asset classes?

A resource with economic value that an individual, business, or country holds or controls with the hope of future gain is an asset. Asset classes are groups of investments with comparable characteristics governed by the same laws and regulations. Example such as equity, fixed income, commodities, etc.

What is an asset?

An asset can produce cash flow, cut expenses, or increase sales in the future. Asset classes are groups of investments with comparable characteristics governed by the same laws and regulations.

What are the five major classes of assets?

The most common asset classes are equities, fixed-income securities, cash, commodities and real estate and alternatives