PSU… We heard a lot about this after our PM Narendra Modi gave a green signal about it during a discussion on the motion of no-confidence in the Council of Ministers and since then it has never looked back. We are observing all the PSU stocks are reaching new heights every day.

PSU are closely linked to the core sectors of the economy and have been successfully able to build a strong industrial base in the country. These undertakings are majorly covered by the Government of India. Since most of the entities are owned or backed by the Government of India, it does not have the credit risk. PSUs have a long-lasting presence in India. The sector contributes around 15% of India’s GDP.

The current total market cap of the PSU companies is more than ₹20 lakh crore. PSU contributes a good amount of money regularly to the government in the form of dividends, excise duty, customs duty, and corporate tax. PSU is majorly impacted by any changes in government policies.

The valuation of stocks in our favorite capital goods, healthcare, QSR and real estate sectors discount growth for the next few years and leave absolutely no room for any disappointments. We would have had to remove such stocks from our portfolio as it would not be correct to keep such stocks for a healthy portfolio.

As the late ‘Big Bull’ Rakesh Jhunjhunwala had predicted, it has been tough for investors to ignore PSU stocks in 2022 as several of them, spread across industries in railways, banks, and defense have turned multi-baggers.

Why is PSU undervalued?

PSU stocks often trade at undervalued prices due to government policies prioritizing public welfare over investor attractiveness. Unlike private companies, government-run enterprises are not solely profit-driven.

In this context, the State Bank of India (SBI) stands as the largest PSU bank, closely followed by Punjab National Bank (PNB). However, it’s not just banks; PSUs across various sectors have shown profitability.

LIC, the second most profitable PSU, recorded a net profit of ₹35,997 crore in FY23, marking a remarkable 773% increase from the previous year. Additionally, companies like ONGC, Coal India, NTPC, PFC, Power Grid, and REC Ltd. consistently report impressive profits year after year.

In aggregate, the 55 stocks within the S&P BSE PSU Index, spanning sectors such as finance, power, oil & gas, capital goods, metals & mining, transport, telecom, agriculture, and more, collectively generated a net profit of Rs 3.40 trillion in FY23.

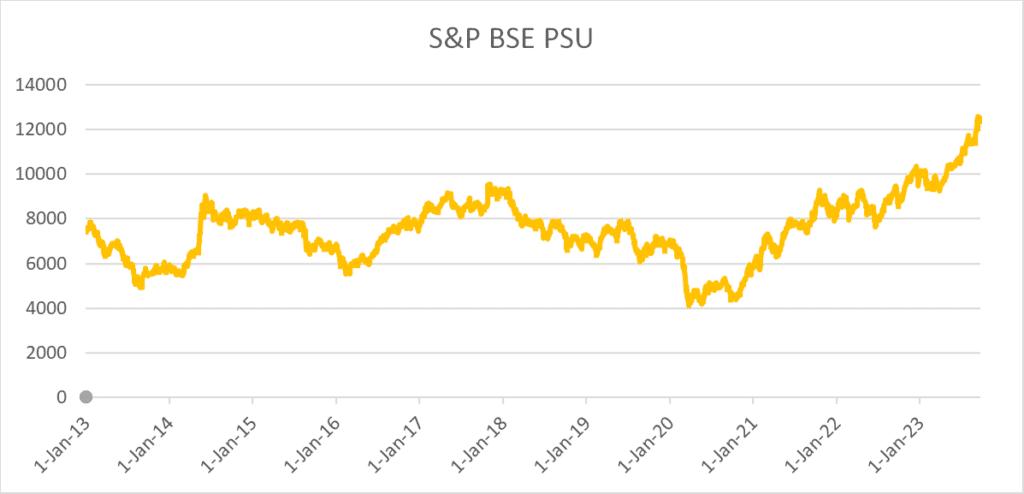

This trend is evident in the performance of the S&P BSE PSU – Total Return Index (TRI), which has experienced significant growth, especially since August 2020.

Period: 01/01/2013 to 01/01/2023 (10 years)

Source: bseindia.com

Comparison of BSE Sensex and BSE PSU

| Period | BSE Sensex | BSE PSU |

| 22-09-2022 to 22-09-2023 (1 year) | 11.65% | 34.95% |

| 22-09-2020 to 22-09-2023 (3 years) | 20.49% | 39.09% |

| 21-09-2018 to 22-09-2023 (5 years) | 12.36% | 10.76% |

(Source: bseindia.com)

Why does PSU make sense now?

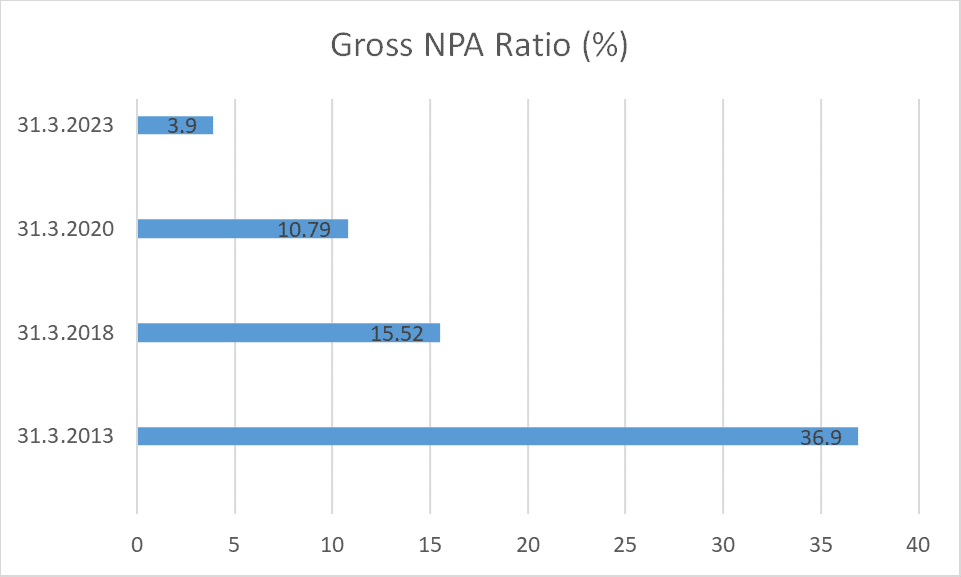

The Indian government has implemented a robust strategy known as the “4Rs” to fortify Public Sector Banks (PSBs). This strategy focuses on transparently recognizing Non-Performing Assets (NPAs), efficiently resolving and recovering value from stressed accounts using clear legal processes, infusing capital into banks, and instituting reforms through the PSB Reforms Agenda.

Thanks to this comprehensive approach of recognition, resolution, recapitalization, and reforms, the percentage of non-performing assets in banks has reached its lowest point in a decade, standing at just 3.9% of total advances.

How should an investor take exposure to the PSU theme?

To play the PSU theme, investors have an option to evaluate PSU Mutual Funds.

Thematic Public Sector Undertakings (PSU) Mutual Funds are a type of investment where your money is combined with that of other investors. These funds then use this pool of money to buy shares in companies owned by the government.

The special thing about these funds is that they don’t just invest in one type of industry. Instead, they spread your money across different government-backed companies. In simple words, PSU mutual funds put your money into shares of government-backed companies.

This way, your investment becomes like a mixed bag of different PSUs from different areas. This helps spread out the risk and can be tailored to your risk tolerance and financial goals.

As per rules by the Securities and Exchange Board of India (SEBI), these thematic PSU funds have to put at least 80% of your money into stocks from public sector companies.

There are different schemes that follow the PSU theme and are available for investors to consider

| Fund Name | SBI PSU Fund | Aditya Birla Sun Life PSU Equity Fund | ICICI Prudential PSU Equity Fund |

| Category | Equity | Equity | Equity |

| Category | Thematic-PSU | Thematic-PSU | Thematic-PSU |

| Fund Age | 10 yrs 8 m | 3 yrs 9 m | 1 yrs 1 m |

| Fund Size | ₹ 679 crore | ₹ 1,246 crore | ₹ 1,474 crore |

| Returns | |||

| 6 months | 38.50% | 36.23% | 27.11% |

| 1 year | 49.06% | 49.17% | 33.20% |

| 3 years | 38.32% | 42.27% | NA |

| 5 years | 16.11% | NA | NA |

| Risk Measures | |||

| Standard Deviation | 20.42 | 20.32 | NA |

| Portfolio Allocation | |||

| Equity% | 91.84% | 97.75% | 91.63% |

| Debt% | 0% | 0% | 2.02% |

| Sectoral Allocation | |||

| Top 3 sectors | Financial (30.62%) | Financial (31.02%) | Energy (50.69%) |

| Capital Goods (19.66%) | Energy (29.65%) | Financial (22.82%) | |

| Energy (19.48%) | Capital Goods (12.37%) | Materials (7.18%) | |

| Expense Ratio | 1.34% | 0.75% | 0.51% |

| Exit Load | 0.50% | 1% | 1% |

| Lock-in | No Lockin | No Lockin | No Lockin |

| Benchmark Index | S&P BSE PSU TRI | ||

| Min. Investment | SIP ₹500 Lumpsum ₹5000 | SIP ₹500 Lumpsum ₹500 | SIP ₹100 Lumpsum ₹5000 |

| Investment Horizon | Good for long-term | Good for long-term | Mittal Kalawadia Anand Sharma |

| Managed By | Richard D’souza | Dhaval Gala | Mittul Kalawadia Anand Sharma |

| Link | SBI PSU | ABSL PSU | ICICI Prudential PSU |

Source: EduFund Research

Who should invest in it?

Opting for thematic mutual funds can be an excellent choice if you want exposure to a diversified portfolio of public sector enterprises spanning various industries.

By doing so, you can enjoy the advantages of diversification while unlocking the potential for optimal returns. Additionally, for risk-averse investors, allocating funds to PSU companies is a prudent move, given their generally higher safety profile compared to other thematic sectors.

Conclusion

Public Sector Undertakings (PSUs) are experiencing a significant uptrend due to anticipated government disinvestments aimed at meeting fiscal goals.

Notably, several PSU banks are exploring capital raising to safeguard asset quality. It will be intriguing to observe the outcome and the sustainability of stock prices at these heights.

These mutual funds offer an attractive option for investors seeking secure investment avenues for surplus funds. They help preserve your entire portfolio while delivering consistent returns.