Tata Asset Management Private Limited (TAMPL) manages investments of Tata Mutual Fund. TATA is one of the pioneers of the Indian Mutual Fund Industry. With an average AUM of more than Rs 1.3 Lakh crore, the AMC is among the oldest asset management companies in the country. It has a 30-year track record in investment management. Let us get to know about – Tata Money Market Fund.

About Tata Money Market Fund

Investment Objective – The investment objective of the scheme is to generate returns with reasonable liquidity for the unitholders by investing in money market instruments.

Investment Style – A money market scheme (liquid fund category) that invests 100% of its net assets in money market securities i.e., securities having a maturity of less than one year.

Investment Philosophy

- Liquidity: To manage the short-term cash surplus of investors and provide optimal returns with moderate levels of risk & high liquidity.

- Low Risk: Effective credit risk management. Investments are only done in high-quality money market instruments

- Transparency: Clearly defined investment universe & asset allocation. All disclosures & portfolios are publicly available.

Portfolio Composition

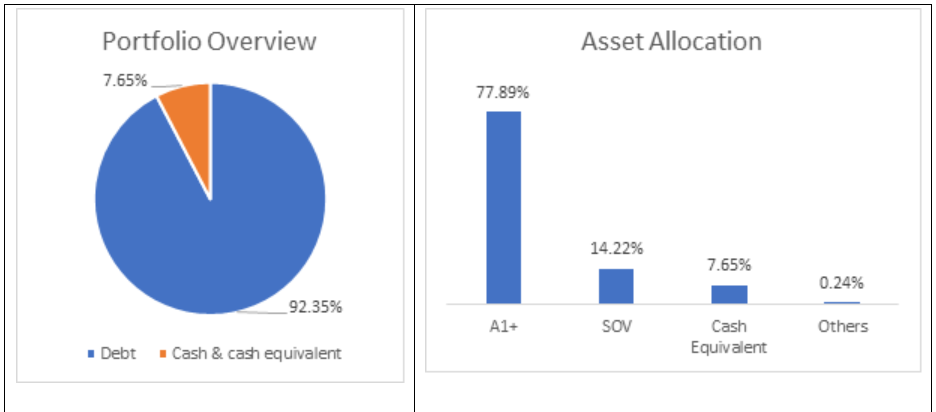

The portfolio comprises 92.35% allocation in debt, and the remaining 7.65% is held in cash and cash equivalents.

Source: Value Research

Top 5 Holdings for Tata Money Market Fund

| Name | Instrument | Weightage % |

| Punjab National Bank CD 31/01/2025 | Certificate of Deposit | 4.24 |

| ICICI Securities Ltd CP 365-D 23/01/2025 | Commercial Paper | 4.22 |

| Reserve Bank of India T-Bills 182-D 06/06/2024 | Treasury Bills | 3.48 |

| Small Industries Devp. Bank of India Ltd CD 07/02/2025 | Certificate of Deposit | 3.38 |

| Kotak Mahindra Bank Ltd CD | Certificate of Deposit | 3.25 |

Source: Value Research

Performance Since Inception

| Period | Tata Money Market Fund return (Annualised) (%) | CRISIL Money Market B-I Index (%) | CRISIL 1-year T-bill Index (%) |

| 1 Year | 7.88 | 7.66 | 7..36 |

| 3 Years | 5.85 | 5,68 | 5.06 |

| 5 Years | 6.26 | 5.78 | 5.52 |

| Since Inception | 6.61 | 7.03 | 6.42 |

Source: tatamutualfund.com

Fund Manager

Mr. Amit Somani, has over 21 years of experience in Global and Indian financial markets specializing in Credit Analysis and Fund Management. Amit is currently managing Tata’s Liquid Fund, Money Market Fund and Banking & PSU Fund. He joined Tata Asset Management Pvt. Ltd. as a Credit Analyst in the year June 2010 and since September 2012, he has been working as a Fund Manager (Fixed Income). He has been managing this fund since 16th October, 2013.

Who Should Invest in Tata Money Market Fund?

This fund is suitable for Investors

- Who have a short-term investment horizon and low risk appetite.

- Who are looking for regular income over short term.

- Who wish to seek exposure in money market instruments.

Ideal Time to Stay Invested

- Ideal for investment with a time horizon of up to 12 months.

Want to start investing for your child’s future?

Conclusion

Tata Money Market fund is an open-ended debt scheme investing in money market instruments. It has relatively low interest rate risk and moderate credit risk and serves as an alternative to traditional instruments such as FDs. The portfolio of this fund is composed of high-quality bonds and is positioned to capture yield movement in the short term. Thus, investors who want to park their money for a short period with low to moderate risk metrics can explore this fund.

Disclaimer: This is not recommendation advice. All information in this blog is for educational purposes only.