What are the top 3 ETFs in the Mega cap category?

Earlier we read about the top three ETFs in the small-cap category. In this article, we will look into the top three ETFs in the mega-cap category. However, before that, let’s understand what mega-cap is.

What exactly is Mega-Cap?

As measured by market capitalization, the largest corporations in the financial universe are mega-cap.

Mega-cap firms have a market capitalization of more than $200 billion, and the exact criteria vary depending on market conditions. Apple (AAPL), Amazon (AMZN), and Meta (FB), previously Facebook, are just a few of the companies that have significant brand awareness and operate in large regions around the world.

Overview of Mega Cap

Mega-cap stocks often hold a substantial impact in various industry sectors due to the sheer size and volume of sales of goods and services in a given period.

For example, Apple has a market worth over $2 trillion due to continuing iPhone sales strength. Amazon has reached new highs thanks to the success of its retail operations and web services, and Facebook has renamed itself, Meta, to reflect its future focus.

Currently, there are roughly a dozen businesses listed on the New York Stock Exchange with market capitalizations exceeding $300 billion, most of which are in the technology industry.

The top three ETFs in the mega-cap category

| Rank | ETF |

| 1 | iShares Global 100 ETF |

| 2 | Vanguard Mega Cap Growth ETF |

| 3 | iShares Russell Top 200 ETF |

1. iShares Global 100 ETF

Overview

IOO’s parent index, the S&P Global 1200, aims to provide market-cap-weighted coverage to 100 of the world’s largest multinational companies. It lands firmly in the mega-cap rather than the large-cap area.

The fund completely avoids midcaps. It has some sector and geographic tilts due to its focus on mega-caps and the avoidance of emerging economies outside Korea.

The index tracks the performance of significant blue-chip corporations with international exposure. Companies must receive a substantial amount of their revenue and holdings from many countries to be deemed global.

The rejigging of the index is done every three months, beginning in March. The MSCI ESG Fund Rating of AAA for the iShares Global 100 ETF is 8.60 out of 10.

The MSCI ESG Fund Rating assesses a portfolio’s long-term resistance to risks and opportunities posed by environmental, social, and governance variables.

Performance

| Performance [as of 03/02/22] | 1 year | 3 years | 5 years | 10 years |

| IOO | 15.18% | 18.53% | 15.06% | 11.64% |

| S&P Global 100 Index | 15.46% | 18.50% | 14.95% | 11.52% |

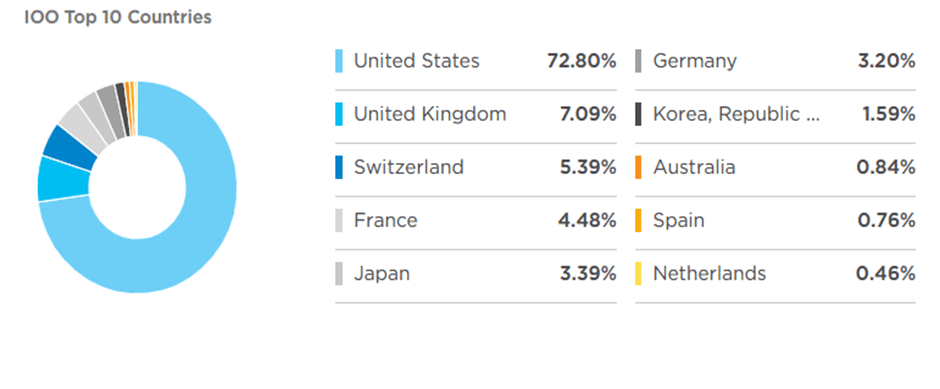

IOO Top 10 Countries exposure

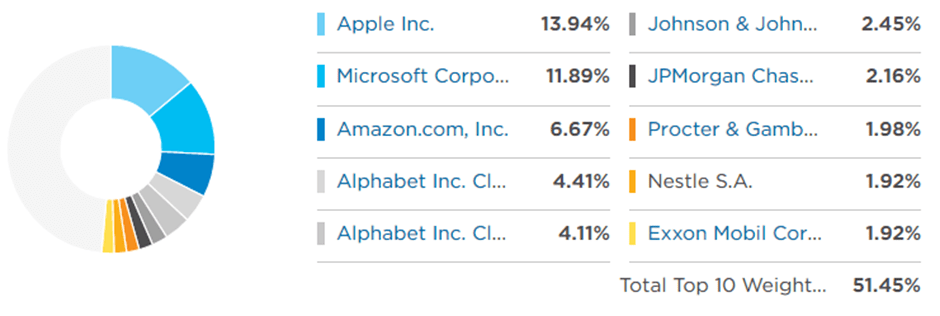

IOO Top 10 Holdings

IOO details

| Brand | iShares |

| Expense Ratio | 0.40% |

| YTD Return | -5.52% |

| AUM | $3.61B |

| Number of Holdings | 104 |

| Avg. Spread ($) | $0.07 |

| Average Daily $ Volume | $18.12M |

2. Vanguard Mega Cap Growth ETF

Overview

MGK targets the biggest growth businesses in the United States. It looks for companies with six growth characteristics: future long-term EPS growth, future short-term EPS growth, three-year historical EPS growth, three-year historical sales per share growth, current investment-to-assets ratio, and return on assets.

Combining all these six growth variables is used to score and rank securities. MGK delivers market-like exposure by having the same capitalization size split as its index and similar sector weighting.

MGK, like all Vanguard ETFs, only publishes its holdings once a month. The MSCI ESG Fund Rating for Vanguard Mega Cap Growth ETF is AA, based on 8.19 out of 10.

Performance

| Performance [as of 03/02/22] | 1 year | 3 years | 5 years | 10 years |

| MGK | 10.51% | 23.76% | 19.86% | 16.85% |

The fund invests entirely in the USA.

Top 10 holdings MGK

MGK details

| Brand | Vanguard |

| Expense Ratio | 0.07% |

| YTD Return | -13.51% |

| AUM | $11.93B |

| Number of Holdings | 111 |

| Avg. Spread ($) | $0.07 |

| Average Daily $ Volume | $105.49M |

3. iShares Russell Top 200 ETF

Overview

IWL provides a broad range of large-cap exposure. This simple fund invests in the top 200 US companies in the Russell 3000 Index, weighted by market capitalization.

The fund’s portfolio has adequate allocations to household brands, representing around 68% of the US equities market. IWL is notable for having a somewhat skewed exposure at the top, as its focus on the top 200 stocks excludes large caps from the bottom.

Fund employs a representative sampling indexing approach rather than copying the index. Every year, the index is recreated and rebalanced. The MSCI ESG Fund Rating for the iShares Russell Top 200 ETF is AA, with a score of 7.78 out of 10

Performance

| Performance [as of 03/02/22] | 1 year | 3 years | 5 years | 10 years |

| IWL | 14.57% | 19.17% | 15.88% | 14.98% |

| Russell Top 200 | 14.81% | 19.33% | 16.09% | 15.16% |

The fund invests entirely in the USA.

Top 10 holdings IWL

IWL details

| Brand | iShares |

| Expense Ratio | 0.15% |

| YTD Return | -8.05% |

| AUM | $959.11B |

| Number of Holdings | 201 |

| Avg. Spread ($) | $0.05 |

| Average Daily $ Volume | $14.09M |

One should look out at these ETFs before investing in the mega-cap category in the USA.

FAQs

What’s the market value of the Mega-Cap category?

The market value of companies under the Mega Cap category should be $200 billion or more.

What are some examples of Mega-Cap companies?

Some publically-funded companies with a market capitalization of $200 billion or more under the Mega-Cap category are Microsoft, Alphabet, Meta, Apple, Amazon, Nvidia, etc.

Why should one invest in Mega-Cap stocks?

Mega-cap stocks often offer stability, a proven track record, protection against market downturns, and potential dividend payouts.

Consult an expert to get the right plan for you

recommended reading

10 Reasons Why You Should Study in the USA

4 essential tips on investing in your child's education

4 W’s of Balanced Advantage Funds

5 financial things to consider before child planning.

5 investment plans every parent should have

5 reasons why SIP is the best investment choice?

5 tips to know before investing in US stocks

5 top investments for risk-averse investors