UTI is one of the pioneers of the Indian Mutual Fund Industry. With over Rs 2.4 Lakh crore, the AMC is one of the most trusted names in the mutual fund space.

The UTI Mutual Fund offers products across asset classes. Let us talk about the flagship product – UTI Dividend Yield Fund.

UTI Dividend Yield Fund

Investment Objective:

The objective of the scheme is to generate long-term capital appreciation and income by investing predominantly in dividend-yielding equity and equity-related securities.

However, there can be no assurance or guarantee that the investment objective of the scheme would be achieved.

Investment Process:

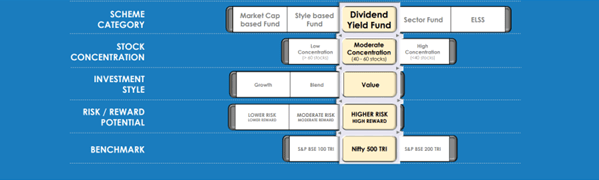

The UTI Dividend Yield Fund would follow a bottom-up approach for stock picking following a value investment style and maintaining a well-diversified portfolio.

By virtue, the fund tends to be less aggressive (less risky) than other types of funds, such as growth stock mutual funds.

Portfolio Composition

The portfolio holds the major exposure in large-cap stocks at 69% and sectoral major exposure is to Information Technology, which accounts for roughly one-fourth of the portfolio. The top 5 sectors hold more than 70% of the portfolio.

Source: UTIMF

Top 5 Holdings in UTI Dividend Yield

| Name | Sector | Weightage % |

| Infosys Ltd. | Information Technology | 8.01 |

| ITC Ltd. | Consumer Goods | 6.49 |

| NTPC Ltd. | Power | 6.06 |

| Tech Mahindra Ltd. | Information Technology | 5.43 |

| Mphasis Ltd. | Information Technology | 4.38 |

Source: UTIMF

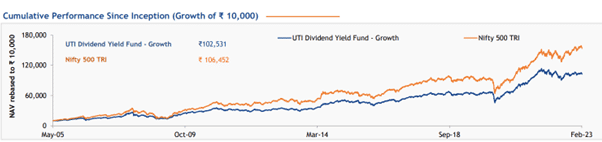

Performance Since Inception

If you had invested 10,000 at the time of inception of the fund, it would be now valued at Rs. 1,02,531, whereas the benchmark (Nifty 500 TRI) would have fetched you Rs1,06,452.

Source: utimf.com

The fund has underperformed against the benchmark. Investors have to be invested for a longer investment horizon to see the fund outperforming the benchmark.

Fund Manager

The fund is ably managed by Mr. Amit Premchandani. Mr. Amit Premchandani is Senior Vice President & Fund Manager – Equity.

He holds a PGDM from IIM Indore and a CFA charter from CFA Institute, USA. He has completed a CA from ICAI. He graduated with a Bachelor of Commerce in 2001 from Heramba Chandra College, Kolkata.

Amit joined UTI AMC in 2009 as a Senior Research Analyst and has covered Banks, NBFCs, telecom, and cement in his research role. In addition, he took up portfolio responsibilities in June 2014. He has over 13 years of experience.

Who should invest?

Investors looking to

- Supplement their core equity portfolio with a differentiated portfolio strategy

- Increase their equity allocation with the intention of relative downside protection

- A twin benefit of capital appreciation as well as dividend yield Investment Horizon

Why Invest?

- The Fund endeavor to benefit from investing primarily in dividend-yielding equity shares at the time of investment.

- The advantage of a portfolio with a ‘value’ style is that it provides a significant upside potential when a revival results in value unlocking.

- Dividend-yielding stocks tend to have higher downside protection. Being rich in cash generations from their business result in a fair amount of stability and tend to be less aggressive (less risky) than other types of funds, such as style-based or market cap-based funds.

- Probable twin benefit of capital appreciation and dividend yield from the fund.

Horizon

- Ideal for investment with a time horizon of, preferably, five years or above

- Investment through Systematic Investment Plan (SIP) may help in tackling the volatility of the broader equity market.

Conclusion

The UTI Dividend Yield Fund has delivered consistent returns in the long run. Investors looking for relatively less risky funds with consistent dividends and capital appreciation returns can consider this fund.

Disclaimer: This is not recommendation advice. All information in this blog is for educational purposes only.