What is ESG ETF?

In the previous article, we discussed Marijuana ETFs. In this article, we will discuss ESG ETF.

An ESG investment is a socially responsible investment that considers a company’s impact on the environment, its shareholders, and the planet in addition to financial rewards.

Investors have recently become interested in the financial efficiency of ESG stocks. Many companies with good ESG track records demonstrated lower fluctuation than their non-ESG rivals during the market upheaval caused by the COVID-19 epidemic.

ESG investment was justified for many investors because good corporate behavior leads to more significant financial results.

ESG ETFs?

ESG stands for Environmental, Social, and Governance – the three criteria to adjudge the company’s sustainable performance.

E- Environmental addresses the effect of the company’s business on the planet through

- Climate change policies

- Greenhouse gas emissions

- Carbon footprint

- Water use and conservation and waste disposal

- Renewable energy sources

- Recycling and disposal methods

- Green products, technologies, infrastructure, and so on.

S-Social addresses the company’s responsibility toward society, its employees, and its customers.

- Employee dealing and remuneration

- Employee Skills and Development

- Employee Security and sexual harassment deterrence

- Social inclusion

- Ethical supply chain sourcing

- Mission or higher purpose

- Consumer service

- Whistleblower protection programmers

- Public stance on social justice matters

G – Governance relates to the governance position and standards in the firm.

- Executive remuneration and benefits and their link with long-term corporate value

- Ethical governance policies.

- Social diversity in top-level management.

- Presence of conflict of interest in the board.

- Shareholders’ Influence on the Board

- Tenure of board members

- Mutually exclusive responsibilities of chairman and CEO

- Communication with shareholders is transparent.

- Addressing shareholder grievances.

ESG’s performance evaluation can be done with the help of corporate reporting and third-party sources like MSCI ESG Ratings and Sustain Analytics ESG Ratings.

Why choose ESG ETF?

Environmental, social, and governance challenges are essential threats to operations and profits in every industry. Hence firms segregated on such grounds are bound to perform well in the foreseeable future.

Companies trying to address ESG issues will perform well and have fewer disruptions in business routines. They face less scrutiny from regulators and produce reliable financial returns resulting in a lower risk for investors.

ESG-compliant companies also produce superior financial returns. Take, for instance, JUST Capital’s JUST U.S. Big Cap Diversified Index (JULCD), which analyses the performance of large, publicly traded firms with substantial environmental, social, and governance (ESG) scores.

It comprises half of the Russell 1000 index’s large-cap public firms. Still, it excludes those without a demonstrable dedication to employee well-being, valuable goods, positive environmental performance, and strong communities. For three years, JUST Capital’s JULCD index has outperformed the Russell 1000.

Thus, ESG-compliant investing helps keep portfolio risks at bay and generate competitive returns.

What are some risks of ESG ETF investing?

- There are no universally accepted ESG standards, thus leaving a scope of discretion to the ESG scoring agencies. For instance, some ESG funds also hold companies manufacturing tobacco!

- As ESG is a comparatively newer concept, no long-run data proving its efficacy is available.

- Companies may no longer report sustainability data of their own volition. Any reduction in the availability of high-quality (investable) ESG enterprises results from a general dereliction of ESG qualities.

ESG ETFs have a total asset under management of $159.76 billion, with 50 ETFs trading on U.S. exchanges. The expense ratio is 0.36 percent on average.

With $48.64 billion in assets, the Vanguard Information Technology ETF is the largest ESG ETF. FLCA was the best-performing ESG ETF in the previous year, with a gain of 22.43 percent.

On 11/08/21, the iShares ESG Advanced Investment Grade Corporate Bond ETF ELQD became the most current ETF in the ESG area.

Let us look at some top gainers and losers

Top ETF performers according to etf.com

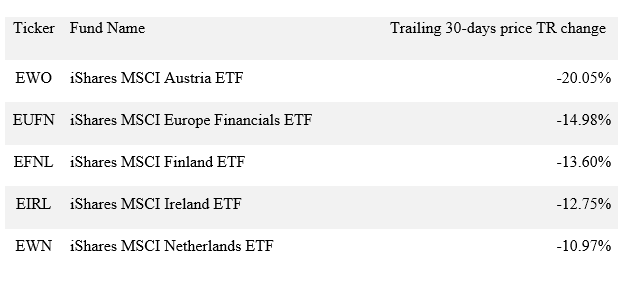

Bottom ETF performers according to etf.com

There is no paucity of money or interest going into ESG investment. ESG investments will stay valid and expand further, thanks to drivers of change like E.V.s and the effect of the coronavirus.

That implies it’s time for investors to start paying notice. A fantastic strategy to assure portfolio success is to align your money with your values.

FAQs

What is an ESG investment?

An ESG investment is a socially responsible investment that considers a company’s impact on the environment, its shareholders, and the planet in addition to financial rewards.

What are some risks of ESG ETF investing?

- There are no universally accepted ESG standards, thus leaving a scope of discretion to the ESG scoring agencies. For instance, some ESG funds also hold companies manufacturing tobacco!

- As ESG is a comparatively newer concept, no long-run data proving its efficacy is available.

- Companies may no longer report sustainability data of their own volition. Any reduction in the availability of high-quality (investable) ESG enterprises results from a general dereliction of ESG qualities.

Consult our expert advisor to get the right plan for you

recommended reading

10 Reasons Why You Should Study in the USA

4 essential tips on investing in your child's education

4 W’s of Balanced Advantage Funds

5 financial things to consider before child planning.

5 investment plans every parent should have

5 reasons why SIP is the best investment choice?

5 tips to know before investing in US stocks

5 top investments for risk-averse investors