What is SIP?

Before we get into SIP investment myths in India, let’s look at what is SIP.? SIP (Systematic Investment Plan) is a disciplined way of investing. In this, the investor makes periodical payments to create a corpus at the end of the investment horizon.

SIP mode is one of the effective ways for retail investors to generate wealth over a long period. SIP has become a prevalent mode of investment as you can start as low as Rs.100 depending on the fund.

Some advantages of investing via SIP

- They offer your portfolio the power of compounding. In this, the returns you earn with your existing sip investments get reinvested, and you generate returns on that too.

- SIPs have a low initial cost; you do not have to start with high amounts and are the best option for retail investors.

- It offers you the advantage of rupee cost averaging. It is a concept where you acquire more units of the investment when the fund’s NAV – Net Asset Value is low.

It creates a disciplined way of investing in every investor. This helps the individual to achieve their investment goals and objectives.

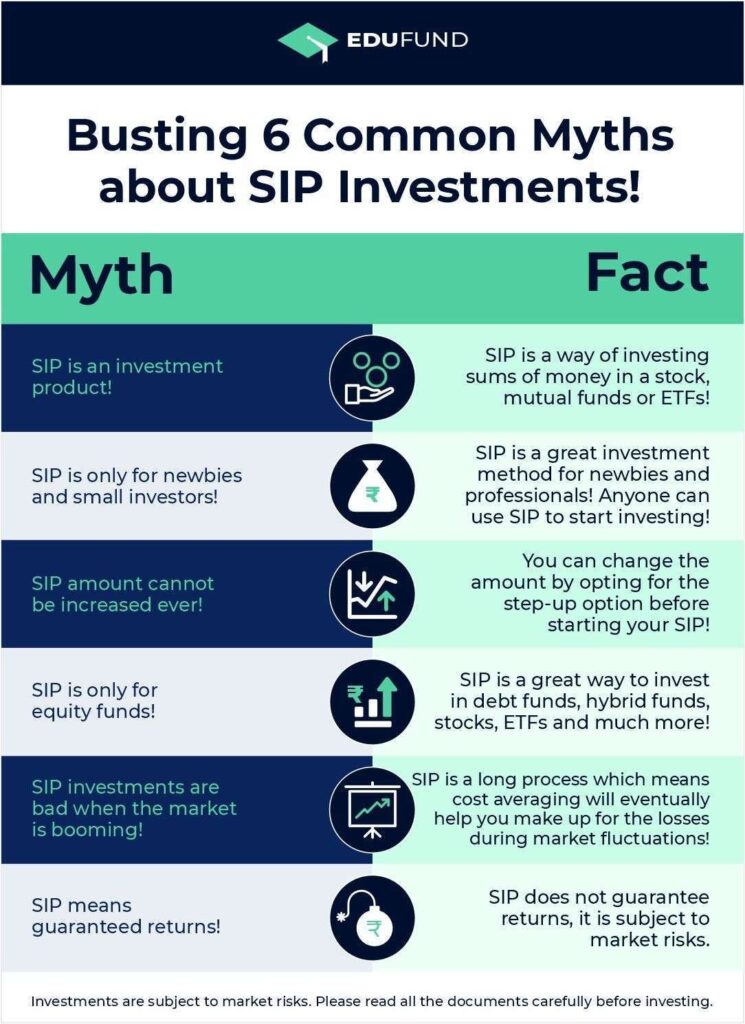

Busting the common SIP investments myths

1. SIP is an investment instrument

The common misconception that people have when they start their investment journey is that SIP in itself is an investment product.

The common question is, how much will the SIP generate? But one thing to remember is that SIP is not an investment instrument.

It is an investment mode through which you can invest in mutual funds.

2. Only small investors should take the SIP route

SIP is the best way for a retail investor to start with smaller amounts, but it is not confined to just too small investors. Even investors with higher periodical investments can use SIP to generate wealth.

For example, an investor can invest through SIP mode with Rs. 500 or even Rs. 20000 depending on their savings.

3. SIP amount or tenure cannot be modified

Investments are meant to be flexible to help smooth an individual’s investment journey. People often assume that the SIP tenure and amount cannot be changed, which adds pressure on the investor.

This is not the case. SIP tenure and amount can be modified with some conditions involved. In the case of equity funds, there is an exit load if the fund is exited before the one-year tenure is complete.

Moreover, ELSS or tax saving schemes have a lock-in of 3 years. But other than this, SIP investments are very flexible to fit the investor’s requirements.

Additional read: Is SIP a good way to save for your child’s college?

4. SIP is only for Equity funds

SIP investments are recommended more in equity funds as such funds are more exposed to market volatility. However, investing in debt-based mutual funds via SIP mode is equally beneficial.

They almost replicate the way recurring deposits (RDs) work but with the potential of better returns. Moreover, you have a variety of debt funds to choose from while making your investment.

Understanding SIP investment

5. SIP investments should not be made when the market is booming

During a bull run, when the markets are continuously rising, people always think it is not the right time to invest. But this is not correct in the case of SIP investments.

When you invest in a SIP mode, the number of units purchased will be less due to the high Net Asset Value (NAV), but SIP is a long-term process.

The markets will change and not stay the same due to fluctuations and volatility. When the market falls, SIP investment acquires more units at a discounted NAV, averaging out the overall NAV of the Mutual fund holding in the portfolio.

6. SIP means guaranteed returns

SIP investments help you invest in any fund at periodic intervals. They’re considered a safer option as you don’t have to time the market as in the case of lumpsum investments.

But still, Mutual funds are also subjected to market risks and volatility. In the short term, SIPs do not generate guaranteed returns.

Instead, SIP helps an investor with long-term capital appreciation. Therefore, every investor should be prepared for market volatility and have a risk appetite before investing.

If you are looking to invest in a Mutual fund through the SIP route, be prepared to be invested for a long time with a wealth creation perspective.

7. SIP is a Product

SIP is not a product. It is an investment tool. As an investor, you can use it to invest via SIP in stocks, mutual funds, index funds, and even in recurring deposits or PPF.

SIP is an excellent investment tool that helps one become a disciplined and consistent investor for the long haul.

FAQs

Is it worth investing in SIP?

Yes, investing in SIP is worth it. SIP (Systematic Investment Plan) is a disciplined way of investing. The investor makes periodical payments to create a corpus at the end of the investment horizon.

Is there any chance of loss in SIP?

Yes, there can be losses in SIP. SIP is a means of investing in mutual funds, stocks and other investment products. These products are subject to market risk and can fall & rise as a result of market changes.

Is investing in SIP profitable?

Yes, SIP is profitable. It allows you to invest small sums of money for a long duration and grow it into a sizable corpus.

Does SIP have market risk?

Yes, SIP does carry market risk especially if you are investing in mutual funds. This is because the latter is subject to market risks.

SIPs guarantee profits. Is that true?

No, SIPs don’t guarantee profits. They’re subject to market fluctuations; returns depend on the performance of the underlying investments.

SIPs are only for the wealthy. Can anyone invest in SIPs?

SIPs are affordable, allowing people with modest incomes to start investing and benefit from compounding over time.

SIPs are only for stocks. Can I use SIPs for other assets?

Yes, SIPs can be used for various assets like mutual funds, gold, bonds, and more, not just stocks.

How to start a SIP?

You can start a SIP on the EduFund App to save for your kid’s college, school fees, education expenses like uniform, laptop and much more. All you need is a bank account, PAN card and your adhar card to get started. Download the App today and start investing in over 5000 funds from all the top mutual fund companies in India.