UTI is one of the pioneers of the Indian Mutual Fund Industry. With over Rs 2.4 Lakh crore, the AMC is among the most trusted names in the mutual fund space. The UTI Mutual Fund offers products across asset classes.

UTI Small Cap Fund

Investment objective

The scheme aims to generate long-term capital appreciation by investing predominantly in equity and equity-related securities of small-cap companies.

Investment process

The fund would follow a bottom-up approach for stock picking following a value investment style, and it is an open-ended equity scheme predominantly investing in small-cap stocks.

The fund is well-diversified and aims to exploit the potential growth opportunities of small-cap and select mid-cap companies.

Portfolio composition

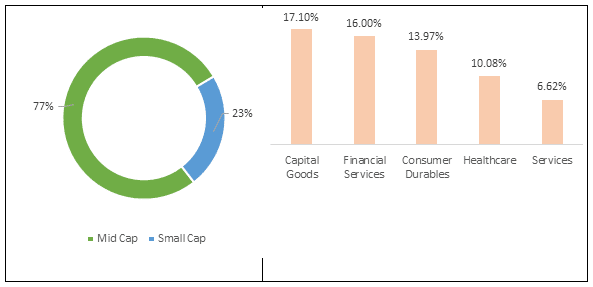

The portfolio holds significant exposure in small-cap stocks at 77%, and significant sectoral exposure is to Capital Goods, which accounts for 17.10% of the portfolio.

The top 5 sectors hold more than 60% of the portfolio.

Source: UTIMF

Top 5 Holdings for UTI Small Cap Fund

| Name | Sector | Weightage % |

| Karur Vysya Bank Ltd. | Financials | 2.71 |

| Carborundum Universal Ltd. | Metals & Mining | 2.49 |

| Brigade Enterprises Ltd. | Construction | 2.22 |

| Timken India Ltd. | Capital Goods | 2.08 |

| Cera Sanitaryware | Materials | 2.01 |

Source: UTIMF

Performance Since Inception

The UTI Small Cap Fund has given a return of -2.94% in one year, whereas the Nifty Small-cap 250 TRI has given a return of -6.03% for the corresponding period.

The fund has generated a CAGR of 18.72% since inception in December 2020, whereas the Nifty Small-cap 250 TRI has given a return of 21.91% for the same period.

Hence the fund has performed better in the last year but underperformed its benchmark over the long term.

Fund Manager

Mr. Ankit Agarwal manages the UTI Small Cap Fund. Mr. Ankit Agarwal joined UTI in August 2019. He has been designated as Fund Manager, managing UTI Mid Cap Fund.

He has more than 12 years of experience. Before joining UTI, he worked with Lehman Brothers and Barclays Wealth and was associated with Centrum Broking Ltd. as Sr. Vice President.

He graduated from the National Institute of Technology (B.Tech.) with a postgraduate degree in Management (PGDM) from IIM, Bangalore.

Who should invest?

Suitable for:

- Investors looking for investment in a portfolio that invests predominantly in small-sized companies.

- Investors with a high risk-taking ability and seeking to benefit from the potential high growth opportunity from a portfolio predominantly investing in small caps.

Why Invest?

The fund aims to exploit the potential growth opportunities of small-cap and select mid-cap companies.

- A well-diversified portfolio of scalable businesses with a long growth runway.

- Pursue a bottom-up stock selection approach to pick businesses with healthy financials and potential for the sustenance of margins over some time

- UTI covers a large cross-section of companies in the small-cap universe. Coupled with robust investment processes, enables this fund to benefit from such opportunities.

- The fund maintains a well-diversified portfolio and follows a patient approach toward companies in the portfolio.

Time Horizon

- Ideal for investment with a time horizon of, preferably, five years or above

- Investment through Systematic Investment Plan (SIP) may help in tackling the volatility of the broader equity market.

Conclusion

The UTI Small Cap Fund has underperformed against the benchmark over the long term, but it has performed better than the benchmark in the last year.

So, investors should remain invested for a longer investment horizon to see the fund outperforming the benchmark.

Hence, investors willing to take exposure to small-cap companies having strong growth potential can consider this fund with a long-term time horizon to see the fund outperforming the benchmark and witness the alpha generation.