One of India’s leading asset management companies, ABSL offers clients a wide range of investment solutions and has had a strong presence in retail and institutional segments for over 28 years.

ABSL AMC is a wholly-owned subsidiary of Aditya Birla Capital Limited which is backed by Aditya Birla Group, a large conglomerate with a diverse portfolio of businesses.

The Aditya Birla Group is one of India’s leading business houses, with a strong presence across various sectors in India and around the world. ABSL AMC benefits from the financial strength and stability of Aditya Birla Capital Limited and the Aditya Birla Group.

ABSL Pure Value Fund

Investment objective

The scheme aims to generate consistent long-term capital appreciation through a value investing strategy.

Investment process

It follows a value investment strategy, i.e., the fund invests in the stocks available at discounted or lower prices than prices based on stocks’ fundamentals. The scheme tends to follow a flexi-cap approach. This involves investing in stocks across market capitalizations depending on available investment opportunities.

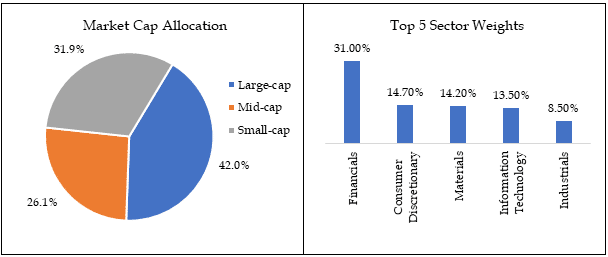

Portfolio composition

The fund holds a much lower proportion of its assets in cash, i.e., 98% of the assets were invested in equities, and only 2% were held in cash as of 31st May 2023. Also, the portfolio holds its assets majorly in large-cap, that is, 42%, then 26% in Mid-cap, and the remaining 32% in small caps.

The significant sectoral exposure is to Financials, which account for roughly 26%. The top five sectors hold more than 80% of the portfolio.

Source: ABSL MF, Value Research

Top 5 sector holdings for ABSL Pure Value Fund

| Name | Weightage % |

| SBI | 5.49 |

| ICICI Bank | 4.60 |

| Infosys | 4.59 |

| Ramkrishna Forgings | 3.84 |

| LTI Mindtree | 2.8 |

Source: ABSL MF

Performance

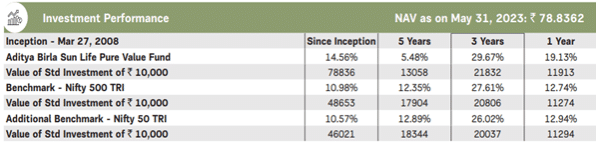

Given below is the Return over time:

Note: Data as of 31st May 2023 Source: ABSL MF

Since its inception on 27th May 2008, the fund has generated a CAGR (Compounded Annual Growth Rate) of 14.56% for its regular plan.

Although the fund has underperformed both benchmarks over five years, it has outperformed them over one year, three years, and since inception.

Fund Manager for ABSL Pure Value Fund

- Kunal Sangoi is a Fund Manager and Senior Analyst with Aditya Birla Sun Life AMC Limited (ABSLAMC). Kunal comes with an experience of 16 years in capital markets in the areas of equity research and portfolio management. At ABSLAMC, he is responsible for managing select equity funds per the given mandate and specializes in the Technology, Internet, Media, and Telecom sectors.

- Mr. Dhaval Joshi has an overall experience of 15 years in equity research and investments. Before joining Aditya Birla Sun Life AMC Limited, he was associated with Sundaram Mutual Fund (India) Ltd. for around five years. He has also worked as a research analyst with Emkay Global Financial Services and Asit C Mehta Investment Intermediates Ltd.

Who should invest in this Fund?

This fund is suitable for investors seeking

- Long-term capital growth

- Investment predominantly in equity and equity-related securities following value investing strategy, i.e., investing in stocks priced lower than their true value, based on fundamentals

Why invest in this Fund?

- It provides an opportunity for long-term capital growth.

- It invests in well-researched stocks which are undervalued.

- It invests in companies across different market capitalizations.

Time Horizon

- The ideal time horizon for investing is at least five years or even more.

- Investment through Systematic Investment Plan (SIP) may help in tackling the volatility of the broader equity market.

Conclusion

ABSL Pure Value Fund has been in existence for more than 15 years and had an AUM of Rs. 4,159 crores as of 31st May 2023.

Although the fund has underperformed the benchmark over five years, it has outperformed over the long term since its inception.

Therefore, investors need to remain invested long-term to see the fund outperforming the benchmark and generating alpha.

Disclaimer

This is not recommendation advice. All information in this blog is for educational purposes only.