DSP Group is a 150+ years old financial entity, started back in the 1860s with its stock broking business. Gradually they entered the mutual fund industry.

DSP AMC was incorporated in 1996, and it is one of India’s leading AMC in India. DSP AMCs offer a wide range of products to meet the requirement of every investor in the best way by offering mutual funds.

DSP AMC has schemes across debt, equity, hybrid, international funds, and ETFs (Exchange Traded Funds). It holds 25 years of Honest Asset Management.

For over two decades DSP has helped its investors to take responsible money decisions based on two pillars i.e., honesty & Integrity.

About DSP Natural Resources and New Energy Fund

DSP Natural Resources and New Energy FundInvestment objective

The primary investment objective of the Scheme is to seek to generate capital appreciation and provide long-term growth opportunities by investing in equity and equity-related securities of companies domiciled in India whose predominant economic activity is in the:

(a) discovery, development, production, or distribution of natural resources, viz., energy, mining, etc

(b) alternative energy and energy technology sectors, with emphasis given to renewable energy, automotive and on-site power generation, energy storage, and enabling energy technologies.

The Scheme will also invest a certain portion of its corpus in the equity and equity-related securities of companies domiciled overseas, which are principally engaged in the discovery, development, production, or distribution of natural resources and alternative energy and/or the units/shares of:

- BlackRock Global Funds – Sustainable Energy Fund

- BlackRock Global Funds – World Energy Fund and similar other overseas mutual fund schemes.

The secondary objective is to generate consistent returns by investing in debt and money market securities.

Investment process

The DSP Natural Resources and New Energy Fund follows a value style of investing which consists of value stocks of majorly large-cap companies.

The investment philosophy of the fund is to buy value stocks of companies involved in the commodity business and energy-based business.

Portfolio construction involves investing majorly in large-cap companies. The fund core portfolio is based on long-term themes, core equity portfolio.

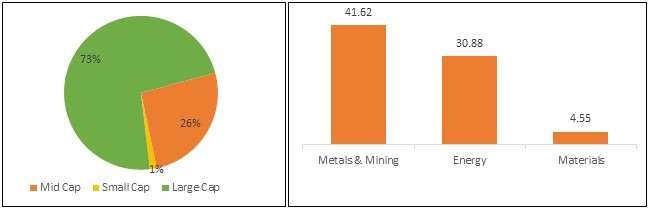

Portfolio composition

The portfolio holds the major exposure in large-cap stocks at 73% and the fund is a sectorial fund that focused on the materials and energy sector. Both sectors together consist of more than 72% of the portfolio.

Source: Value Research

Top 5 holdings

| Name | Sector | Weightage % |

| Black Rock Global Funds – New Energy Fund | Financial (Foreign Fund) | 14.71 |

| Jindal Steel & Power | Metals & Mining | 9.88 |

| Hindalco | Metals & Mining | 8.71 |

| Tata Steel | Metals & Mining | 8.25 |

| Reliance | Energy | 7.47 |

Source: Value Research

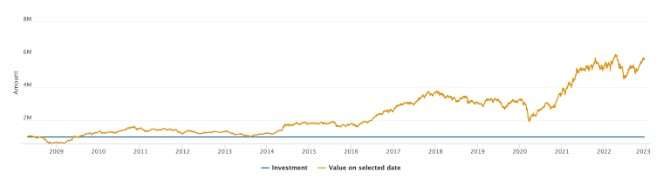

Performance over 22 years

If you would have invested 10 lakhs at the inception of DSP Natural Resources and New Energy Fund, it would be now valued at Rs 56.95 lakhs.

Source: Money Control

The DSP Natural Resources and New Energy Fund has given consistent returns and has outperformed the benchmark over the period of 14 years by generating a CAGR (Compounded Annual Growth Rate) of 12.61%.

Fund Manager

Rohit Singhania: Prior to joining DSP Mutual Fund, he worked with HDFC Securities Ltd. and IL&FS Investment Limited.

Who should invest?

Investors looking to

- Hold a focused portfolio of companies involved in the metals, mining & energy sector

- Tactically allocate 10-15% of your overall portfolio to very high-risk opportunities.

Why invest?

- Aim to grow your money by investing in companies from the commodities, energy and renewable energy sectors.

- Favorable sector dynamics- As the world develops, the focus on energy companies to become more efficient to grow & an increase in the adoption of renewable energy means companies in this space could do well.

Horizon

- One should look at investing for a minimum of 5-7 years or more

- A systematic investment Plan (SIP) is an ideal way to take exposure as it helps tackle market volatility

Conclusion

The DSP Natural Resources and New Energy Fund has delivered good returns over the period with a CAGR of more than 12.61%.

One should have a longer horizon before investing in the DSP Natural Resources and New Energy Fund as it is a sectoral fund. The fund is suitable for investors who have the patience & mental resilience to remain invested for a decade or more