Investing isn’t about beating others at their game. It’s about controlling yourself at your own game.

-By Benjamin Graham

When it comes to investing, many investors restrict themselves to only India. This may be because of a lack of knowledge, expertise, a certain perspective, and/or many other factors. Let’s simplify the equation of whether should you consider investing in the US market or not.

When you invest in the US market, there are two returns that an Indian investor gets:

- Returns from rupee depreciation

- Return that the US market is generating

Rupee depreciation against the Dollar

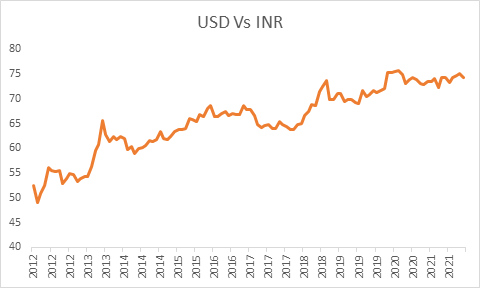

When the rupee becomes less valuable with respect to the dollar, that means the rupee has depreciated. This means that to buy 1 USD, we need to pay more rupees than we used to pay earlier.

Due to Interest Rate Parity, inflation is likely to be higher in emerging economies like India because of the growth and inflation in developed counties will always be lower.

Because of this difference in inflation and interest rate, the currency of an emerging economy is likely to depreciate. So, if we look at the rupee, it has depreciated by almost 4% annually in the last 10 years.

If we look at the graph below, we can see that every year the rupee has depreciated.

Note: Period understudy is between Jan’12-Dec’21.

Therefore, the Indian investor will be benefitted from the rupee depreciation of approximately 4% annually. And we should not rule out that this 4% depreciation in the rupee is compounding.

If you invested $1000 (Rs.53000) in the year 2012 when USDINR was at Rs.53/Dollar, it would have now become Rs. 75000, without even considering the returns of NASDAQ.

NASDAQ performance

Now, let’s look at the performance of the NASDAQ compared to the Sensex Index, Mid-cap Index, and Small-cap Index.

Note: Period understudy is between Jan’12-Dec’21.

When we look at the Indian market, we say that better returns are generated in mid-cap & small-cap sectors, where the risk is also high. when compared to the large-cap sector.

In the above graph, if we compare the performance, we can say that NASDAQ has given better returns than the BSE mid-cap & BSE small-cap index in the past 10 years, whereas the risk is also low when investing in NASDAQ (Index).

NASDAQ has generated more than 17% CAGR (Compounded Annual Growth Rate) over the past 10 years whereas BSE Sensex, and BSE Mid-cap BSE Small-cap have given CAGR of 13%, 15%, and 16% respectively.

The US market is generating more returns than the Indian market when compared with the benchmark.

Let’s talk about the US market

Some of the companies’ size is more than double the economy of some developing countries.

For example, the revenue of Amazon and Apple both surpassed the value of the GDP of Pakistan (296 $ billion) by almost 90 $ billion and 69 $ billion, respectively.

Companies like Amazon & Apple; have achieved economies of scale and their traction in the market is constant. Despite excellent performance over the years, these companies are still generating wealth for investors. Amazon and Apple have given 1525% & 953% returns in the last 10 years.

The story doesn’t end here

There are some large companies across the globe like Alibaba & Industrial & Commercial Bank of China (ICBC), with a market size (capitalization) of $314.76 Bn. & $254.65 Bn., respectively. So, investing in these companies is also possible through investing in US ETFs, which gives global exposure.

Having said that, investing in the US market not only helps you to generate good returns but also helps to diversify the risk.

An opportunity for Indian Investors

Interest rates in India are likely to increase, which is a cause for concern. Due to this, many foreign investors are pulling out their money from India to their home country because many attractive asset classes are present outside India. All this will also lead to demand in the US market.

After the Covid rally in the market, it has bottomed out, and there are high chances that the US market will see a rebound.

Let’s consider three scenarios:

- Best scenario – If we look at the past returns of NASDAQ, which has delivered 17% annually, and the rupee depreciation which is depreciating at 4% annually. Then, the Indian investors will get 21% returns, which is most likely to continue.

- Average scenario – Even if the rupee doesn’t depreciate, the returns that NASDAQ has delivered are higher than the BSE Sensex, BSE Mid-cap, and BSE Small-cap.

- Worst scenario – Even if NASDAQ doesn’t deliver or delivers fewer returns, then the rupee depreciation will help to generate the returns, which is likely to happen.

FAQs

What are the benefits of investing in US market from India?

When you invest in the US market, there are two returns that an Indian investor gets:

- Returns from rupee depreciation

- Return that the US market is generating

- A chance to invest directly in big companies like Apple, Microsoft, Netflix, etc

What does Nasdaq stand for?

Nasdaq is an American stock exchange. It stands for National Association of Securities Dealers Automated Quotations. It compromises of US’s top 20 companies like Apple, Amazon, Google, Meta, etc. Some of these companies have a market value bigger than of countries like Pakistan and even India!

How can you invest in the US from India?

You can invest in the US market from India by downloading the EduFund App. Open your US account on the App in a seamless process with no extra charges. Click here to know how US stocks!

Therefore, the rupee will work as a hedging tool with no extra cost and risk while investing in the US market.

If you are investing in the US market (dollar currency) either of the three things is going to happen, which is in your favor. Start investing in the US market as the market has bottomed out, and the market will see a rebound.