As an investor, you may have heard about three broad types of funds

- equity funds

- hybrid funds

- debt funds

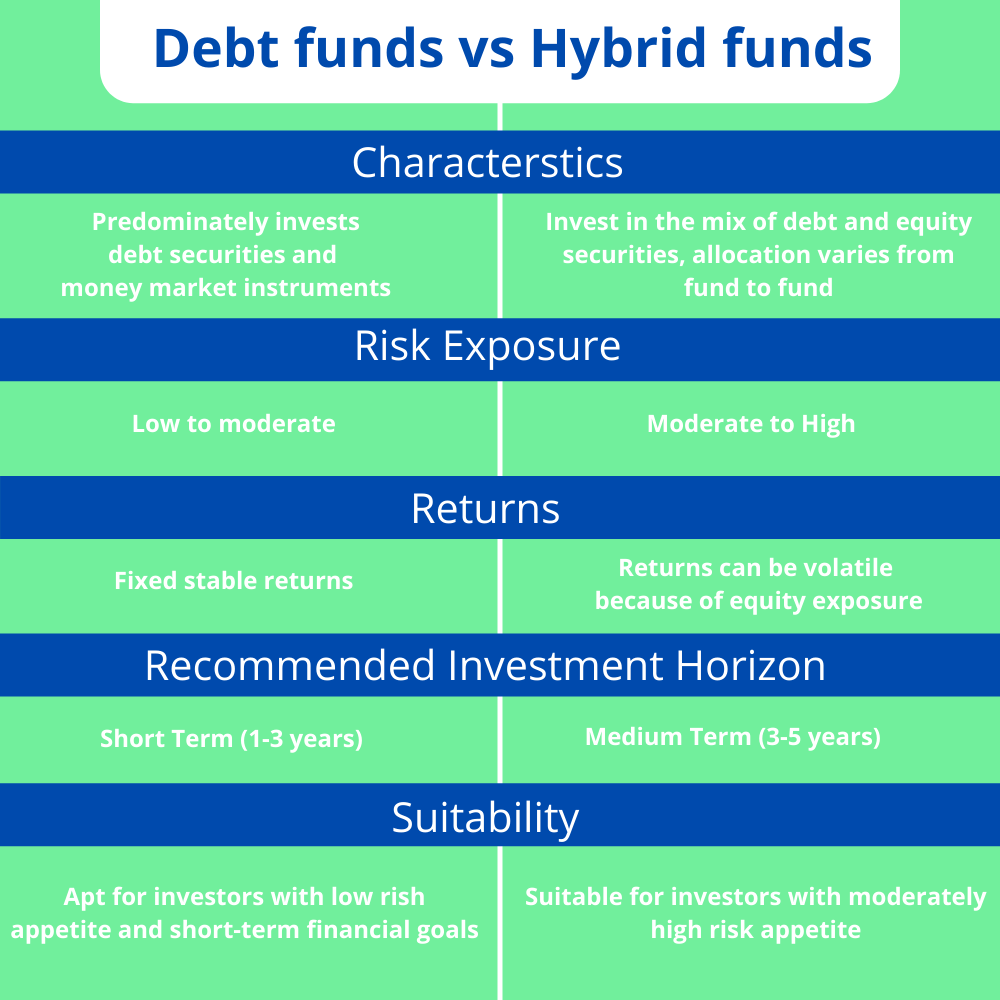

In this article, we will be trying to put out a comparison between debt funds and hybrid funds. We will try to differentiate them based on risks-returns and tax assessment.

Difference between Debt funds and Hybrid funds

1. Debt fund

A debt fund is a mutual fund, an exchange-traded fund (ETF), or any other pooled investment instrument that invests primarily in fixed-income assets.

Debt funds have lower fees than equity funds due to lower management costs. Investors in debt funds can choose between passive and aggressive solutions.

Credit funds and fixed-income funds are common names for debt funds. These funds are popular among investors looking to preserve their capital, along with the generation of low-risk income.

Debt funds invest in a wide range of securities, each with its own set of risks. Companies with a steady outlook and high credit quality issue investment-grade debt. High-yield debt is usually issued by low-credit-quality businesses with good growth potential and a larger risk-return profile.

Debt funds are appropriate for people with short to medium-term investment horizons, where “short-term” refers to 3 months to one year, and “medium-term” refers to a period of 3 to 5 years.

2. Hybrid funds

A hybrid fund is a mutual fund scheme that invests in a mix of equity and debt instruments to create a balance between the risk and returns of the instruments mentioned above.

The risk of investing in a hybrid fund is dependent on the allocation of funds between equity and debt.

Hybrid funds obtain their returns effectively in two parts:

- From the risk-free debt instrument

- The risky and high-delivering equity segment is volatile as well.

A comparative analysis of Debt and hybrid funds

1. Comparison of the risk-return scale

Without a second thought, hybrid funds are riskier than debt funds because of equity components.

The riskiest ones within hybrid funds are those with more than 65% of equity exposure; among debt funds, the fund with low credit quality and high growth prospects carry a riskier profile.

Returns are dependent on the risk you take so returns will vary depending upon your separate exposure to equity and debt, though debt funds are categorically safer than a hybrid.

2. Comparison of the funds on the taxation scale

These funds are subject to taxation on capital gains and dividend distribution tax. Funds are categorized into equity (if equity exposure is >65%) and non-equity.

Equity funds are subject to STCG of 15% if held for less than one year and LTCG of 10% if held for more than a year. On the other hand, non-equity funds (debt funds and hybrid funds with <65% equity) are taxable according to your income-tax slab.

If held for less than three years, LTCG is payable at 15% with an indexation benefit. Equity and non-equity funds attract Dividend distribution tax (DDT) of 10% and 25%, respectively.

So, while choosing the fund you wish to invest in, you have to account for your risk-return equation before deciding.

FAQs

What are debt funds?

A debt fund is a mutual fund, an exchange-traded fund (ETF), or any other pooled investment instrument that invests primarily in fixed-income assets. Debt funds have lower fees than equity funds due to lower management costs. Investors in debt funds can choose between passive and aggressive solutions.

What are hybrid funds?

A hybrid fund is a mutual fund scheme that invests in a mix of equity and debt instruments to create a balance between the risk and returns of the instruments mentioned above.

What is the difference between debt funds and hybrid funds?

Hybrid funds predominantly invest in equity whereas debt funds invest in debt and debt-related instruments.