One of the largest AMCs in India, DSP has been helping investors make sound investment decisions responsibly and unemotionally for over 25 years.

DSP is backed by the DSP Group, an almost 160-year-old Indian financial giant. The family behind DSP has been very influential in the growth and professionalization of capital markets and the money management business in India over the last one-and-a-half centuries

Let us talk about the flagship product of the DSP Equity & Bond Fund

About DSP Equity and Bond Fund

Investment objective

The primary investment objective of the Scheme is to seek to generate long-term capital appreciation and current income from a portfolio constituted of equity and equity-related securities as well as fixed-income securities (debt and money market securities).

Investment process

The scheme invests in equity (for capital appreciation) and debt (for income generation). It has an auto-balancing element wherein the portfolio is rebalanced to maintain the 65:35 equity-to-debt allocation.

The investment framework is such that equity investments seek long-term growth opportunities across market caps and debt investments are only in highly rated instruments with short-term maturity profiles.

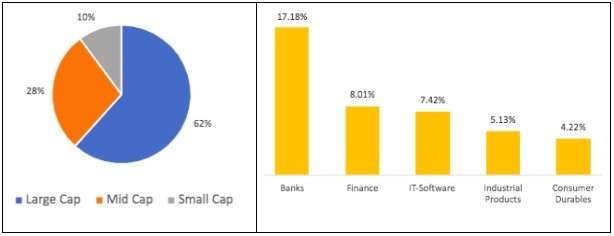

Portfolio composition

The portfolio’s major exposure of more than 60% in large-cap followed by 28% in mid-cap. The top 5 sectors hold nearly 41% of the portfolio, with major exposure to Banks and Finance.

Source: dspim.com

Top 5 holdings in DSP Equity & Bond Fund

| Name | Sector | Weightage % |

| HDFC Bank Ltd. | Bank | 7.20 |

| ICICI Bank Ltd. | Bank | 5.73 |

| Bajaj Finance Ltd. | Financial Services | 4.24 |

| Infosys Ltd. | Information Technology | 2.99 |

| Axis Bank Ltd. | Bank | 2.85 |

Source: dspim.com

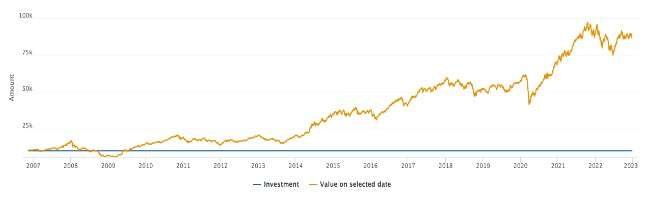

Performance over 23 years

If you would have invested 10,000 at the inception of the DSP Equity & Bond Fund, it would be now valued at Rs. 2.21 lakhs. This fund has outperformed the benchmark in all time horizons.

Source: Moneycontrol

The DSP Equity & Bond Fund. has given consistent returns and has outperformed the benchmark over the period of more than 23 years by generating a CAGR (Compounded Annual Growth Rate) of 14.23%.

Fund Managers

- Atul Bhole – Total work experience of 10 years. He joined DSP Investment Managers in May 2016 as Vice President-Investments.

- Dhaval Gada – Total work experience of 13 years. He joined DSP investment managers in Sept-2018 as Associate Vice President and was promoted to Vice President in Feb-2022.

- Vikram Chopra – Total work experience of 14 years. He comes from L&T Investment Management. He has also previously worked with Fidelity, IDBI Bank, and Axis Bank Ltd.

Who should invest in DSP Equity and Bond Fund?

Investors

- Want to invest in the equity markets but don’t know how to begin?

- Accept that equity investing means exposure to risk and recognize market falls as good opportunities to invest even more.

Why invest in DSP Equity & Bond Fund?

- The simplest way to get the benefit of asset allocation is with a balance of growth & stability orientation.

- Offers potential capital preservation during falling markets due to debt allocation.

Horizon

- One should look at investing and holding the investment for more than 10 years.

- Investment through a Systematic Investment Plan (SIP) may help in tackling the volatility of the broader equity market.

Conclusion

This scheme offers a diversified portfolio to investors who do not have much experience in the equity markets.

Diversification is such that equity investments offer capital appreciation and debt investments offer wealth preservation. The scheme has a slightly lower impact on market fluctuations compared to pure equity funds