UTI is one of the pioneers of the Indian Mutual Fund Industry. With a quarterly average AUM of Rs 2.72 Lakh crore, the AMC is among the most trusted names in the mutual fund space. The UTI Mutual Fund offers products across asset classes. Let us get to know about their UTI Nifty 50 Index Fund Scheme.

About UTI Nifty 50 Index Fund

Investment Objective – The investment objective is to invest in stocks of companies comprising Nifty 50 Index and endeavor to achieve a return equivalent to Nifty 50 Index by “passive” investment. However, there can be no assurance or guarantee that the investment objective of the scheme will be achieved.

The UTI Nifty 50 Index Fund does not take any active sector or stock exposure that deviates from the composition of the Nifty 50 Index.

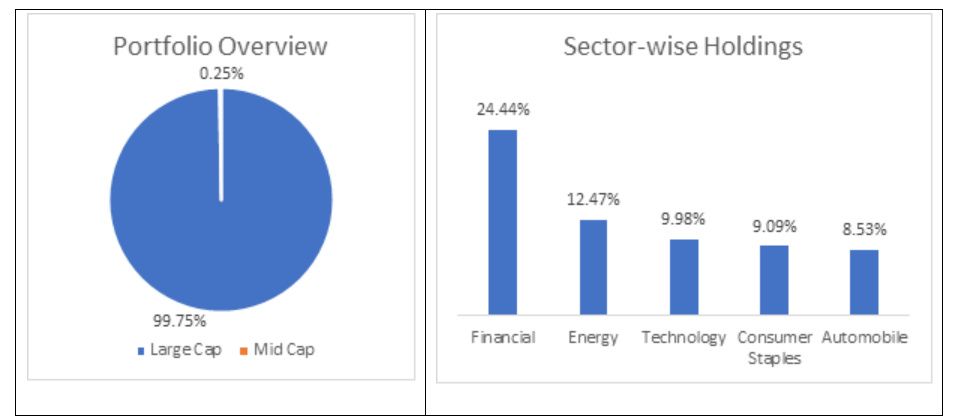

Portfolio Composition

The scheme distributes the majority of its investments across financial services, Energy, IT, fast-moving consumer goods and automobiles.

Source: Value Research

Top 5 Holdings for UTI Nifty 50 Index Fund

| Name | Sector | Weightage % |

| HDFC Bank Ltd. | Financial | 10.98 |

| Reliance Industries Ltd. | Energy | 10.29 |

| ICICI Bank Ltd. | Financial | 7.68 |

| Infosys Ltd | Technology | 6.22 |

| Tata Consultancy Services Ltd | Technology | 4.32 |

Source : Value Research

Start a goal for your child’s college dreams!

Performance Since Inception

| Period | UTI Floater Fund | Nifty 50 TRI (%) | S&P BSE Sensex TRI (%) |

| 1 Year | 28.03 | 28.49 | 24.58 |

| 3 Years | 15.75 | 16.15 | 15.24 |

| 5 Years | 16.22 | 16.64 | 16.48 |

| Since Inception | 11.91 | 12.82 | 13.03 |

Source: utimf.com

Fund Manager

Mr. Sharwan Kumar Goyal, who has been managing the scheme since July-2018.

Mr. Ayush Jain is an assistant Fund Manager and has been managing the scheme since May-2022.

Why Invest in UTI Nifty 50 Index Fund?

- The scheme is passively managed and invests in stocks that endeavour to generate returns in line with the underlying index, subject to expenses and tracking error. Further, the probability of generating alpha in large cap space is very low due to the availability of a smaller universe of stocks and large base size. Therefore, exposure to large-cap space is recommended through passive investing.

- The fund with a track record of over 22 years one of the largest funds in the category fund with one of the lowest tracking error and tracking difference.

Who Should Invest in UTI Nifty 50 Index Fund?

This fund is suitable for Investors

- Who are seeking steady capital growth in tune with the index returns.

- Who are looking for passive investment in equity instruments comprised in Nifty 50 index.

Ideal Time to Stay Invested

- The scheme is suitable for investors with a long-term investment horizon of at least 5 years.

Conclusion

UTI Nifty 50 Index fund is an index-based diversified equity scheme that has delivered a compounded annual growth rate (CAGR) of 11.56% since its inception and the scheme has a relatively lower expense ratio. The UTI Nifty Index Fund offers an accessible option for new investors with a limited budget to diversify their portfolios by investing in India’s top 50 publicly traded companies.

Disclaimer: This is not recommendation advice. All information in this blog is for educational purposes only.