One of the largest AMCs in India, DSP has been helping investors make sound investment decisions responsibly and unemotionally for over 25 years. DSP is backed by the DSP Group, an almost 160-year-old Indian financial giant.

The family behind DSP has been very influential in the growth and professionalization of capital markets and the money management business in India over the last one-and-a-half centuries

Let us talk about the consumer product – DSP Dynamic Asset Allocation Fund.

About the DSP Dynamic Asset Allocation Fund

Investment objective

The investment objective of the Scheme is to seek capital appreciation by managing the asset allocation between equity and fixed-income securities.

The Scheme will dynamically manage the asset allocation between equity and fixed income based on the relative valuation of equity and debt markets.

The Scheme intends to generate long-term capital appreciation by investing in equity and equity-related instruments and seeks to generate income through investments in fixed-income securities and by using arbitrage and other derivative strategies.

Investment process

- Investment Strategy for Equity Investments – The stock selection process proposed to be adopted is generally a bottom-up approach seeking to identify companies with long-term sustainable competitive advantage (as this is one of the key factors responsible for withstanding competitive pressures and does not allow rivals to eat up any excess profits earned by a successful business). The fund would also use a top-down discipline for risk control by ensuring the representation of companies from select sectors.

- Investment Strategy for Debt Investments – The Fund Manager will invest only in those debt securities that are rated investment grade by a domestic credit rating agency such as CRISIL, ICRA, CARE, FITCH, etc., or in unrated debt securities that the Fund Manager believes to be of equivalent quality. The securities mentioned above could be listed, unlisted, privately placed, secured, unsecured, rated, or unrated (subject to the rating or equivalency requirements discussed above) and of any maturity. The Fund may also invest in Securities of issuers supported by the Government of India or State Governments subject to such securities satisfying the criteria relating to rating etc.

Portfolio composition

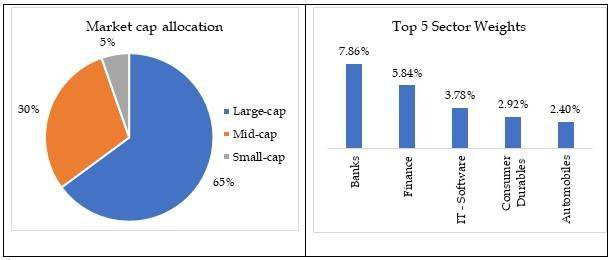

The portfolio holds the major exposure in large-cap stocks at 65% and sectoral major exposure is Banks which account for roughly 8% of the portfolio. The top 4 sectors hold nearly 18% of the portfolio.

Source: DSP MF

Top 5 holdings DSP Dynamic Asset Allocation Fund

| Name | Weightage % |

| HDFC Bank Limited | 3.93 |

| Bajaj Finance Limited | 3.29 |

| ICICI Bank Limited | 2.22 |

| Avenue Supermarts Limited | 2.14 |

| Maruti Suzuki India Limited | 1.94 |

Source: DSP MF

Performance

Source: DSP MF

The fund has generated a CAGR (Compounded Annual Growth Rate) of 8% since its inception.

Fund manager

- Mr. Atul Bhole is the fund manager and brings over 16 years of experience. He joined DSP in May 2016 and is the Vice President. He is managing the fund since February 2018. He has previously worked with Tata Asset Management Ltd, JP Morgan Services (India) Private Limited, and State Bank of India (Treasury). He holds a B. Com, MMS (Finance from JBIMS), and Chartered Accountant (ICAI India).

- Mr. Dhaval Gada is the fund manager and brings over 13 years of experience. He joined DSP in September 2018 and is managing the fund since September 2022. He has previously worked with Sundaram AMC Pvt. Ltd, Motilal Oswal Securities Ltd, Evalueserve.com Pvt. Ltd. He holds a PGDM – Finance from Welingkar Institute of Management.

- Mr. Laukik Bagwe is the fund manager and brings over 22 years of total professional experience. He has been managing the scheme since July 2021. He has previously worked with Derivium Capital & Securities Private Limited, and Birla Sunlife Securities Ltd. He holds a B.Com, and PGDBA (Finance).

Who should invest in DSP Dynamic Asset Allocation Fund?

- Investors want to invest in the equity markets but don’t know how to begin.

- An investor who gets confused by the noise when markets fluctuate and also believes that an unemotional asset allocation strategy has a higher chance of success.

- Investors not looking to chase the highest returns.

Why invest in this Fund?

- Helps you invest unemotionally by ‘doing what it needs to’, instead of you having to react to changing markets.

- It offers you ‘built-in-advice’ & actions on your behalf.

- Offers the potential to grow your wealth by investing in equities but with a smoother long-term investment journey.

- It tries to reduce the impact of market fluctuations in the portfolio.

- Potential capital preservation during falling markets through debt allocation.

Time horizon

- One should look at investing for a minimum of 5 years or even more.

- Investment through Systematic Investment Plan (SIP) may help in tackling the volatility of the broader equity market.

Conclusion

The DSP Dynamic Asset Allocation Fund was launched in February 2014 and in its track record of nearly nine years, the fund has delivered ~8% CAGR consistently.

Thus, it is best for investors who are willing to take equity exposure but not knowing how to begin and where to begin.

Disclaimer

This is not recommendation advice. All information in this blog is for educational purposes only.