Why is the market falling ahead of the budget?

Look at the market fluctuations as your friend rather than your enemy; Profit from folly rather than participate in it.”

Warren Buffet

Market falling or fluctuation is extremely common. The market (NIFTY50 Index) has corrected by 6.31% from its recent peak of 18350 (17th Jan 2022) to 17149 (25th Jan 2022) & 7.82% from its all-time high of 18604 (19th Oct 2021).

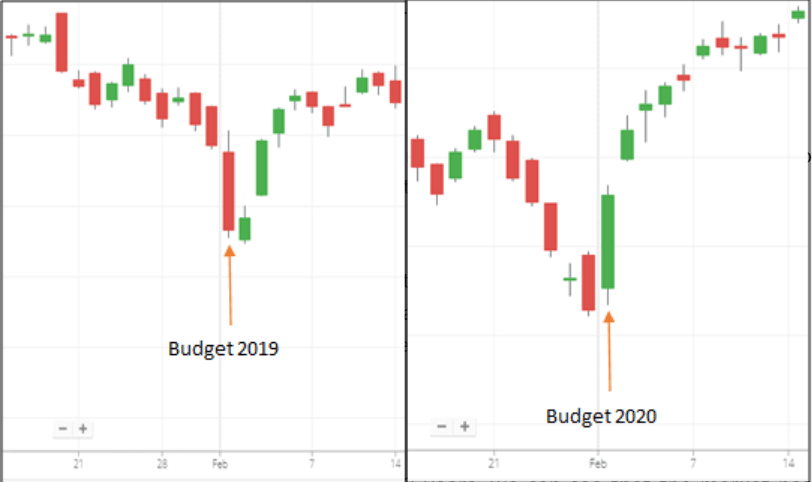

Market movement for 15 days before & after the budget

Decoding the charts

The EduFund Research Team has performed the study to determine the reason for the recent fall in the markets and here’s what they came up with.

Reasons for the fall

- Tightening of monetary policy by the US Fed department

- Lower than expected results of major corporates

- Tension on the borders of Ukraine-Russia

How the fall affects you?

According to Nifty50’s data for the past 2 years, we can see that the market has fallen by 6.56% in 2020 and 7.83% in 2021, just before the budget.

And after these falls, the market rebounded 5.32% & 13.49% in 2019 & 2020 – in a short time frame from the correction.

This means that there is actually no need to be worried about the fall in the market. After the budget, we could see a positive movement in the market.

We believe such correction/volatility in the market is a great time for long-term investors.

Make the most of the recent market fluctuations

These short-term market fluctuations and volatility actually provide a good entry point in an otherwise rising market.

Also, if you are an investor investing through the SIP route, you should not panic about these volatile situations.

Instead, let the rupee cost averaging work in your favor by topping up a lump sum during this time. India is currently trading at a PE of 24.84 (Median – 20.45).

Take a look at some of the top funds you can invest in

| Fund Name | Category | Annualized Returns (3-Years) | Risk |

| ICICI Prudential Corporate Bond Direct-Growth | Corporate Bond | 8.19% | Low |

| Tata Hybrid Equity Direct Growth | Hybrid | 15.28% | Average |

| Mirae Asset Large-cap Fund Direct-Growth | Large-cap | 18.61% | Moderately High |

| DSP Flexi-cap Fund Direct Growth | Flexi-Cap | 23.02% | High |

FAQs

What is the reason of market going down?

- Tightening of monetary policy by the US Fed department

- Lower than expected results of major corporates

- Tension on the borders of Ukraine-Russia

How the fall affects you?

According to Nifty50’s data for the past 2 years, we can see that the market has fallen by 6.56% in 2020 and 7.83% in 2021, just before the budget.

And after these falls, the market rebounded 5.32% & 13.49% in 2019 & 2020 – in a short time frame from the correction.

Should you stop your investments during market fluctuations?

Yes, it is important to check on your investments when market fluctuates but stopping and/or pausing depends on the type of investment and the effect of the market on the industry. Consult your financial advisor before making changes to your portfolio.

Consult an expert advisor to get the right plan

recommended reading

10 Reasons Why You Should Study in the USA

4 essential tips on investing in your child's education

4 W’s of Balanced Advantage Funds

5 financial things to consider before child planning.

5 investment plans every parent should have

5 reasons why SIP is the best investment choice?

5 tips to know before investing in US stocks

5 top investments for risk-averse investors