Earnings Before Interest Taxes Depreciation and Amortization, or EBITDA is one of the most important financial metrics, which speaks about the operation of the business. EBITDA calculates earnings resulting from business operations excluding financing and certain non-operating factors to paint a clear picture of a company’s performance.

This blog will explore what EBITDA is, how it can be calculated, why investors prefer it, its use in valuating companies, comparison of this figure across companies, its drawbacks and uses for investors.

What is EBITDA?

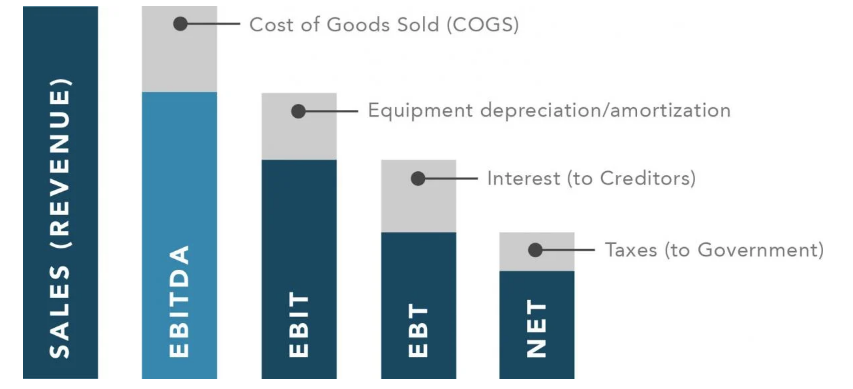

EBITDA means operating income that does not include interest expenses, taxes, depreciation of physical capital assets and other reigning expenses associated with amortization of intangible capital assets. This metric gives a far better picture of the company’s operating efficiency and profit-making potential.

Calculation of EBITDA

To calculate EBITDA, you can use the following formula:

EBITDA=Net Income + Interest + Taxes + Depreciation + Amortization

Alternatively, it can be derived from operating profit (EBIT):

EBITDA= EBIT+ Depreciation + Amortization

This calculation shows how much money is created straight from operations, filtered through the lens of excluding all the noise of financing and accounting. Relative to the Gross Profit technique, EBITDA is especially beneficial in situations where one is comparing multiples of companies that offer similar services or products.

Importance of EBITDA

EBITDA is also an important performance measure because it provides an understanding of real operating profit in the sense of ‘realized’ or ‘realisable’ business operations. By excluding interest, taxes and depreciation and amortisation, investors can be able to see exactly how efficiently a business is performing their core business functions.

Why Investors Favor EBITDA

Investors often prefer EBITDA over net income and other financial metrics for several compelling reasons:

⦁Focus on core operations: EBITDA gives focus to the net income earned through business operation, thus offering a better perspective of business returns.

⦁Elimination of non-operational factors: Interest and taxes included will distort the true picture and therefore EBITDA is preferred as it eliminates the distortion of financing and taxes.

⦁Better comparability: EBITDA is preferred to other measurements of earnings since it makes it easier and uniform to compare companies and industries. It turns out to be very useful when comparing companies with different capital structures or tax treatments.

Comparison with Net Income

Net income as expressed as the total income after all the operating and non-operating expenses have has been charged off and it varies with factors such as interest and taxes among others. But EBITDA gives a much more straightforward look at the operational profit by excluding any factors apart from operating revenue and cost from the company’s operations.

EBITDA as a Valuation Tool

Business valuation uses EBITDA as one of the important factors. One of these is the Enterprise Value (EV) to EBITDA ratio. Analysts use this ratio to evaluate the worth of a business as compared to its earnings before evaluating the structure of capital.

Example:

If a company has an enterprise value of $1 million and an EBITDA of $250,000, the EV/EBITDA ratio would be:

EV/EBITDA = 1,000,000/2,50,000 = 4

A lower EV/EBITDA ratio means that a firm is cheaper relative to other firms in the industry or cheaper than found to be overvalued if it has a higher ratio. It is important for investor through investment prospects assessment and corporations’ worth determination.

Comparative Analysis

One of the strengths of using EBITDA is its ability to provide better comparisons between companies within the same industry. For instance, two firms may have different capital structures or tax obligations; however, their EBITDA can reveal which company operates more efficiently.

The advantage of EBITDA is that it offers improved ability for comparison of companies in different industries. For instance, two firms may have different capital structures or have different tax treatments, nonetheless, the two firms’ EBITDA might show which firm is more efficient than the other.

Case Study Example:

Consider two tech startups – Company A and Company B, be compared based on their balance sheet data; While Company A has high levels of debts leading to high interest expenses, Company B hardly has any debts. In some cases, using net income may obscure the truth, so when comparing only net income, Company A will look less profitable because of the interest. But on comparing EBITDA of both companies’ investors are able to assess that the companies are almost similar in terms of operational margins.

Limitations of EBITDA

Despite its usefulness, relying solely on EBITDA has limitations that investors should be aware of:

⦁Ignores capital expenditures: EBITDA does not factor in fixed capital investments required for ongoing or expansions to the business. The metric does not account for necessary investments that companies often need to make in the capital-intensive industries.

⦁Potential for manipulation: There exist conditions in which organizations employ accounting techniques that distort the EBITDA value. For instance, they might well postpone a certain expenditure or incorporate some outlaying costs in an attempt to boost their proclaimed revenues.

⦁Not suitable for all industries: In the industries demanding large capital investment in the fixed assets (like manufacturing or utility sector), using only EBITDA will not give a accurate picture of the profitability of the firm.

Practical Applications for Investors

Investors can incorporate EBITDA into their investment strategies by:

⦁Screening potential investments: By using EBITDA at least to a certain extent, one criterion can be used for the selection of investment opportunities, in addition to other values such as the growth in revenues and cash flows.

⦁Analyzing trends: It is important to track variability in EBITDA of a company to evaluate an increase or degression in the operation of the company.

⦁Combining metrics: One should use EBITDA in conjunction with other profitability indicators such as the net income and free cash flow so that you would be able compare the company’s current performance and efficiency without the impact of financial transactions affecting the profit and loss account.

Conclusion

EBITDA enables the investors to come up with sound decisions concerning investment by giving light on operating performance and promoting comparisons across industries.

Interested in increasing the EBITDA of your company? Grow your money more intelligently with our customised solutions in Corporate FDs and Mutual Funds from EduFund. Secure the highest possible returns, minimal risks and obtain your desired financial outcomes with ease. What are your waiting for? Get started with EduFund now to finance your education.

About the author

Niraj Satnalika

Head Of Research,EduFund

Dr. Niraj is a finance professional with 12+ years of experience and is part of the founding team at EduFund. He’s worked with Goldman Sachs, CRISIL and Sakal Media in roles spanning investment management, research and leadership. With a PhD in Finance from IIT Bombay, he brings deep expertise in valuation, governance and education planning. When he’s not teaching or writing, you’ll find him cooking or going on long drives.