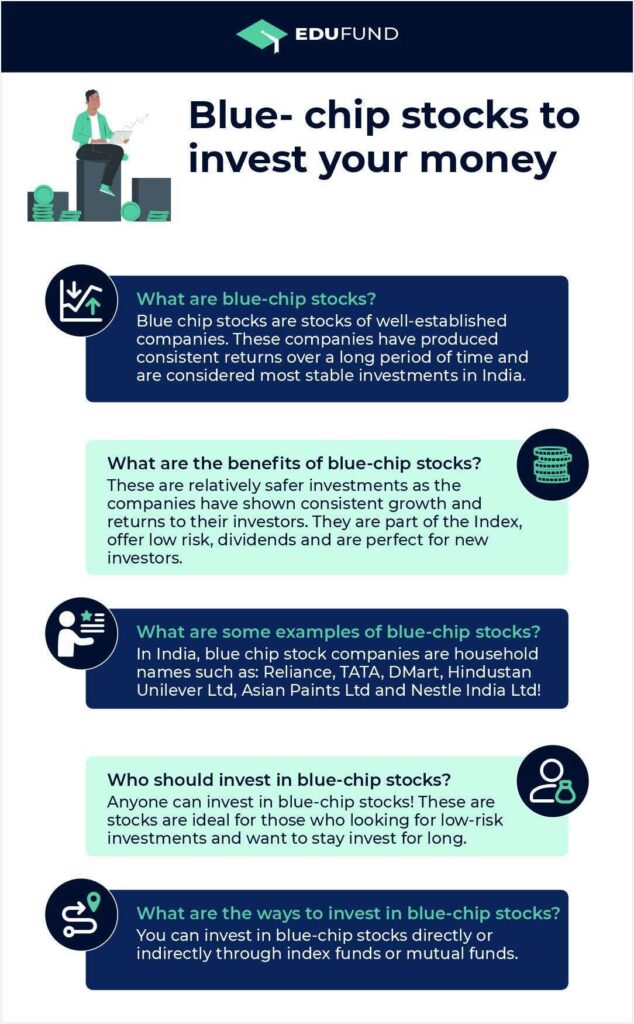

Blue-chip stocks are considered the safest equity investment because of their operations and market dominance.

Give it a read if you want to know more about some blue-chip stocks.

What are blue chip companies?

Companies with more than Rs 50,000 crore in market capitalization possess solid fundamentals and excellent track records.

These companies are the market leaders in their operations. Blue-chip companies are considered the most stable companies in India and have delivered consistent returns to their investors over a long period.

Let’s discuss some blue-chip stocks for long-term investment.

| S.No. | Company Name | Sector | Current Market Price |

| 1 | Reliance Industries Ltd. | Oil & Gas | ₹ 2,632 |

| 2 | Tata Consultancy Services Ltd. | Information Technology | ₹ 3,218 |

| 3 | Avenue Supermarts Ltd. (DMART) | FMCG | ₹ 4,341 |

| 4 | Hindustan Uniliver Ltd. | FMCG | ₹ 2,574 |

| 5 | Asian Paints Ltd. | Chemical – Paint | ₹ 3,363 |

1. Reliance Industries Ltd

| Market Capitalization (in Crores) | ₹ 17,74,233 | Current Market Price | ₹2,632.05 |

| Price to Earning (P/E) | 27.6 | 52-Week High/Low | ₹ 2,856/2,130 |

| Stock Price CAGR (10 Years) | 21% | Earnings Per Share (EPS) | ₹ 99.49 |

Reliance Industries Limited comes under the list of Fortune 500 companies, and it is the largest private sector corporation in India.

It has evolved from a textile and polyester company to an integrated player across energy, materials, retail, entertainment, and digital services.

Reliance’s portfolio of products and services touches almost every Indian on a daily basis, across the economic and social spectrum.

Reliance was founded by Dhirubhai Ambani and is now supported and managed by his elder son Mukesh Dhirubhai Ambani. The Ambani family has about a 50% stake in the conglomerate.

2. Tata Consultancy Services Ltd

| Market Capitalization (in Crores) | ₹ 11,80,044 | Current Market Price | ₹ 3,218 |

| Price to Earning (P/E) | 30.4 | 52-Week High/Low | ₹ 4,046/2,953 |

| Stock Price CAGR (10 Years) | 17% | Earnings Per Share (EPS) | ₹ 105.46 |

Tata Consultancy Services is a flagship company and part of the Tata Group.

It is an IT services, consulting, and business solutions organization that has worked with many of the world’s largest enterprises on their transformation journeys for more than 50 years.

TCS offers a consultative, cognitive-integrated portfolio of business, technology, and engineering services and solutions.

The company operates in 5 key verticals, based on industry classification, i.e. Banking, Financial Services & Insurance (BFSI), which accounts for 39% of revenue, followed by Retail & Consumer Business (17%), Communications, Media & Technology (16%), Manufacturing (11%) and other platforms that account for the remaining 17% of revenue.

Additional read: What are blue-chip stocks

3. Avenue Supermarts Ltd. (DMart)

| Market Capitalization (in Crores) | ₹ 2,85,410 | Current Market Price | ₹ 4,341 |

| Price to Earning (P/E) | 140 | 52-Week High/Low | ₹ 5,900/3,185 |

| Stock Price CAGR (5 Years) | 34% | Earnings Per Share (EPS) | ₹ 31.50 |

Avenue Supermarts is primarily engaged in organized retail and operates supermarkets under the D-Mart brand.

The company derives 57% of its revenue from the Food segment, 20% from the FMCG segment, and the remaining 23% is contributed by the General Merchandise and Apparel segment.

The company’s Sales revenue per retail business per square ft is Rs 30,353 cr for FY22.

4. Hindustan Unilever Ltd

| Market Capitalization (in Crores) | ₹ 6,04,080 | Current Market Price | ₹ 2,574 |

| Price to Earning (P/E) | 65.8 | 52-Week High/Low | ₹ 2,859/1,902 |

| Stock Price CAGR (10 Years) | 17% | Earnings Per Share (EPS) | ₹ 39.00 |

Hindustan Unilever operates in the FMCG sector, which mainly includes home care, beauty & personal care, and foods & refreshment segments.

The company has a presence and manufacturing facilities across the country and sells primarily in India.

Beauty & Personal Care segment (42% of sales), In this segment, the company has a broad portfolio of over 900 SKUs spread across one or more categories that are created for 14 consumer clusters identified in India.

The company earns ~29% margin from this segment, the highest among its divisions.

5. Asian Paints Ltd

| Market Capitalization (in Crores) | ₹ 3,18,775 | Current Market Price | ₹ 3,363 |

| Price to Earning (P/E) | 89.1 | 52-Week High/Low | ₹ 3,590/2,560 |

| Stock Price CAGR (10 Years) | 25% | Earnings Per Share (EPS) | ₹ 36.27 |

Founded in 1942, the Asian Paints Group is India’s largest paint manufacturer and is also involved in the manufacture of varnishes, enamels or lacquers, surface preparation, organic composite solvents, and thinners.

It operates in 15 countries and has 26 paint manufacturing plants worldwide, serving consumers in more than 60 countries.

Apart from Asian Paints, the group operates globally through its various brands, which are Asian Paints Berger, Apco Coatings, SCIB Paints, Taubmans, Causeway Paints, and Kadisco Asian Paints.

It also manufactures metal sanitary ware such as bathtubs, sinks, basins, and similar products. Recently introduced lighting fixtures, furniture, and furnishings, adding more products in the Home Decor and Interior Design category.

How can you take exposure to these companies?

If any investor wants to invest in blue-chip companies once at a time at a low cost. Then, they can consider investing through the Navi Nifty 50 Index Fund.

One can consider investing in this fund as this possesses the lowest expense ratio in the industry and offers diversification at a low cost.

Conclusion

Blue-chip stocks may not seem like a successful short-term investment, but they generate high value over the long term due to their consistent growth and returns.

Blue-chip stocks should be a staple of your portfolio, but should not be your only investment.

Consult an expert advisor to get the right plan

Disclaimer

It is not a recommendation and investors should read the offer documents and understand the risk involved before investing