ETFs (exchange-traded funds) are a straightforward method to begin investing. ETFs are easy to understand and can generate significant returns with little cost or effort.

Here is everything you need to know about ETFs, including how they work and how to do investing in US ETFs.

What is an exchange-traded fund (ETF)?

An ETF, an exchange-traded fund, enables investors to buy many shares or bonds at once. Investors purchase ETF shares, and the funds are employed to invest in a specific way.

If you buy a Nasdaq 100 ETF, your money is put in the index’s 100 companies. The ETF trading on the exchange is precisely like a regular stock.

Throughout the trading day, ETFs are bought and sold, and the price of an ETF share might swing above or below its net asset value (NAV) according to supply and demand.

Although ETFs and Mutual Funds appear to be similar on the surface, both are bundles of assets in which thousands of owners regularly invest; they have a few key differences.

Mutual Funds, for example, are usually actively managed. Unlike ETFs, which trade continuously throughout the day, mutual funds are transacted once daily.

Mutual fund prices are determined once every 24 hours based on the NAV at the end of the trading day.

ETFs have two categories: passive and active.

- Passive ETFs (also known as index funds) monitor a stock index like the S&P 500. Passive ETFs replicate the performance of an index.

- Active ETFs hire portfolio managers to invest their money. Active ETFs aim to outperform a benchmark index.

5 Steps on how to Invest in US ETFs

- The first step is to open an account with a brokerage firm. This account can be used to buy and sell stocks, ETFs, commodities contracts, and other securities. For all deposits, the broker acts as a custodian. A broker which provides services in India and the USA must be selected.

- Make an ETF investment strategy that suits your goals and risk profile.

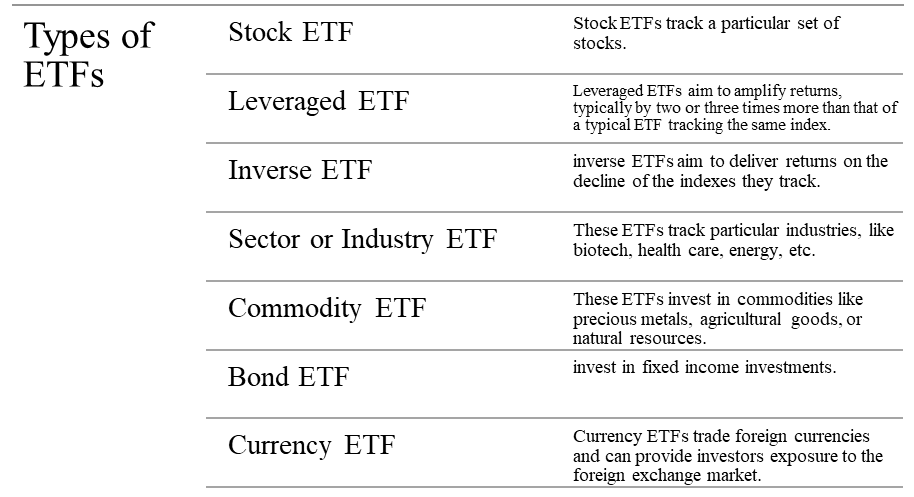

- Once the investor decides on his investment strategy, he should focus on the ETFs. He should research the various types of ETFs available in the market.

- The final step in the ETF purchase process is to purchase the ETF. The investor must first deposit monies into the brokerage account from which the purchase will be performed. After ensuring that the funds are sufficient, the investor must look for the ETF ticker symbol and make a buy order. The investor must also specify the number of ETF shares he wants to buy. ETF shares cannot be purchased in fractions in most cases. Confirm the order.

- Since the investor has purchased the shares, he must prepare an exit strategy for minimizing losses (if any) or minimizing capital gains taxes.

What to look for in the ETFs before buying/investing?

Expense ratio: Expenses eat into the earnings of the investor, so the smaller the expense ratio, the better. In addition, an investor should consider the costs charged by an ETF to maintain a portfolio.

ETFs often have lower costs than actively managed funds since they track an underlying index. When purchasing specialty ETFs, however, an investor must use caution.

Volume: ETF volume reflects the ETF’s trading potential and, as a result, its liquidity. Higher volume means lower spreads and more liquidity.

Underlying Holdings: Look at the underlying holdings of the ETF.

Performance: Look at the fund’s past performance and compare that to its peers.

Market price: An ETF should ideally trade near its NAV. Before making any acquisitions, investors should consider the NAV.

Beta: Beta measures how much security is likely to go up or down daily concerning the tracking Index. It is, in essence, a measure of a security market or systemic risk.

For example, a stock having a beta =1.0 swings in tandem with the general market, so a 1% increase or decrease in the underlying index is mirrored by a 1% gain or fall in the ETF’s price.

Alpha: Alpha is referred to as ‘excess return’, which measures the return earned by a stock above or below the market’s demand for its risk class.

Age of the ETFs: The age of the fund can be used as a proxy for the reliability of the fund. A fund that has been around for a considerable time must have a proven track record.

Why should you invest in US ETFs?

All key US stock exchanges have companies listed worldwide, making it a potential investment destination. If you invest in the US share market, you diversify your financial portfolio while investing in worldwide companies.

The equity market in the United States is the largest in the world. The US financial markets accounted for 54.5 percent of worldwide stock market value as of December 2021.

Investments in US stocks can help you get a good return on your money because global corporations are there, and the return you receive will be high due to various factors.

Unlike India, you can hold US stocks in fractions. After all, buying a single Google share is out of range for most individuals. You can own a part of the company for as little as Rs 1,000 or even less.

According to historical data, the Indian Rupee has been losing value against the US dollar, and there is a probability that this trend may continue.

The rupee-to-dollar exchange rate influences the profit you make from foreign equities. Any rupee weakening helps boost profits if dollar-denominated investments such as US shares appreciate.

Even if global markets are disappointed or remain steady, you benefit if the rupee falls against the dollar.

How to send money to the United States?

All residents, including minors, are entitled to freely transmit up to USD 2,50,000 per financial year (April – March) for any permissible current or capital account transaction, or a combination of both, under the Liberalized Remittance Scheme.

Furthermore, residents can use the foreign exchange facility for up to USD 2,50,000 for the purposes listed in paragraph 1 of Schedule III of the FEM (CAT) Amendment Rules 2015, dated May 26, 2015.

Indian residents can use the LRS to send money overseas for tourism, education, medical treatment, stock and property purchases, care of family living abroad, presents, and donations.

Individuals may also create, manage, and retain foreign currency deposits with foreign banks to conduct transactions. The scheme does not cover corporations, partnerships, trusts, etc.

All about taxation when investing in the US Market

Let us sum up the taxation aspect in an easy-to-understand flowchart

1. Dividends

An intended distribution of a company’s profit to its shareholders is known as a dividend. You must thus pay the tax on the dividend you receive because your investment is lucrative.

2. Capital gains on the sale

You can choose to make money or lose money when you sell a stock. If you experience a loss, no tax is owed; but, if you experience a profit, you must pay capital gains tax.

The capital gains tax rate is based on how long the stock has been held. Foreign investors in US stocks are not subject to the country’s capital gains tax. However, the Capital Gains Tax plan in India requires you to pay taxes.

a) Long-Term Capital Gains Tax Rate (LTCG)

If you own a stock for more than 24 months, the profit from selling it would be taxed at the Long-Term Capital Gains rate in India. Long-term capital gains are taxed at a rate of 20%. (Plus, any additional surcharge and cess).

b) Short-Term Capital Gains Tax Rate (STCG)

If a sale is made before the 24-month period, it will be considered normal income, and the tax rate will depend on your tax bracket.

Understanding some critical ETF terms

- Smart Beta ETFs – “Factor-based” or “Strategic Beta” ETFs are other names for Smart Beta ETFs. These ETFs wisely select their underlying assets in keeping with their namesake.

These ETFs choose the primary assets based on factors other than market capitalization.

- ETF liquidity – 2 different types of allied liquidities – Primary and Secondary.

Primary Liquidity is the Liquidity associated with the ease of creating and redeeming ETF shares with the help of underlying securities.

The Liquidity of the underlying securities plays a significant role in determining the Liquidity of the ETF shares in the primary market.

Secondary Liquidity is the Liquidity associated with the already created ETF shares in the stock market. This Liquidity is generally the visible Liquidity on the market.

The non-institutional investors or investors with a smaller scale of operations generally are concerned with this type of liquidity. Investors buy and sell ETF units on the secondary market without the involvement of the ETF issuer.

- Tracking difference – which can be either positive or negative, indicates how well a fund has outperformed or underperformed its benchmark index.

It’s derived by subtracting the fund’s total return from the benchmark’s total.

- Tracking error – reflects how much variability occurs among the individual data points that make up the fund’s average tracking difference.

The value of a fund’s assets subtracted the value of its liabilities is known as net asset value (NAV). The term “net asset value” is frequently used in the context of mutual funds and ETFs, and it refers to the value of the assets owned in the fund.

If the ETF’s price is higher than its NAV, it is considered to be trading at a “premium.” In contrast, if the ETF’s price is below its NAV, the ETF is considered to be trading at a “discount.”

- Spread – At any given point in the market, there are two prices: the sale price, i.e., ‘ask’ and the other to buy, i.e., ‘bid’. Buyers of ETFs aim to pay a fair price and, if possible, a discount on the market price of the core securities in the ETF, while sellers want to get the highest price -leading to the existence of spreads.

International investments allow you to diversify your portfolio and acquire exposure to new markets. Geographic diversification can help mitigate country risk, such as the chance of bad events affecting India’s domestic economy.

Furthermore, when comparing investing in Indian vs US markets, US stocks have traditionally displayed lower volatility, higher returns, and greater foreign exposure.

FAQs

What is an exchange-traded fund (ETF)?

An ETF, an exchange-traded fund, enables investors to buy many shares or bonds at once. Investors purchase ETF shares, and the funds are employed to invest in a specific way.

If you buy a Nasdaq 100 ETF, your money is put in the index’s 100 companies. The ETF trading on the exchange is precisely like a regular stock.

What to look for in the ETFs before buying/investing?

There are many parameters to look out for while buying an ETF: performance, expense ratio, volume, market holdings, age of the ETFs, etc.

What are the two types of ETFs?

ETFs have two categories: passive and active.

- Passive ETFs (also known as index funds) monitor a stock index like the S&P 500. Passive ETFs replicate the performance of an index.

- Active ETFs hire portfolio managers to invest their money. Active ETFs aim to outperform a benchmark index.