One of the largest AMCs in India, DSP has been helping investors make sound investment decisions responsibly and unemotionally for over 25 years. DSP Mutual Funds is backed by the DSP Group, an almost 160-year-old Indian financial giant. In this blog, let us explore their – DSP Nifty 50 Equal Weight Index Fund.

About the DSP Nifty 50 Equal Weight Index Fund

Investment Objective: The primary investment objective of the Scheme is to invest in companies that are constituents of the Nifty 50 Equal Weight Index (underlying Index) in equal proportions and it seeks to generate returns (before fees and expenses) that mirror the performance of underlying index, subject to tracking error.

Note: There is no assurance that the investment objective of the Scheme will be realized

What is in the DSP Nifty 50 Equal Weight Index Fund?

- This is an index fund that replicates the Nifty 50 Equal Weight Total Returns Index (TRI) i.e., same stocks and same weights.

- Rebalancing an equal-weight index introduces a value tilt. By assigning equal weight to each constituent, the index leans towards smaller market-cap companies and lower valuations, which have historically outperformed their larger counterparts.

- The portfolio is re-aligned every quarter so every stock’s weight is brought back to 2%.

- The portfolio is rebalanced semi-annually to adjust for any stock additions or subtractions to the Index.

Portfolio Composition

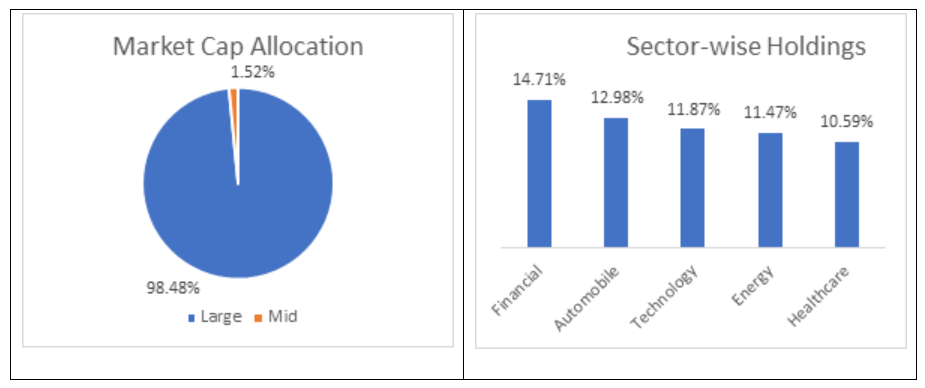

The portfolio is well diversified across market caps and sectors. It had 98.48% of the funds allocated to large-cap stocks, and 1.52% to mid-cap stocks. At the same time, significant sectoral exposure is to banks and automobiles. The top five sectors hold more than 60% of the portfolio.

Source: Value Research

Top 5 Holdings

| Name | Weightage % |

| Bharat Petroleum | 2.54 |

| Tata Motors | 2.51 |

| Adani Ports and Special Economic Zone | 2.44 |

| Oil & Natural Gas | 2.42 |

| Sun Pharmaceutical | 2.40 |

Source: Value Research

Performance

| Particular | DSP Nifty 50 Equal Weight Index Fund | NIFTY 50 Equal Weight TRI ^ | Nifty 50 TRI |

| CAGR (%) | CAGR (%) | CAGR (%) | |

| 1 year | 42.87 | 43.61 | 28.42 |

| 3 years | 21.75 | 22.39 | 16.12 |

| 5 years | 18.97 | 20.09 | 16.64 |

| Since Inception | 13.87 | 14.83 | 14.23 |

Source: DSP MF

Fund Manager

- Mr. Anil Ghelani is a fund manager. He has been managing this fund since July 2019 and he has a total work experience of 26 years.

- Mr. Diipesh Shah is a fund manager. He has been managing this fund since November 2020 and has a total work experience of 22 years.

Who Should you consider the DSP Nifty 50 Equal Weight Index Fund?

- This is a smart way to build wealth by investing conveniently and equally in the top 50 Indian companies.

- This fund follows the philosophy that every company has a chance to outperform accordingly.

- This fund is relatively low-cost, with a comparatively lower expense ratio than active large-cap funds.

- The portfolio of this fund is well diversified and it avoids undue concentration in a few stocks/sectors.

- It can help you beat the impact of rising prices over the long term

- This is a zero-bias product since it only replicates the index and does not carry any stock or sector bias.

- Recognize market falls as good opportunities to invest even more.

- Accept that equity investing means exposure to risk.

Start a goal to save for your child’s college dreams!

Time Horizon

- One should look at investing for a period of ten years or more.

- Investment through a Systematic Investment Plan (SIP) may help in tackling the volatility of the broader equity market.

Conclusion

The DSP Nifty 50 Equal Weight Index Fund has a proven track record of more than 6 years, where it has delivered a CAGR (Compounded Annual Growth Rate) of 13.87% as of 29th February 2024, since its inception in October 2017. As the fund invests in Nifty 50 Equal Weight Index Fund it carries high risk. Hence one can consider it from a long-term point of view for wealth creation.

Disclaimer: This is not recommendation advice. All information in this blog is for educational purposes only.