What is the S&P 500 index? All you need to know

What financial barometer would you use to gauge the economy’s health if you had to choose only one?

The S&P 500 is the de facto daily economic index in the United States. Even though the S&P 500 is given second billing in the financial press and receives little attention elsewhere, its significance is critical.

Let’s learn about the S&P 500 in this article.

What is the S&P 500?

The S&P 500 is a stock market index that tracks the stock prices of 500 of the country’s top publicly traded corporations. It covers corporations from 11 industries to represent the stock market’s and economy’s health in the United States.

The S&P 500, often known as the Standard & Poor’s 500 Composite Stock Price Index – is one of the most used indices for tracking the performance of U.S. equities.

What companies make up the S&P 500, and how does the index stack up?

Companies need to meet some criteria in order to be in the index.

- Have a market capitalization of at least $8.2 billion, which refers to the total value of the company’s outstanding shares.

- Be based in the United States.

- Assume the form of a corporation and issue common stock.

- Be listed on a U.S. exchange that qualifies. (REITs, or real estate investment trusts, are eligible for inclusion.)

- Have positive as-reported earnings in the most recent quarter and during the last four quarters combined?

Due to this criterion, only the largest and most stable firms in the country can be included in the S&P 500. The list is re-evaluated and updated every quarter.

The index tracks the market capitalization of the businesses in the S&P 500 index. The entire value of all shares of stock issued by a corporation is its market cap.

It is calculated by multiplying the stock price by the number of shares issued. A corporation having a market capitalization of $200 billion will be represented twenty times as much as a company having a market capitalization of $10 billion.

As of January 2022, the S&P 500 had a cumulative market cap of $34 trillion.

Top 10 constituents by index weight in the S&P 500

| Company | Stock Ticker | Sector |

| Microsoft Corp. | MSFT | Information Technology |

| Apple Inc | AAPL | Information Technology |

| Amazon.com Inc | AMZN | Consumer Discretionary |

| Facebook Inc A | FB | Communication Services |

| Alphabet Inc A | GOOGL | Communication Services |

| Alphabet Inc C | GOOG | Communication Services |

| Johnson & Johnson | JNJ | Healthcare |

| Berkshire Hathaway B | BRK.B | Financials |

| VISA Inc A | V | Information Technology |

| Proctor and Gamble | PG | Consumer Staples |

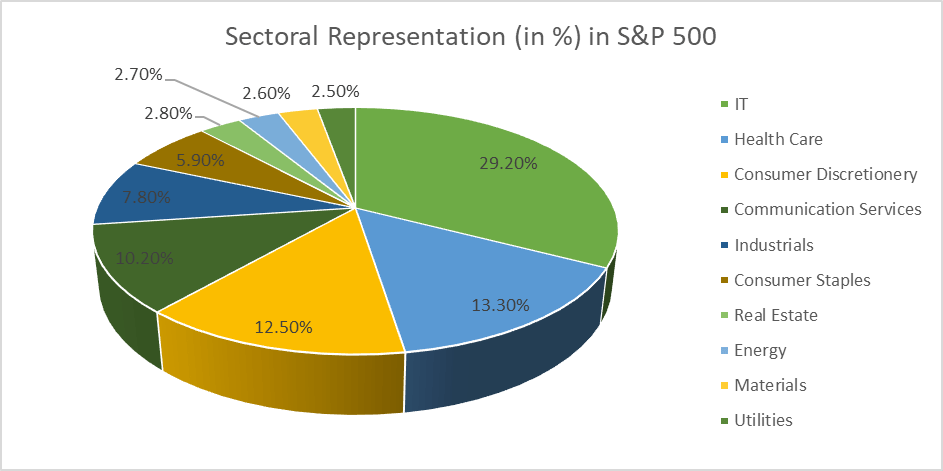

The S&P 500 sector breakdown as of January 2022 included

The S&P index performance

Without adjusting for inflation, the average yearly rate of return of the S&P 500 (that comprises dividends) has been around 10% for nearly a century.

However, keep in mind that this does not guarantee a yearly return of 10% on an S&P 500 index fund.

S&P 500 milestones

The table below depicts several S&P 500 milestone events, including highs and lows and memorable occasions.

| June 4, 1968 | 100.38 | First time above 100 |

| Oct. 19, 1987 | 224.84 | Black Monday |

| March 24, 1995 | 500.97 | First close above 500 |

| Feb. 2, 1998 | 1,001.27 | First close above 1,000 |

| Oct. 9, 2007 | 1,565.15 | Highest close before the financial crisis |

| Oct. 13, 2008 | 1,003.35 | Largest % gain of 11.6% |

| Aug. 26, 2014 | 2,000.02 | First close above 2,000 |

| Sept. 21, 2018 | 2,929.67 | New record high |

| Feb. 19, 2019 | 2,779.76 | New record high |

| July 12, 2019 | 3,013.77 | First close above 3,000 |

| March 12, 2020 | 2,480.64 | Largest % decline since Black Monday entered bear market |

| March 23, 2020 | 2,237.40 | Stock crash low |

| August 18, 2020 | 3,389.78 | New record high end of a bear market |

| August 28, 2020 | 3,508.01 | Closes above 3,500 |

| April 1, 2021 | 4,019.87 | Closes above 4,000 |

| Oct. 13, 2021 | 4,519.63 | Closes above 4,500 |

How to invest in the S&P 500 index?

You don’t have to buy all 500 stocks in the S&P 500 to invest in the index. Investors can also trade in individual equities directly.

Investors can choose from various index funds and exchange-traded funds (ETFs). These funds track the S&P 500 index’s performance this is, in fact, one of the most effective strategies for novice investors to get their toes wet in the financial markets.

Some popular S&P 500 index funds

- Vanguard 500 Index Investor Shares (VFINX)

- Fidelity 500 Index Fund (FXAIX)

- Schwab S&P 500 Index Fund (SWPPX)

- T. Rowe Price Equity Index 500 Fund (PREIX)

Some popular S&P 500 ETFs

- SPDR S&P 500 ETF (SPY)

- iShares Core S&P 500 ETF (IVV)

- Vanguard S&P 500 ETF (VOO)

- SPDR Portfolio S&P 500 ETF (SPLG)

FAQs

What is the S&P 500 in simple terms?

S&P 500, or Standard and Poor’s 500, is a stock market index that tracks 500 large companies listed on stock exchanges in the United States. It is one of the most commonly followed equity indices.

What is the S&P 500 and how does it work?

S&P 500 is one of the most commonly followed equity indices in the United States. The index tracks 500 large companies listed on the stock exchanges. The S&P 500 is a free-floated weighted index. It is calculated by multiplying the stock price by the number of shares issued.

What is the difference between S&P 500 and S&P 500 index?

The S&P 500 index and the total stock market index fund represent US stocks only. While S&P 500 index tracks only large-cap stocks, the total stock market index includes small, mid and large-cap stocks.

What does S&P 500 index include?

The S&P 500 is a stock market index that tracks the stock prices of 500 of the country’s top publicly traded corporations. It covers corporations from 11 industries to represent the stock market’s and economy’s health in the United States.

Consult an expert advisor to find the right plan for you

recommended reading

10 Reasons Why You Should Study in the USA

4 essential tips on investing in your child's education

4 W’s of Balanced Advantage Funds

5 financial things to consider before child planning.

5 investment plans every parent should have

5 reasons why SIP is the best investment choice?

5 tips to know before investing in US stocks

5 top investments for risk-averse investors