One of the largest AMCs in India, DSP has been helping investors make sound investment decisions responsibly and unemotionally for over 25 years.

DSP is backed by the DSP Group, an almost 160-year-old Indian financial giant. The family behind DSP has been very influential in the growth and professionalization of capital markets and the money management business in India over the last one-and-a-half centuries.

DSP Mid Cap Fund

Investment objective

The primary investment objective is to seek to generate long-term capital appreciation from a portfolio that is substantially constituted of equity and equity-related securities of mid-cap companies.

From time to time, the fund manager will also seek participation in other equity and equity-related securities to achieve optimal portfolio construction.

Investment process

The DSP Mid Cap Fund has an investment philosophy that selects stocks with durable business, which are run by able managers and have high sustainable Returns on Equity.

It focuses on small and mid-cap stocks that have a strong alpha generation potential, competitive advantage, and high cash flows.

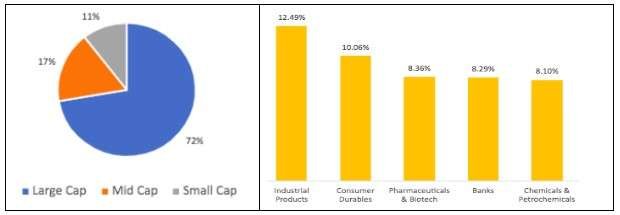

Portfolio composition

The portfolio major exposure of more than 70% in mid-cap followed by 17% in small cap. The top 5 sectors hold nearly 48% of the portfolio, with major exposure to Pharmaceuticals and Biotechnology.

Source: dspim.com

Top 5 holdings

| Name | Sector | Weightage % |

| Supreme Industries Ltd. | Plastic Pipes Company | 4.67 |

| The Phoenix Mills Ltd. | Retail Mall Developer | 3.65 |

| Atul Ltd. | Chemicals Company | 3.49 |

| IPCA Laboratories Ltd. | Pharmaceutical | 3.36 |

| Bharat Forge Ltd. | Forging Company | 3.28 |

Source: ICICI Pru

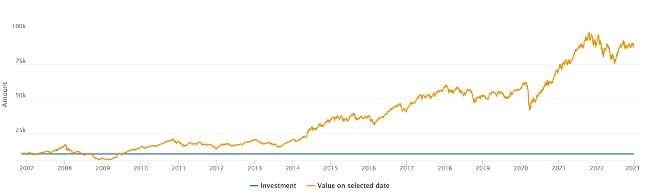

Performance over 16 years

If you would have invested 10,000 at the inception of the DSP Mid Cap Fund, it would be now valued at Rs. 77,034. This fund has outperformed the benchmark in all time horizons.

Source: Moneycontrol

The DSP Mid Cap Fund has given consistent returns and has outperformed the benchmark over the period of more than 16 years by generating a CAGR (Compounded Annual Growth Rate) of 14.37%

DSP Top 100 Equity Fund

Fund managers at DSP mid-cap mutual funds

- Resham Jain: Total work experience of 9 years. He joined DSP Investment Managers in March 2016 as Assistant Vice President of the Equity Income Team.

- Abhishek Ghosh: Total work experience of 14 years. He joined DSP investment managers in September 2018 as Assistant Vice President of the equity team.

- Vinit Sambre: Total work experience of 16 years. Vinit joined DSPIM in July 2007, as a Portfolio Analyst for the firm’s Portfolio Management Services (PMS) division.

- Jay Kothari – Total work experience of 20 years. Vice President & Product Strategist -Jay has been with DSP Investment Managers since May 2005.

Who should invest?

- An experienced investor with a well-defined core portfolio.

- Investors with high patience understand that this category of funds is associated with high risk.

Why invest?

- Offers the potential to grow your wealth & ‘earn big’ returns if this theme does well (a high-risk, high-return strategy).

- Can be a suitable choice for tactical allocation.

Horizon

- One should look at investing and holding the investment for more than 7 years.

- Investment through a Systematic Investment Plan (SIP) may help in tackling the volatility of the broader equity market.

FAQs

What are the top five holdings of DSP Midcap Fund?

The top 5 holdings of DSP Midcap Fund:

Supreme Industries Ltd.

The Phoenix Mills Ltd.

Atul Ltd.

IPCA Laboratories Ltd.

Bharat Forge Ltd.

Who are the fund managers for DSP Midcap Fund?

- Resham Jain

- Abhishek Ghosh

- Vinit Sambre

- Jay Kothari

What has the performance of DSP Mid cap fund over 16 years?

If you would have invested 10,000 at the inception of the DSP Mid Cap Fund, it would be now valued at Rs. 77,034. This fund has outperformed the benchmark in all time horizons.

Conclusion

This scheme offers exposure to mid-size companies that have a durable business run by able managers. Mid-sized companies like these can offer more growth potential than larger companies but at lower risk levels than smaller-sized companies.

This scheme is best suitable for investors with a long investment horizon.