Nifty50 is one of the two leading stock indices used in India. The recent volatility in the market has caused a wave of shock amongst investors and traders.

This article will address what has caused the current market volatility, and how you can deal with the same with a few tricks.

Reasons for the tank in the markets

The bearish view tightened its grip on the Indian equity markets on 13th June, as inflation concerns and fears of aggressive interest rate hikes by the US Fed spooked investors.

\Nifty tanked by 2.5%, breaking below the 15800 levels, and Sensex fell by 1500 points. All sectors bled in red, with banks, metals, and realty falling the most under selling pressure.

The main reasons for this significant correction are:

- High Inflation Rates: The consumer inflation rate in May, hit a 40-year high of 8.6% in the US and the CPI inflation is expected to stay above % in India.

- Aggressive Rate Hikes: There was a significant gap in the markets opening on Monday. The global markets are witnessing a significant sell-off amid the fear of major interest rate hikes by the US Fed.

- Crude Oil Price Volatility: Major losses were incurred by investors in the oil as both Brent Crude, and WTI Crude slipped by 1.4%.

- Rupee Depreciation and FII Exit: The INR fell to a record low of Rs.78.15 against the US Dollar due to fear of high-interest rates and volatile crude oil prices. Also, there has been persistent selling of Foreign Institutional Investors (FIIs), which has weakened market sentiments.

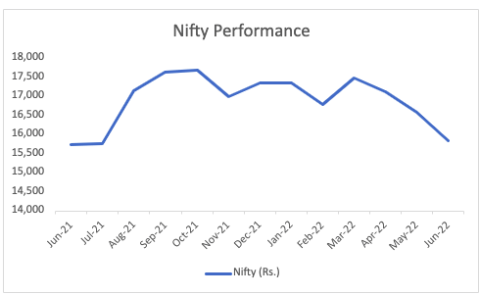

Nifty Performance

The graph shows the Nifty performance from June 2021 to June 2022.

The market fell significantly, touching the floor prices during the pandemic. Post this, the market started picking up in April 2021. The market continued to stabilize till October 2021, reaching 17500 levels. But this sweet story ended when the market faced a significant fall in November 2021.

The market rebounded in January 2022. It again reversed when the market fell to extreme lows amidst the geopolitical issues between Ukraine and Russia. It faced a significant fall in February, after which it quickly recovered in March.

But since mid-March, the market started falling due to various reasons like high inflation rates, FII exit, hikes in interest rates, and escalation of Ukraine – Russia war.

This continuous fall has led to the Nifty falling to such an extent that it reached a 0% return over one year. The dotted line on the graph shows Nifty in June 2022 at the same level as Nifty in June 2021.

What can you do as an investor?

- Lumpsum Investment: A lumpsum investment can help you attain units of a Mutual Fund at a relatively cheaper NAV in the current market conditions. If you have a long investment horizon and a good risk appetite, invest in mid-cap or small-cap funds, which will give you good capital growth when held for more than five years. In the case of a short to medium investment horizon, you could invest in a Hybrid fund, more like a Dynamic Asset Allocation fund, where you get the best of both equity and debt.

- Rebalance your Portfolio: Now is the right time to rebalance your portfolio. If your portfolio has significant losses, you can balance it out in two ways.

- You can average out your losses by buying more units of that fund or equity now at a lower price to reduce the total loss.

- Allocate more funds in your portfolio to mutual funds and equity that have a value which means they have a potential for high growth and performance.

- Invest in US ETFs: You can make the most of the INR depreciation by investing in the US Dollar market. There is a wide range of ETFs, namely, large-cap, small-cap, mid-cap, sectoral, etc. This is again the right time to invest in US ETFs as they are trading at significantly low prices. These funds expose you to the US Stock market with an expert managing your funds.

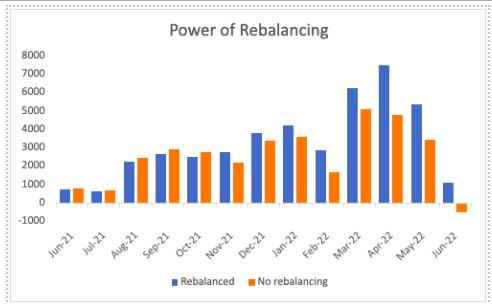

Power of Rebalancing

One fundamental matrix many investors use is portfolio rebalancing when there is high volatility. Portfolio rebalancing is moving closer to the initially decided asset allocation strategy.

The idea behind asset allocation is to balance risk and return in your portfolio by spreading your investment among different types of assets based on market conditions.

Let’s assume that here you have a SIP of Rs. 20,000 monthly. The asset allocation here is taken in Equity, Gold, and Debt.

A rebalanced portfolio captures the market better during upward market movement, whereas there is a lag or shortfall in the portfolio that is not rebalanced.

Moreover, even when the market returns are negative, an actively rebalanced portfolio ensures that the equity, debt, and gold allocation is done so that the portfolio still generates a positive return and efficiently captures the market volatility.

In June 2022, the percentage of Nifty returns (1 year) was 0. The monthly Nifty returns are at –4.53%. The rebalanced portfolio is at a positive level, whereas a non-rebalanced portfolio yields negative returns.

How do advisors help you?

Investors are not required to go through the hassle of rebalancing the portfolio quarterly on their own. This is what RIAs are here for!

Registered Investment Advisors (RIAs) are certified and experienced to help you with periodical portfolio rebalancing. When your portfolio is not managed actively by an RIA, your portfolio’s asset allocation remains unchanged throughout the period unless and until you change it on your own.

But when an RIA manages your account, your portfolio is rebalanced periodically based on the market requirements.

Therefore, having an experienced RIA with expertise in the market makes your life easier and ensures that the portfolio volatility is maintained at minimum levels even with high market volatility.

FAQs

What is market volatility?

Market volatility is a way to track price variation in a market and to check how the market performance will change and fluctuate.

How much market volatility is normal?

Market volatility is fairly common. Investor should watch their investments carefully. Price fluctuations across investments, if the volatility increases to a point of bear market scenario then it’s time to rethink your strategy.

How can you lessen the impact of market volatility?

To minimize the effect of market volatility, investors should diversify their investments, choose low-risk investment baskets, rebalance their investments to avoid loss, and keep investing for the long run with expert guidance.