ICICI is a leading Asset Management Company (AMC) in the country focused on bridging the gap between savings and investments and creating long-term for investors through a range of simple and relevant investment solutions.

Let us talk about the flagship product – ICICI Prudential FMCG Fund

About ICICI Prudential FMCG Fund

Investment objective

To generate long-term capital appreciation through investments made primarily in equity & equity-related securities forming part of the FMCG sector.

However, there is no assurance or guarantee that the investment objective of the Scheme would be achieved.

Investment process

The ICICI Prudential FMCG Fund invests prominently in FMCG stocks as FMCG is purchased frequently and in regular intervals and the FMCG market in India is large given that it has the 2nd largest population in the world.

It chooses stocks that have very high growth potential. The Scheme may invest in derivatives such as Futures & Options for the purpose of hedging and portfolio balancing.

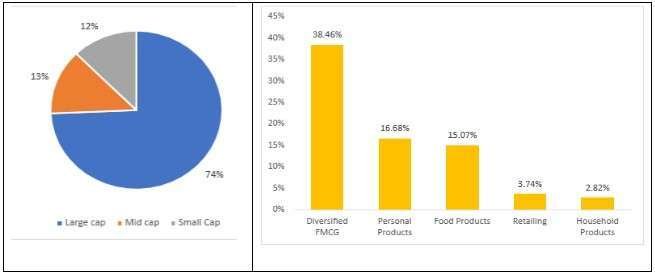

Portfolio composition

The portfolio holds the major exposure in large-cap stocks at 74% and sectorally major exposure is to Diversified FMCG which accounts for almost 38% of the portfolio. The top 5 sectors hold nearly 76% of the portfolio.

Source: ICICI Pru AMC

Top 5 holdings for ICICI Prudential FMCG Fund

| Name | Sector | Weightage % |

| ITC Ltd. | Indian Hotel Chain | 20.29 |

| Hindustan Unilever Ltd. | Consumer Goods Company | 18.17 |

| Nestle India Ltd. | Food & Beverage Company | 6.69 |

| Britannia Industries Ltd. | Food Industry | 5.65 |

| Dabur India Ltd. | Consumer goods company | 5.41 |

Source: ICICI Pru AMC

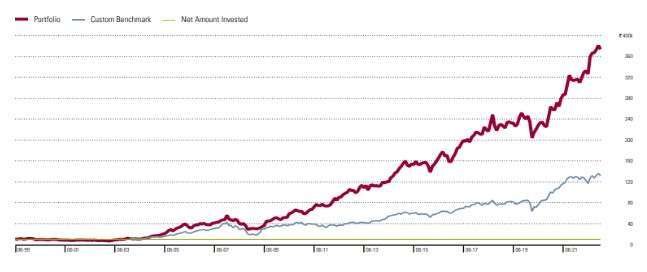

Performance over 23 years for ICICI Prudential FMCG Fund

If you would have invested Rs. 10000 lakhs at the inception of the fund, it would be now valued at Rs. 3.73 lakhs.

Source: Morningstar.

The fund has given consistent returns and has outperformed the benchmark over the period of 23 years by generating a CAGR (Compounded Annual Growth Rate) of 16.59%.

Fund manager

Priyanka Khandelwal – Comes with a total experience of 11 years. She has been with ICICI Prudential since October 2014. She joined ICICI Pru in Strategic Planning and Analysis.

Who should invest?

Investors looking for

- Long-term wealth creation.

- An equity fund that primarily invests in a select group of companies in the FMCG sector.

Why invest?

- ICICI is a renowned name in the finance industry with a proven track record

- FMCG is a booming sector in India and all over the world as the demand for the FMCG sector never goes down.

Horizon

- One should look at investing for a minimum of 7 years or more

- A systematic investment Plan (SIP) is an ideal way to take exposure as it helps tackle market volatility

Conclusion

The ICICI Prudential FMCG Fund has delivered consistent returns over 23 years with a proven track record and has delivered 16.59% CAGR consistently.

Thus, suitable for investors who want sectoral exposure in their portfolio and FMCG is a better-performing theme compared to others.

Disclaimer

This is not recommendation advice. All information in this blog is for educational purposes only.