ABSLAMC is primarily the investment manager of Aditya Birla Sun Life Mutual Fund, a registered trust under the Indian Trusts Act, of 1882.

ABSLAMC is one of the leading asset managers in India, servicing around 8.1 million investor folios with a pan India presence across 280 plus locations and a total AUM of over Rs. 2,926 billion.

Let us talk about the flagship product – Aditya Birla Sun Life Frontline Equity Fund

Aditya Birla Sun Life Frontline Equity Fund

Investment objective

The objective of the scheme is long-term growth of capital, through a portfolio with a target allocation of 100% equity by aiming at being as diversified across various industries and/ or sectors as its chosen benchmark index, NIFTY 100 TRI.

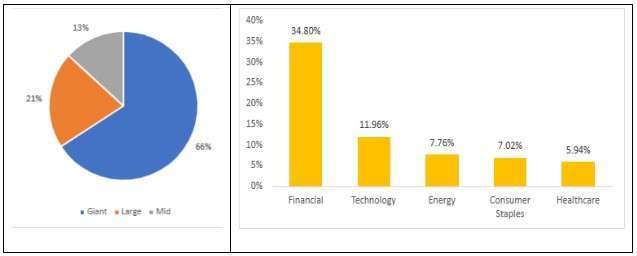

Portfolio composition

The portfolio holds the major exposure in Giant-cap stocks at 66%. The major sectoral exposure is to Finance which is at around 25%. The top 5 sectors hold around 67% of the overall portfolio.

Top 5 holdings Aditya Birla Sun Life Frontline Equity Fund

| Name | Sector | Weightage % |

| ICICI Bank Ltd. | Financial Services | 9.40 |

| Infosys Ltd. | Information Technology | 7.55 |

| HDFC Bank Ltd. | Financial Services | 7.38 |

| Reliance Industries | Conglomerate | 5.58 |

| Axis Bank Ltd. | Financial Services | 4.45 |

Source: Morningstar

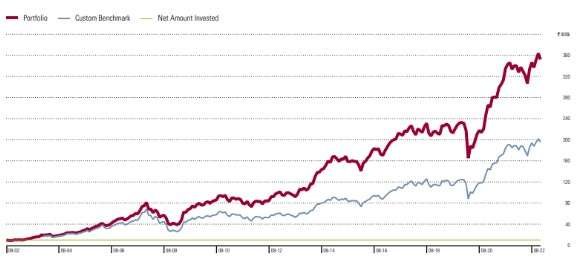

Performance over 21 years

If you had invested Rs. 10,000 at the inception of the fund, it would be now valued at Rs. 3.52 lakhs

Source: Morningstar

The fund has given consistent returns and has outperformed the benchmark over the period of 21 years by generating a CAGR (Compounded Annual Growth Rate) of 19.12%.

Fund manager

Mahesh Patil: Mr. Patil is a B.E (Electrical), an MMS in Finance, and a Chartered Financial Accountant from ICFAI Hyderabad. Prior to joining Aditya Birla Sun Life AMC, he worked with Reliance Infocom Ltd., Motilal Oswal Securities, and Parag Parikh Financial Advisory Services Ltd.

Who should invest?

Investors who are seeking: –

- To generate long-term capital appreciation along with steady portfolio growth.

- Investments in a mix of large-cap and mid-cap stocks.

Why Invest?

- The fund offers exposure to mid-cap for good opportunities for wealth creation.

- At the same time, it offers large caps as diversification and steady portfolio growth.

Horizon

- One should look at investing for a minimum of 5 years or more.

- Investment through a Systematic Investment Plan (SIP) may help in tackling the volatility of the broader equity market.

Conclusion

This is the oldest fund with a proven track record of 21 years and has delivered 19.12% CAGR consistently which is better than most equity funds.

Thus, it is best for investors looking for a diversified portfolio with exposure to large and mid-cap for wealth creation as well as steady growth.

Disclaimer

This is not recommendation advice. All information in this blog is for educational purposes only.