Before talking about the advantages of ETFs. Let’s talk a bit about Mutual Funds.

For several years, traditional Mutual Funds have provided investors with the ease of building a diversified portfolio without choosing single security at a time.

These funds have provided retail investors like you and me far-reaching diversification and these funds have provided retail (non-professional) investors with far-reaching diversification and specialized management at a relatively lower cost.

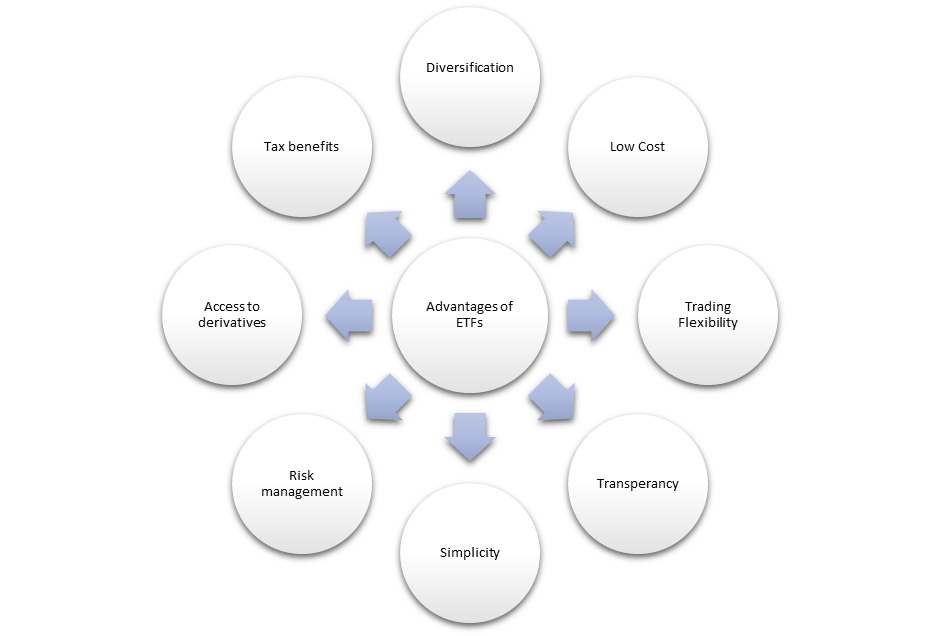

Exchange-traded funds (ETFs) take these benefits to a whole new level. ETFs have several advantages associated with them.

Let’s see how each of them pans out for our use.

Advantages of ETFs

ETFs on similar lines to Mutual Funds offer a wide range of diversification.

The general tendency of investors is to get concentrated in any particular sector without having any requisite knowledge of that sector, which results in lesser realized gains than actual potential.

This psychological problem can be countered by investing in ETFs, managed professionally and diversified to minimize risk and maximize growth.

Nowadays, ETFs are available in a variety of types and orientations covering all major asset classes and sectors.

Global ETFs, local market ETFs, Industry-specific ETFs, and market niches provide investors access to industries where it may be cumbersome to buy and sell individual stocks and bonds.

Diversification also leads to risk management as the concentration in a given sector without expertise is avoided. ETFs can be a great tool to hedge your portfolio against any untoward market runs.

ETFs typically are low-cost instruments compared to traditional mutual funds because of their very nature. While trading ETFs, fewer hands and minimal paperwork are required; naturally, the costs fall compared to selling mutual funds.

Thus, the expense ratio for ETFs is lower than other such securities, hence leaving you with a more significant amount of total capital in return compared to others.

For instance, the Vanguard REIT Index Fund Investor Shares (VGSIX) has a redemption fee of 1% if held for less than one year compared to Vanguard REIT ETF (VNQ), which has the same portfolio and has no redemption fees.

ETFs are traded openly in the stock market and hence are liquid compared to mutual funds, which aren’t. Redeeming a mutual fund is a very tedious process and requires a lot of time, whereas ETF selling is easy at any point of the day.

Mutual fund settlement takes place only once a day after the market timings, and this delay can prove costly.

Most ETFs are very transparent in their operations and disclose their holding almost daily, which helps the investor make sound decisions about holding the ETFs in their portfolio.

Active semi-transparent ETFs reveal their complete portfolio holdings monthly or quarterly with a lag.

Moreover, ETFs are simple products that can be easily understood by a layman investor, unlike some complex financial products except some specialized ETFs like inverse and leveraged ETFs.

With the help of a single transaction, the investor can buy or sell a bunch of underlying securities without the hassle of purchasing each stake individually.

A commodity derivative market is a place where there is restricted access to a few people and institutional investors due to the high costs of owning them.

On the other hand, ETFs have enabled retail investors to be a part of this segment at low prices. Thus, your portfolio gets new exposures with the help of such ETFs.

ETFs also come with an added advantage of tax benefits compared to mutual funds. The tax benefits in the ETFs are due to the very working of the ETFs.

The swap agreements between the fund and AP reduce the tax liability for the investors.

The capital gains tax on ETFs is due to selling the ETF, whereas, in a mutual fund, the tax liability is on the investor during the entire life of the holding.

There are several advantages to making ETFs a part of your investment portfolio. Besides rock-solid investments like equities, mutual funds, and derivatives, ETFs are a financial tool that should be part of your investing arsenal, which increases the firepower of your portfolio manifold!

Disadvantages of ETFs

- Long-term venture capital firms may only have a time horizon of 10 to fifteen years, thus daily price fluctuations may not be beneficial to them. Some venture capitalists could trade often as a result of these hourly pricing delays. A transaction that costs at the end of each day might avoid irrational fears of damaging an investment goal that may be inspired by a substantial movement over a short period of time.

- Diversity is less crucial because fewer shares make up the market index, which may cause investors to concentrate on big businesses in certain industries or foreign equities. Future growth prospects may be out of reach for ETF owners due to a lack of exposure to mid-and small-cap companies.

- Expenses can be higher. Although many people compare trading ETFs to trading other types of funds, the costs are greater when comparing ETFs to buying a single stock. Although the actual commission paid to that broker may have been identical, the stock has no management fee. Additionally, specialty ETFs are considerably more likely to follow a lower traffic index as more of them are introduced. This might result in a significant bid/ask spread. If you invest in real stocks, you could receive a better offer.

- Some ETFs provide lower interest yields. Some ETFs are ETFs that pay a dividend, but their yields might not be as high as those of owning a company or group of equities with a high yield. ETFs often come with reduced risks, but stocks can offer much higher dividend yields if a buyer is willing to assume the risk. Even if you can choose the company with the highest dividend yield, ETFs follow a wider range of securities, so the average return will be lower.

- A leverage ETF is a type of fund that boosts the returns of an underlying index using debt and financial products. Some double- or triple-leveraged ETFs have the possibility of losing more than twice as much as the underlying index. These speculative investments kinds require careful consideration. The overall loss could increase quickly if the ETF is held for a long time.

FAQs

Why ETF is not popular in India?

Costs are affordable yet insufficient. Although ETFs have minimal prices worldwide, they are marginally greater in India. The charges increase even more when brokerage fees are included. Due to poor margins, not enough has been done to increase investor awareness of ETFs in India.

Is ETF as a long-term plan good for India?

ETFs are incredibly secure and a great choice for long-term investment. Experts believe that just because ETFs are balanced and combine the investments of several investors, they are less unstable than stocks and indexes and only slightly move in price.

Is ETFs worth investing?

A fantastic way to vary your investment portfolio is with an ETF. Whenever you participate in the stock market, you have a finite amount of equity options.

What are some advantages of ETFs?

Some of the biggest advantages of ETFs are:

- Diversification and global stock exposure

- Trading flexibility

- Low costs

- Transparency

- Tax efficiency

- Risk management

- Professional management

What are some disadvantages of ETFs?

Some of the biggest disadvantages of ETFs are:

- Additional charges like Hidden fees, trading fees and operating fees

- Lack of liquidity

- Tracking errors

- lower interest yields.