While the Dow Jones Industrial Average and the S&P 500 receive the most media attention, investors should be aware that there are several stock indexes.

The Russell 2000, often regarded as the benchmark for smaller U.S. stocks, is one of the most popular indexes that does not cover significant corporations.

With that in mind, here’s a quick review of what investors need to understand about the Russell 2000 Index.

What is the Russell 2000 index and how does it work?

The Russell 2000 index follows the Russell 3000 stock index’s 2,000 smallest public businesses by market capitalization. The Russell 1000 large-cap stock index contains the remaining 1,000 firms.

As small-cap companies, such as those in the Russell 2000, account for a substantially lower portion of the U.S. share market as compared to large caps, the Russell 2000 accounts for around 10% of the market capitalization of the entire market.

The FTSE Russell Group ranks every company in the Russell 3000 based on market capitalization. It divides the top 1/3 into the Russell 1000 and the bottom 2/3 in the Russell 2000 to determine which companies make each list.

Every May, the FTSE Russell Group re-examines companies to see if their current ranking is appropriate – because corporations grow or shrink coverage, and new businesses that deserve to be in the indexes may emerge.

Eligible firms that go public via an initial public offering (IPO) and fit by market capitalization can be included in the Russell 2000 every quarter between the yearly rank day reconstitution.

As a result, the Russell 2000 may occasionally monitor over 2,000 equities.

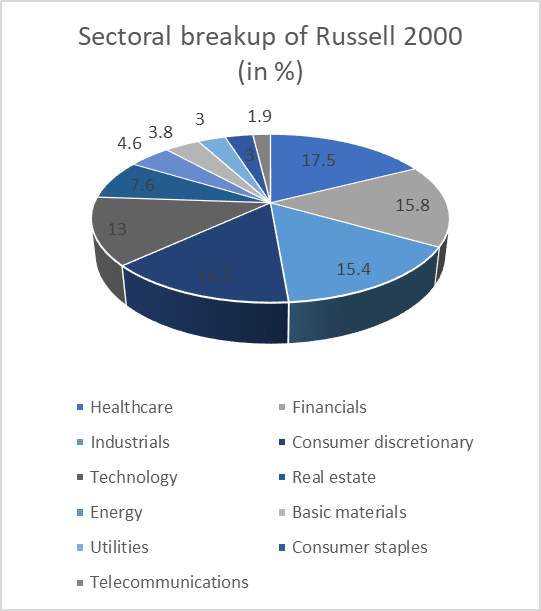

Breakup of index

Here is a look at some of the companies in the index and the sectoral breakup.

| Company | Ticker |

| AMC Entertainment | AMC |

| Asana | ASAN |

| Crocs Inc. | CROX |

| Ovintiv Inc. | OVV |

| Tetra Tech Inc | TTEK |

| Lattice Semiconductor | LSCC |

| Intella Therapeutics Inc | NTLA |

| Avis Budget Group Inc | CAR |

| Silicon Laboratories Inc | SLAB |

| Macys Inc | M |

Related indices

FTSE for traders keen on tracking the performance of specific areas of the small-cap world, Russell Group divides the Russell 2000 into smaller indexes. The following are some of the additional indexes

- Russell 2000 Defensive

- Russell 2000 Dynamic

- Russell 2000 Growth

- Russell 2000 Value

- Russell 2000 Growth-Defensive

- Russell 2000 Growth-Dynamic

- Russell 2000 Value-Defensive

- Russell 2000 Value-Dynamic

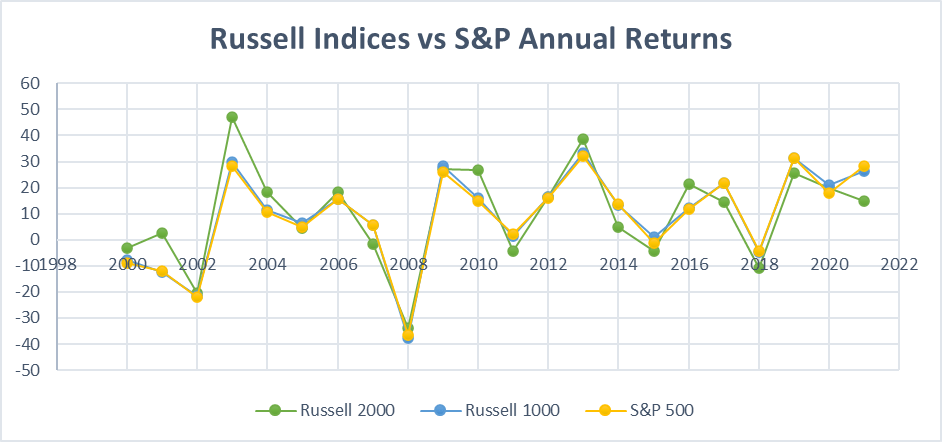

The Russell 2000 Index performance

Since 2000, the Russell 2000 has outperformed the Russell 1000 (the Russell 3000’s large-cap section) and the S&P 500 in terms of total yearly returns.

The Russell 2000 small-cap index follows the S&P 500 large-cap index rather closely, though there are periods when it moves more significantly on one side or the other.

Small-cap stocks are much more volatile than large-cap stocks in general. Thus, they react more significantly to market changes.

The Russell 2000 Limitations

Investors who desire to invest in small-cap stocks follow the Russell 2000. Keep in mind that the index excludes hundreds of companies that are too insignificant to be in the index.

The Russell 2000 does not include the “micro-cap” category, which represents the smallest companies on the market. They are, nevertheless, among the fastest-growing equities in the market.

Investors who rely too heavily on the Russell 2000 may be missing out on opportunities in other industries and areas.

For example, the index favors financials, health care, tech, and industrials, but it has little representation of companies in the communications and materials industries.

What is the best way to invest in the Russell 2000 index fund?

You don’t have to buy all 2,000 stocks in the Russell 2000 Index to invest in it. You can invest in the index through a mutual fund or an exchange-traded fund (ETF) that tracks it passively.

The Vanguard Russell 2000 ETF (VTWO), for example, invests in all of the stocks in the index based on their relative weights.

The ETF’s costs are low, with a 0.10 percent expense ratio, so its long-term returns should be nearly comparable to those of the index sectors.

Should you put your money in the Russell 2000 index?

The Russell 2000 index is a brilliant complement to any investment portfolio, but it isn’t for everyone.

The Russell 2000 exposes investors to the greater risk and greater reward of small-cap investing without disclosure to any firm or industry because of its broad exposure.

This can provide investors with the perfect blend of a comfortable ride while allowing for the significant returns that small-cap firms may be better poised for.

FAQs

What is the Russell Index 2000?

The Russell 2000, often regarded as the benchmark for smaller U.S. stocks, is one of the most popular indexes that does not cover significant corporations.

Which companies are in the Russell 2000?

Companies in Russell 2000 are

- Crocs Inc. (CROX)

- Ovintiv Inc. (OVV)

- Tetra Tech Inc (TTEK)

- Lattice Semiconductor (LSCC)

- Intella Therapeutics Inc (NTLA)

- Avis Budget Group Inc (CAR)

- Silicon Laboratories Inc (SLAB)

- Macy’s Inc (M)

Is Russell 2000 a major index?

Russell 2000 is one of the most watched and followed indexes in the USA.

When should you invest in Russell 2000?

The Russell 2000 exposes investors to the greater risk and greater reward of small-cap investing without disclosure to anyone firm or industry because of its broad exposure.