One of the largest AMCs in India, DSP has been helping investors make sound investment decisions responsibly and unemotionally for over 25 years. DSP is backed by the DSP Group, an almost 160-year-old Indian financial giant.

The family behind DSP has been very influential in the growth and professionalization of capital markets and the money management business in India over the last one-and-a-half centuries.

Let us discuss the consumer product – DSP Nifty Next 50 Index Fund.

DSP Nifty Next 50 Index Fund

Investment Objective

The primary investment objective is to invest in companies that are constituents of the NIFTY Next 50 Index (underlying index) in the same proportion as in the index and seeks to generate returns that are commensurate (before fees and expenses) with the performance of the underlying index, “subject to tracking error”.

Investment Process

- The fund replicates the Nifty Next50 TR Index, i.e., invests in the same stocks and proportion as in the Nifty Next50 TRI.

- The portfolio is rebalanced semi-annually to adjust for any stock additions or subtractions to the index.

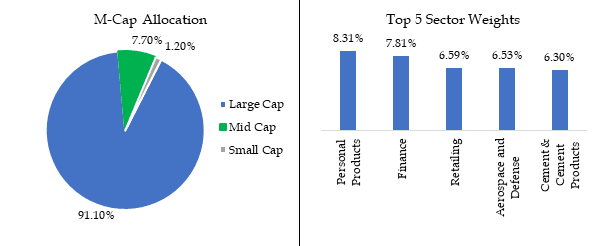

Portfolio Composition

The fund had invested 99.82% in equity, and the remaining was held in the form of debt/cash and cash equivalents as of 30th June 2023.

Source: DSP MF

Top 5 Holdings for DSP Nifty Next 50 Index Fund

| Name | Weightage % |

| LTIMindtree Limited | 3.86 |

| Cholamandalam Investment and Finance Company Limited | 3.65 |

| Bharat Electronics Limited | 3.65 |

| Godrej Consumer Products Limited | 3.31 |

| Pidilite Industries Limited | 3.21 |

Source: DSP MF

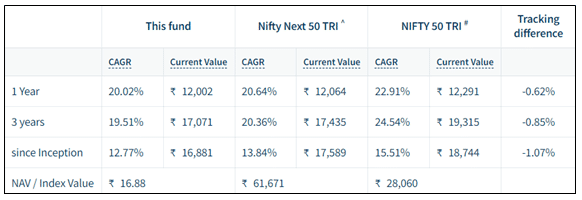

Performance

If you had invested 10,000 at the fund’s inception, it would now be valued at Rs 16,881.

Source: DSP MF

Since its inception, the fund has generated a CAGR (Compounded Annual Growth Rate) of 12.77%.

Fund Manager

- Anil Ghelani has been managing this fund since July 2019 as a Co-Fund Manager. Anil has been working with DSP Group since 2003 and is Head of Passive Investments & Products. Previously, he was the Business Head & Chief Investment Officer at DSP Pension Fund Managers. Before that, he led the Risk and Quantitative Analysis team at DSP Mutual Fund, responsible for monitoring portfolio risk and buy-side credit research on companies across various sectors.

- Diipesh Shah has been managing this fund since November 2020 as a Co-Fund Manager. Diipesh has a total work experience of Over 20 years. He has been working with DSP since September 2019 as a Dealer for ETF and Passive Investments. Now he is also the Fund Manager of various schemes of DSP Mutual Fund. Diipesh has worked with JM Financial Institutional Broking Limited, Centrum Broking Limited, IDFC Securities Limited, and Kotak Securities Limited as Institutional Equity Sales Trading.

Who Should Invest in DSP Nifty 50 Index Fund?

Consider this fund if you:

- Are an experienced investor & know what you’re doing.

- Are looking to tactically allocate 10-15% of your overall portfolio to very high-risk opportunities?

- Value low-cost, passive investing.

- Have the patience & mental resilience to remain invested for a decade or more.

- Accept that equity investing means exposure to risk.

Why Invest in this Fund?

- Aim to build wealth by investing conveniently in companies that could become the next top 50 Indian companies.

- Relatively low-cost, with a comparatively lower expense ratio than active large-cap funds.

- Offers the potential to ‘earn big’ returns by utilizing this high-risk, high-return strategy.

- Can help you beat the impact of rising prices over the long term.

- Since the fund only replicates an index & does not have an ‘active’ fund manager, it carries no human decision-making bias.

Time Horizon

- One should look at investing for at least ten years or even more.

- Investment through Systematic Investment Plan (SIP) may help in tackling the volatility of the broader equity market.

Conclusion

The DSP Nifty Next 50 Index Fund provides a good option for passive investing in large-cap equities.

It is better to consider index funds for large-cap investing since there is a very low probability of alpha generation in the large-cap space.

Investors seeking capital appreciation through large-cap exposure can consider this fund with a time horizon of ten years or more.