In this blog, we will discuss how mutual funds work. Before we get into greater details regarding a mutual fund, we shall discuss what it is, followed by the types of funds and their operation.

What is a mutual fund?

A mutual fund is a professionally managed fund. It pools money from different investors, such as individuals, companies, trusts, etc.

The corpus accumulated is invested in securities such as stocks, bonds, money market instruments, commodities, etc. While some mutual funds invest in a single type of security, others may have a combination of security types.

The objective of a fund

One of the most important objectives of any mutual fund is to beat the benchmark returns and category average. A fund is aimed at generating alpha.

How does an investor earn through a mutual fund?

An investor invests in a mutual fund so that they can generate income. The following sources contribute to this income:

- Divided payments – Dividend paid by the fund house

- Capital gain – Gains accumulated by the fund upon the selling of any security

- Net Asset Value (NAV) – When NAV increases, the investor benefits during redemption.

Types of Mutual Funds

There are multiple types of funds based on the asset class. The Securities and Exchange Board of India (SEBI) categorizes these:

- Equity Schemes – These mutual funds invest in equities and equity-related securities.

- Debt Schemes – This type of mutual fund invests in debt instruments

- Hybrid Schemes – This type of fund invests in a mix of stocks and bonds

- Solution-Oriented Schemes – These are schemes with a specific goal. Example – Retirement fund

- Other Schemes – This includes funds that are not covered above. For example, funds of funds.

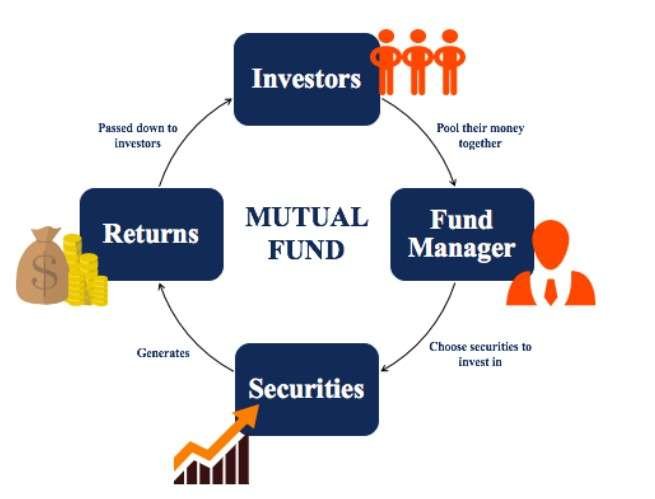

How do mutual funds work?

Fund house collects money from investors. This fund is then invested in securities such as equities, bonds, etc. Investors get units of the mutual fund as per the amount they have invested.

Pictorially the entire process can be elucidated as under:

What is the cost of each unit?

The cost of each unit is determined based on the fund’s total assets net of all expenses. Expenses include management fees, securities transaction tax, other taxes, and administrative expenses.

When divided by the total number of shares, Net Asset gives per-share Net Asset Value (NAV).

How to invest in mutual funds online?

To start investing in a fund, you need to have a Permanent Account Number (PAN), a bank account, and be KYC (know your customer) compliant. You can purchase mutual funds through the following:

- Directly with the fund house – You can invest directly with the fund house. This option is available both online and offline.

- Through third-party portals – You can always invest in using third-party portals such as EduFund. These portals have tie-up with fund houses and offer an unmatched investing experience.