You have seen various aspects of ETFs now; you must focus your attention on how to buy ETFs.

ETFs are intangible and transactions cannot take place in a store or a supermarket. Hence, specialized processes are in place to buy ETFs.

How to buy ETF in India?

1: Open a brokerage account

This type of account can be used to buy and sell securities like stocks, ETFs, commodity derivatives, etc.

The broker acts as a custodian for all securities. He also serves as an intermediary between the stock market and the investor. Hence, having a brokerage account is a prerequisite, resulting in a hassle-free online process.

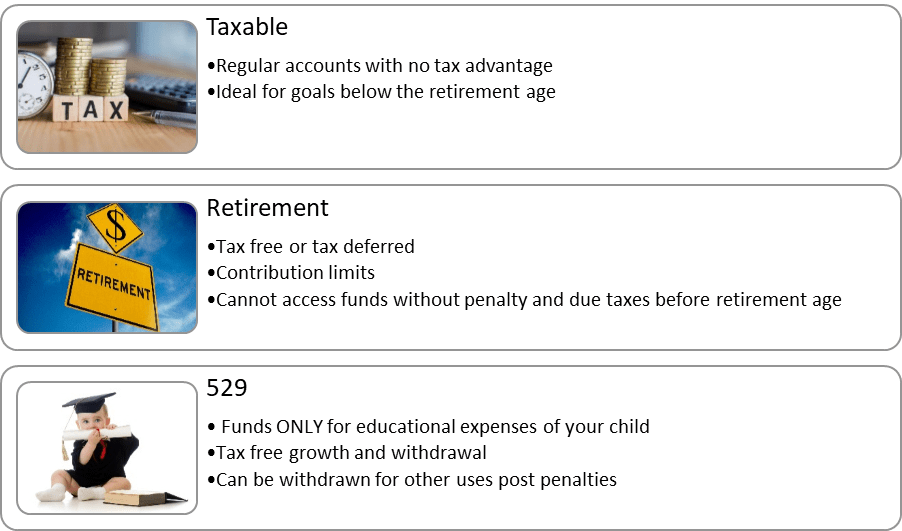

There are different types of brokerage accounts, depending on the investor and his goals. Some prominent types are as follows-

Various brokerage services are available like

- Fidelity

- Merrill Edge

- Zacks

- Trade etc.

You must select a broker based on specific parameters-

- Fees – An investor must look at the fee policy of the broker before opening a brokerage account.

Look at how the broker charges for administration, maintenance, and stock trading commissions.

- Minimum deposits – Some brokers have a minimum balance condition for opening an account.

However, for ETFs, it’s just the cost of one ETF share. Low or no minimums are desirable.

- Types of securities – Not all brokers will allow all types of securities to be tradeable on their platform. Thus, looking at the types of assets that can be traded becomes vital.

- Customer service – The responsiveness and grievance redressal mechanisms of the broker should also be studied.

Now that you have chosen a brokerage account, you must have a clear ETF investment strategy. There are thousands of ETFs available on the market.

The investor must be clear of his goals and invest in an ETF that fulfills such aspirations.

- Stock ETFs offer more incredible growth but at the same time have high volatility and risk.

- Bond ETFs are comparatively less risky and provide fewer returns.

Thus, the realization of a golden balance based on investors’ needs is necessary.

As per investment management firm T. Rowe Price, the asset allocation for retirement based on the investor’s age should be

| Age | Stocks | Bonds | Cash or Cash Equivalents |

| 20s to 30s | 90%-100% | 0-10% | – |

| 40s | 80%-85% | 0-20% | – |

| 50s | 65%-85% | 15%-35% | – |

| 60s | 45%-65% | 30%-50% | 0-10% |

| 70+ | 30%-50% | 40%-60% | 0-20% |

Once the investor has decided upon his investment strategy, they should focus on the ETFs. And should research the various types of ETFs available in the market. The investor should look into a couple of aspects like

- Expense ratio – Expenses eat into the investor’s profits: the lower the expense ratio, the better.

Also, an investor must look at the fees an ETF charges for maintaining the portfolio. In most cases, ETFs have low to nil fees compared to actively managed funds as ETFs generally trace an underlying index.

However, an investor must be vigilant when buying specialty ETFs.

- Volume- ETF volume shows the trading ability of the ETF and, thus, the liquidity. Higher the volume, the lower the spread, and the higher the liquidity.

- Underlying Holdings- Look at the underlying holdings of the ETF.

- Performance- Look at the fund’s past performance and compare that to its peers.

- Market price- Ideally, an ETF should trade near its NAV. Investors should keep in mind the NAV before making any purchases.

2: Buying the ETF

At the very outset, the investor must transfer funds into the brokerage account with which the purchase takes place.

After ensuring sufficient funds, the investor must search for the ETF ticker symbol and place the buy order. The investor also needs to mention the number of ETF shares he wishes to purchase.

Generally, trading ETF infractions is not possible.

Confirm the order. Sit back and relax.

Once an investor purchases the shares, they also need to make an exit strategy to minimize losses (if any) or minimize capital gains taxes.

FAQs

How to choose the best ETF in India?

Here are some checkpoints to complete before choosing the best ETF in India:

- Liquidity: How easy is it to withdraw your money from any given ETF

- Expense Ratio: What is the cost of managing the ETF and how much percentage would you have to pay?

- Tracking errors in any ETFs

- Check past performances and returns of the ETFs you will be investing in

Is ETFs worth investing in?

A fantastic way to vary your investment portfolio is with an ETF. Whenever you participate in the stock market, you have a finite amount of equity options.

What are some advantages of ETFs?

Some of the biggest advantages of ETFs are:

- Diversification and global stock exposure

- Trading flexibility

- Low costs

- Transparency

- Tax efficiency

- Risk management

- Professional management

What are some disadvantages of ETFs?

Some of the biggest disadvantages of ETFs are:

- Additional charges like Hidden fees, trading fees, and operating fees

- Lack of liquidity

- Tracking errors

- lower interest yields.