A Parent’s Guide: How to Plan Your Child’s Engineering Bachelor’s

In the previous article, we discussed, how to plan for your child’s bachelor’s in Australia. In this article, we will discuss how to plan your child’s bachelor’s in engineering

Raising a child involves both, financial and emotional considerations. Along with retail inflation, education inflation is constantly rising.

Once you’ve determined the potential cost of Engineering education and which university to enroll in, the next question is how much you’ll have to pay each semester.

You may relieve your concerns about your children’s academic expenditures by taking a few simple actions like –

- Being specific with your goals,

- Calculating the cost of a bachelor’s in Engineering across universities, and

- Choosing an investment option.

Now, let’s explore them in detail.

Why is it necessary to have an early financial plan for education?

Per an ASSOCHAM analysis, the cost of primary education has increased by 150% in the past 10 years. Regarding professional education, the average rise in tuition costs at the top three IIMs has been roughly 242% in the past 5 years.

Parenthood in the twenty-first century is not an easy task. Education inflation is constantly increasing by more than 10% each year. Consequently, managing educational fees for children is becoming a huge financial concern for parents.

Therefore, if parents plan and take the appropriate measures slightly earlier in a child’s life, covering his or her higher education expenditures will not be a difficult challenge.

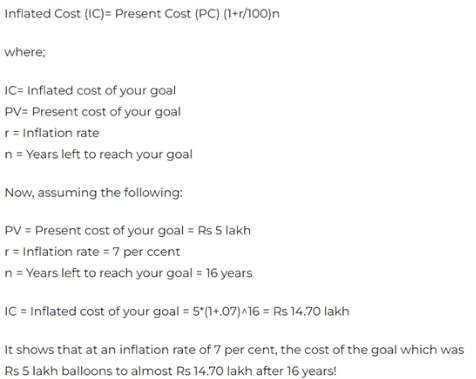

How to calculate the future potential engineering course cost?

It is definitely required to calculate the future potential cost of the present Engineering tuition fees.

The compound interest method computes the future rate of the present educational tuition expenses. For example, suppose the present course price for a Bachelor in Engineering degree is Rs 10 lakh and the inflation rate is 10%.

In that case, the prospective cost after 15 years may be calculated as Target so, you can concentrate on savings accordingly.

Here’s how you can calculate –

Current Amount * (1 + inflation rate) Tenure = 10,00,000*(1+0.10) ^15 = 55,00, 000 (approximately).

Now that the target amount has been established, it is easy to select the types of financial products that would assist you in building a repository of Rs 55 lakh.

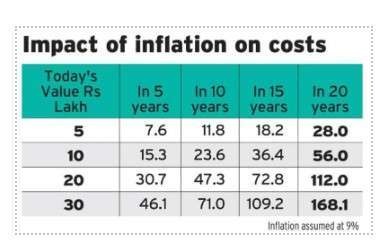

Infographic to show calculations of future potential education costs.

Estimate future education costs

Today, diverse educational websites assist in calculating or categorizing the cost of a bachelor’s in Engineering degree. Create a record of the current cost of the Bachelor in Engineering degree. At this phase, it is important to pick whether the child will study in their home country or abroad.

As a result, when estimating the Bachelor’s in Engineering degree fees, one must also consider the currency component. Only after the present cost is known, determining the probable future cost of the degree on the projected timeline will be easy. This will assist in determining an acceptable savings goal.

Another factor to consider at this stage is inflation. This is because, with education inflation growing at a rate of 10% or higher, inflation is likely to eat into your funds.

First-year total course expenses at the world’s top engineering colleges.

| World’s Top Engineering Colleges | City/ State | Course expenses |

| Massachusetts Institute of Technology | Cambridge, USA | $ 69,000 |

| Stanford University | Stanford, USA | $ 63,000 |

| University of California – Berkeley Campus | Berkeley, USA | $ 48,000 |

| University of Cambridge | Cambridge, UK | $ 68,000 |

| National University of Singapore | Singapore | $ 30,000 |

| Nanyang Technological University | Singapore | $ 33,000 |

| The University of Melbourne | Melbourne, Australia | $ 50,000 |

| University of Toronto | Toronto, Canada | $ 57,000 |

| McGill University | Montreal, Canada | $ 32,000 |

| HECTOR School of Engineering and Management, Karlsruhe Institute of Technology | Karlsruhe, Germany | $ 20,000 |

Course expenses at India’s top engineering colleges:

| India’s Top Engineering Colleges | Course expenses |

| IIT Kanpur | Rs 8.38 lakh |

| IIT Kharagpur | Rs 10.46 lakh |

| IIT Roorkee | Rs 8.58 lakh |

| IIT Guwahati | Rs 8.56 lakh |

| IIT Madras | Rs 8.19 lakh |

| IIT Delhi | Rs 8.66 lakh |

| IIT Bombay | Rs 11.51 lakh |

| IIT Indore | Rs 8.75 lakh |

| IIT Varanasi | Rs 10.41 lakh |

| VIT Vellore | Rs 7.83 lakh |

Plan an early investment option

According to anyone’s financial product expertise and risk tolerance, one can choose equities, borrowing, or a combination of products, including a diversified portfolio, which includes both equity and debt elements.

A child’s education requires a minimum of 15 years to invest. And, for extensive goals, equities are the ideal asset type to concentrate on. If you started saving early, in about 15 years, the multiplier impact in the power of compounding kicks in; the longer the planning range, the greater the multiplier advantage.

To combat excessive inflation, it is critical to employ a multi-asset financial strategy as education expenses have soared.

Education costs have gone up during the previous ten years:

How to plan your child’s Bachelor in Engineering?

Going by the increase in education costs might be alarming. After all, they are not insignificant quantities. The goal should be to participate in a proper instrument regularly and in the appropriate amount, and then you’ll be capable of building this portfolio.

Traditional products, such as fixed deposits, may not be sufficient to cover your child’s educational needs. Other products, such as equities funds, stocks, and balanced funds, should be considered.

You can pick the investing programs based on your investment horizon and timelines. Before establishing an education fund, you should carefully consider the characteristics, dangers, and terms and conditions.

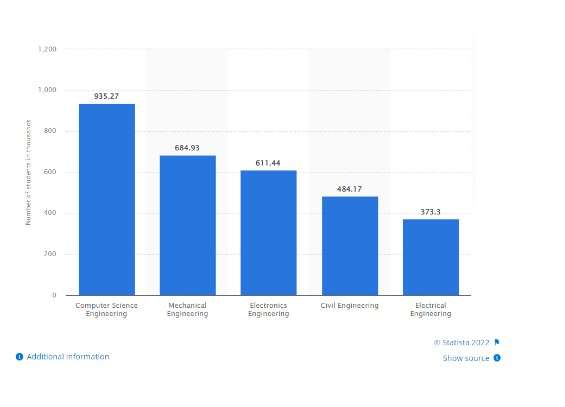

The number of students enrolled for various disciplines of Bachelors In Engineering is increasing every year. It’s becoming a definite need for the parent to start an early investment strategy.

Number of undergraduate engineering students enrolled in India in 2020, by discipline (in 1,000s)

Conclusion

Education expenses are rising, and if you don’t start saving early, supporting your child’s Bachelor’s in Engineering education may become difficult. You must begin by outlining specific goals, like the child’s desired schooling and the associated fees.

This can assist you in determining how much you can set aside for savings after paying all of your monthly expenses. As the objective financial approach, it is prudent to limit your stock exposure to mitigate the risk of adverse market fluctuations.

recommended reading

10 Benefits of Studying in Canada!

10 Reasons Why You Should Study in the USA

11 reasons to study in Australia

4 essential tips on investing in your child's education

4 Reasons why you should have an EduFund

5 Reasons why Global Education is the Best for Indian Students

5 reasons why your child's college education is at stake

5 steps to apply for art school admission

5 ways to deal with rising college fees for your child!