One of India’s leading asset management companies, ABSL offers clients a wide range of investment solutions and has had a strong presence in retail and institutional segments for over 28 years.

ABSL AMC is a wholly owned subsidiary of Aditya Birla Capital Limited which is backed by Aditya Birla Group, a large conglomerate with a diverse portfolio of businesses.

The Aditya Birla Group is one of India’s leading business houses, with a strong presence across various sectors in India and around the world.

ABSL AMC benefits from the financial strength and stability of Aditya Birla Capital Limited and the Aditya Birla Group.

ABSL Equity Advantage Fund

Investment objective

The scheme aims to achieve long-term capital growth at relatively moderate risk levels through diversified research-based investment in Large & Midcap companies.

Investment Process

The scheme’s investment focus would be discovering firms with strong corporate management and promising future development potential.

Past performance will also be taken into account. Essentially, the focus would be on long-term, fundamentally driven values. However, short-term opportunities would also be seized, provided underlying values support them.

Portfolio Composition

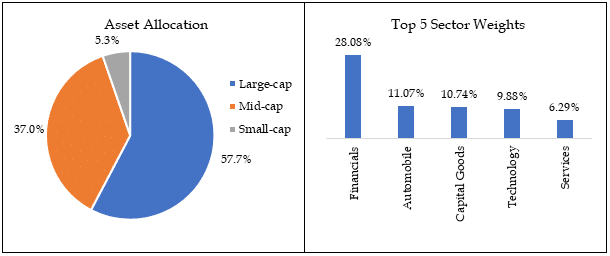

The portfolio holds its assets majorly in large-cap, that is 57%, then 37% in Mid-cap, of which the significant sectoral exposure is to Financials, which account for roughly 28%. The top five sectors hold more than two third of the portfolio.

Source: ABSL MF, Value Research

ABSL Frontline Equity Fund

Top 5 Sector Holdings

| Name | Weightage % |

| ICICI Bank | 7.33 |

| HDFC Bank | 6.92 |

| State Bank of India | 4.69 |

| Infosys | 4.39 |

| Reliance Industries | 4.16 |

Source: Value Research

Performance

Given below is the Return over time:

Note: Data as of 31st March 2023

Source: ABSL MF

Since its inception on 24th February 1995, the fund has generated a CAGR (Compounded Annual Growth Rate) of 16.29% for its regular plan.

However, the fund has generated a CAGR of 13.94% for its direct plan since its inception on 01st January 2013.

Fund manager

- Mr. Atul Penkar has over 21 years of experience in Equity Research and Fund Management. He joined Aditya Birla Sun Life AMC Limited in April 2006 as Research Analyst and Portfolio Manager and has also worked as Portfolio Advisor for offshore funds. Before joining ABSLAMC, he worked as an Equity Research Analyst with Emkay Global Financial Services Limited.

- Mr. Dhaval Joshi has an overall experience of 15 years in equity research and investments. Before joining Aditya Birla Sun Life AMC Limited, he was associated with Sundaram Mutual Fund (India) Ltd. for around five years. He has also worked as a research analyst with Emkay Global Financial Services and Asit C Mehta Investment Intermediates Ltd.

Who should invest in this Fund?

This fund is suitable for investors seeking

- long-term capital growth and income

- investment predominantly in equity and equity-related securities as well as debt and money market instruments

Why invest in this Fund?

- It provides an opportunity for long-term capital growth and income objectives, focusing on equity and equity-related securities and debt and money market instruments.

- It can help investors avoid the long-term effects of rising prices.

- It provides an alternative to investing in gold.

Time Horizon

- The ideal time horizon for investing is at least three years or even more.

- Investment through Systematic Investment Plan (SIP) may help in tackling the volatility of the broader equity market.

Conclusion

Although the ABSL Equity Advantage Fund. has underperformed the benchmark recently, it has outperformed over the long term since its inception.

Therefore, investors need to remain invested long-term to see the fund outperforming the benchmark and generating alpha.

Disclaimer

This is not recommendation advice. All information in this blog is for educational purposes only.