Unlock Your Financial Potential: Explore the Top 6 Hybrid Funds Now

Hybrid mutual funds are the type of mutual fund scheme that invests in two or more asset classes, i.e., equity, debt, and other asset class, depending upon the fund’s objective.

This helps the fund manager to diversify the portfolio not only among the sectors but also among different asset classes.

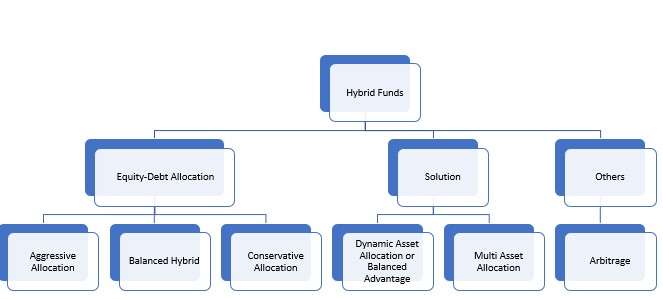

Hybrid funds are subdivided into different categories, i.e., based on equity-debt allocation, based on solutions, and others.

- Aggressive Allocation: The fund has the flexibility to invest 65-80% in equity & equity-related instruments and 20-35% in debt instruments.

- Balanced Hybrid: The fund has the flexibility to invest 40-60% in equity and equity-related instruments and 40-60% in debt instruments.

- Conservative Allocation: The fund can invest 10-25% in equity & equity-related instruments and 75-90% in debt instruments

Types of Hybrid Funds

Hybrid funds come in various types based on their asset allocation:

- Equity-oriented Hybrid Funds: These allocate 65% or more to equity and the rest to debt and money market instruments.

- Debt-oriented Hybrid Funds: They invest at least 60% in fixed-income securities and the remainder in equity.

- Balanced Funds: With a minimum of 65% in equity and the rest in debt, they offer tax benefits on long-term capital gains.

- Monthly Income Plans: These primarily invest in fixed income, with a small portion in equity, providing regular income to investors.

- Arbitrage Funds: These seek arbitrage opportunities by buying low and selling high, switching to debt when opportunities are scarce. They have a tax treatment similar to equity funds.

Each type serves different investment goals, offering a range of risk and return profiles.

Benefits of hybrid funds

Hybrid funds offer several advantages:

- Simplified Diversification: They provide access to multiple asset categories within a single fund, reducing the need for multiple investments.

- Active Risk Management: Hybrid funds actively manage risk through diversification and asset allocation, investing in non-correlated assets like equity and debt.

- Enhanced Diversification: They diversify across various asset classes and sub-classes, such as different stock types and growth/value stocks, boosting portfolio diversification.

- Risk Catering: Hybrid funds cater to various risk profiles, accommodating conservative, moderate, and aggressive investors.

- Multi-Asset Class Exposure: Hybrid funds provide multi-asset allocation to the portfolio by investing in equity, debt, and other asset classes.

- Actively Managed: All the hybrid funds are actively managed by professional fund managers. So, as per the market condition, the fund manager has the flexibility to change the fund’s allocation.

Top 6 hybrid funds

| S.No. | Fund Name | 3-Yr Annualized Performance |

| 1 | Quant Absolute Fund Growth Option Direct Plan | 28.29 % |

| 2 | Bank of India Mid & Small Cap Equity & Debt Fund Direct-Growth | 25.71 % |

| 3 | Edelweiss Balanced Advantage Fund Direct Plan-Growth | 16.37 % |

| 4 | Baroda BNP Paribas Balanced Advantage Fund Direct-Growth | 16.05 % |

| 5 | Bank of India Conservative Hybrid Fund Direct-Growth | 14.74 % |

| 6 | Kotak Debt Hybrid Direct Growth | 12.17 % |

Source: Morningstar

1. Quant Mutual Fund

Fund analysis:

The fund has the flexibility to invest 65-80% in equity & equity-related instruments and 20-35% in debt instruments. The risk grade is above average, and the returns grade is high.

The fund has given consistent performance over different trailing period returns. The fund has outperformed the category average over the period. It has invested in equity and debt securities.

| Pros | Cons |

| Fund has outperformed the category average with good margins. Attractive risk-to-reward ratio. | Low Assets Under Management. |

2. Bank of India Mutual Fund

Fund analysis:

The fund’s objective is to provide capital appreciation and income distribution to investors from a portfolio constituting mid and small-cap equity and equity-related securities as well as fixed-income securities.

The fund holds major holdings in mid-cap companies and the cyclical sector holds 62.84% weightage followed by sensitive 20.52% and defensive 16.64%. The risk grade is high, and the returns grade is also high.

| Pros | Cons |

| High growth potential. Invested in AAA quality bonds. | High expense ratio. |

3. Edelweiss Mutual Fund

Fund analysis:

The fund’s objective is to generate capital appreciation with relatively lower volatility over a longer tenure of time. The Scheme will accordingly invest in equities, arbitrage opportunities, derivative strategies on the one hand, and debt and money market.

instruments on the other. The Scheme may also invest in Infrastructure Investment Trusts and Real Estate Investment Trusts. The fund has outperformed the category average over the long-term period.

The fund has a well-diversified portfolio of 113 equity holdings and 14 bond holdings. The risk grade is average and the returns grade is high. The fund has the flexibility to invest 0-100% in equity instruments and 0-100% in debt instruments.

| Pros | Cons |

| Fund has outperformed the category average with good margins. Fund has invested in both value & growth stocks along with AAA-rated bonds in the debt category. | Fund has underperformed the category average over 3-Months & 6-Months trailing returns. |

4. Baroda BNP Paribas Mutual Fund

Fund analysis:

The fund has the flexibility to invest 0-100% in equity instruments and 0-100% in debt instruments. The risk grade is average, and the returns grade is high.

The fund has a well-diversified portfolio of value & growth stocks and has invested across sectors. In the debt market, the fund has invested majorly in aaa-rated bonds and money market instruments.

| Pros | Cons |

| 5-star rated by Morningstar. The risk grade is average, and the returns grade is high. | Fund has underperformed the category average over 3-Months & 6-Months trailing returns. |

5. Bank of India Mutual Fund

Fund analysis:

The fund can invest 10-25% in equity & equity-related instruments and 75-90% in debt instruments. The risk grade is high, and the returns grade is also high.

The fund has a blended style of investing, indicating both value & growth stocks. The fund has invested across sectors and AAA-rated bonds.

The fund has 23.99% in equity, 50.20% in bonds, and 25.81% in cash & money market instruments.

| Pros | Cons |

| Fund has outperformed the category average over different trailing period returns. The fund has captured the market well when it was falling & rising, better than the category average. | High expense ratio. |

6. Kotak Mutual Fund

Fund analysis:

The fund’s focus is to provide regular income by investing in debt instruments, along with some exposure to equity & equity-related instruments to enhance returns.

The fund may also invest in derivatives to hedge the position. The risk grade is average and the returns grade is high.

The has given a consistent performance over the period and has also outperformed the category average by good margins. The fund has invested 24.88% in equity, 66.94% in bonds, and 8.18% in cash & money market instruments.

| Pros | Cons |

| Consistent performance. The fund captured the market well when it was falling & rising, better than the category average. | Fund has underperformed the category average over 6-Months trailing returns. |

How do hybrid funds work?

Hybrid funds invest in both equity and debt. While equity has the potential to generate high returns, it comes with high risk. On the other hand, debt is a fixed-income instrument with low risk and returns.

So, in hybrid, you can see a fund with moderate risk and return due to the availability of both asset classes. A hybrid fund gives you both asset classes in a single product.

Equity provides long-term gain, whereas debt provides short-term stability or regular income.

Boost Your Financial Liquidity: Dive into the Top 6 Liquid Mutual Funds

Who should invest in hybrid funds?

A hybrid fund is perfect for:

- First-time investors – Investors are looking for stability like fixed deposits and fear the risk of volatility over the short term. Hybrid funds give a good entry point to the equity market.

- Investors with a 3-5 years horizon – For any medium-term goal like buying a car, school fees, etc., hybrid funds can be a good option as returns generated are relatively less volatile.

- Retired Investors: Investors who have retired can look to generate regular income with the help of hybrid funds and their unique asset allocation.

- Short-term investors – Arbitrage funds provide a good option for investors looking to park money in volatile market conditions.

Taxation

1. Equity-Oriented Schemes – A fund with a minimum of 65% in equity or equity-related instruments is treated as equity funds for taxation. Arbitrage funds are also classified as equity funds for tax purposes. For equity, the taxation is as below -.

- Long-Term Capital Gains: If held for more than a year, it is known as long-term capital gains and comes with a 10% tax over Rs 1 Lakh gains which is tax-free.

- Short-Term Capital Gains: If held for less than a year, it is known as short-term capital gains and comes with a 15% tax

2. Other Schemes:

- Long-Term Capital Gains: If held for more than three years, it is known as long-term capital gains and comes with a 20% tax with an indexation benefit.

- Short-Term Capital Gains: If held for less than three years, it is known as short-term capital gains. Gains will be added to the investor’s income and taxed as per their tax slab.

Conclusion:

Investors should consider hybrid funds as part of their portfolios. As they can provide you attractive risk-to-reward ratio along with low volatility.

FAQs

Is it good to invest in hybrid funds?

Hybrid mutual funds are the type of mutual fund scheme that invests in two or more asset classes, i.e., equity, debt, and other asset class, depending upon the fund’s objective.

This helps the fund manager to diversify the portfolio not only among the sectors but also among different asset classes.

What is a hybrid fund example?

Some hybrid fund examples are:

Quant Absolute Fund Growth Option Direct Plan

Bank of India Mid & Small Cap Equity & Debt Fund Direct-Growth

Edelweiss Balanced Advantage Fund Direct Plan-Growth

Is a hybrid fund better than equity?

Hybrid funds are the best of both worlds – equity and debt funds! Investors who are willing to take moderate risks and gain high returns can consider this type of fund after consulting an investment advisor.

Are hybrid mutual funds safe?

Hybrid funds are safer than equity funds and less risky.

Disclaimer:

This is not recommendation advice, use it for educational purposes only. Mutual Fund investments are subject to market risks, read all scheme-related documents carefully. The NAVs of the schemes may go up or down depending upon the factors and forces affecting the securities market including fluctuations in the interest rates. The past performance of the mutual funds is not necessarily indicative of the future performance of the schemes

recommended reading