Mutual fund companies offer flexibility to invest in their schemes through SIP (Systematic Investment Plan).

While some choose the date of SIP based on their salary credit, others may try to time the market by selecting specific dates based on different factors one may choose to invest at the end of the end because of the high volatility and F&O expiry of the month-end contract.

So, is there a best date for SIP investment?

In this blog, we’ll see whether the date of SIP will make a huge difference or not.

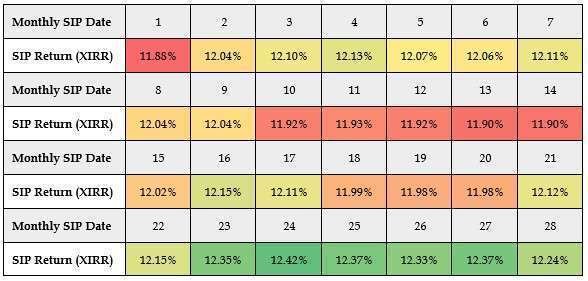

Read on!! We have analyzed the data of the past ten years, from Jan’11 to Sep’22, of BSE Sensex based on daily returns to understand it in a better way.

Source: BSE, EduFund Research Team

The above calculation shows that there is hardly a marginal difference in returns based on the period under observation. So, there is no strong relationship between the SIP date you choose and the returns.

Any date will work if you are investing through SIP. Experts suggest that one should never try to time the market; instead, remain invested with discipline over a longer period to get the most benefit of compounding.

SIPs are designed to deal with the volatility in the market. SIP helps your investments to average out the cost of buying, which is called rupee cost averaging.

This helps investors to buy mutual fund units at lower prices and higher, which averages out the cost of buying the units.

What is Compounding?

Compounding works as a multiplier in your investment. You not only get the returns on the invested amount but also get the returns that keep getting added back to your invested amount.

In short, earning returns on principal & returns as well. The best thing about compounding is that at one point your amount of returns will be more than your invested amount.

What is the rupee-averaging cost?

In this concept, a fixed amount is invested at regular intervals. This allows you to buy more units of a mutual fund when prices are low and fewer units when prices are high. Over the period, this averages out the cost of buying.

Timing the market is challenging. The market goes through different phases, and you never know when the market is going to rise or fall. So, disciplined investing will help you to accumulate wealth over the period.

When we try to time the market, we invest with emotions which can lead to wrong decisions. SIP helps to ignore all these factors and helps to invest regularly.

Suggested SIP Dates Based on Personal Circumstances

| Personal Situation | Recommended SIP Date | Reason |

|---|---|---|

| Salaried Individual | 1st – 5th of the month | Align with salary payment to ensure funds are available. |

| Freelancers | 5th – 10th of the month | Choose a date after receiving payments to maintain cash flow. |

| Rental Income | A few days after rent collection | Ensures funds are available from rental income. |

| Students/Individuals with Variable Income | Flexible (mid-month) | Choose a date that fits your budget and cash flow. |

Analysis of SIP Returns on Different Dates

The following table summarizes the returns generated by SIPs on various dates over a period of time, demonstrating that there is little difference in performance:

| Date of Investment | SIP Returns in NIFTY 50 TRI (%) | SIP Returns in NIFTY Midcap 150 TRI (%) | SIP Returns in NIFTY Smallcap 250 TRI (%) |

|---|---|---|---|

| 1 | 12.00 | 15.87 | 12.73 |

| 15 | 12.03 | 15.91 | 12.72 |

| 30 | 12.01 | 15.93 | 12.79 |

| Other Dates | Similar returns across all dates | Similar returns across all dates | Similar returns across all dates |

Conclusion

SIP can do wonders with your investments if you do discipline and regular investing over a longer period without thinking of the date, by Just following the normal process.