Why should you invest In ELSS funds?

If you don’t find a way to make money while you sleep, you will work until you die.”

Warren Buffet

Many people view saving and investing as the same thing. But they are not. You need to find a way to invest your money so that your money can work for you.

There are many reasons to invest like planning for retirement, planning for your child’s education, planning to bear inflation, or could be to save tax & create wealth, etc.

Let’s see what the reason for investing could be:

- Financial Security – In the first place, people want to be financially secure so that they can protect themselves from unanticipated financial hardship.

- Financial Independence – Your investments allow you to have financial independence as you reach retirement.

- Building Wealth – People invest to create wealth from the process of saving and then investing the savings.

- Attaining Any Specific Goal – Some people invest to achieve specific goals like child education.

You should always consider long-term investing to minimize your risk and let compounding work for you.

Why should you invest in ELSS?

There are many investment instruments available in the market to save taxes like ELSS (Equity Linked Savings Scheme), PPF (Public Provident Fund), NSC (National Savings Certificate), and Tax Savings Fixed Deposits (FD).

But there are many reasons to invest in the ELSS fund. ELSS fund is an effective way to create wealth and to save tax at the same time under one roof. ELSS funds are professionally managed funds.

ELSS funds invest in equity and equity-related securities. ELSS is the only mutual fund class that is eligible for a tax deduction.

You can save up to ₹46,800 /- (tax deduction up to ₹1,50,000/-) in a financial year by investing in ELSS, which is covered under Section 80C of the Income Tax Act,1961.

However, you can invest more than the designated amount; but there will be no tax benefit over ₹1.5 lac.

Let’s see what are the benefits of investing in ELSS:

- Shorter Lock-In Period – ELSS has a short lock-in period of 3 years. Unlike the PPF, NSC & Tax Saver FD, all of which require a 5-15-years lock-in period.

- High Returns – ELSS funds invest predominantly in equity and equity-related securities; the returns are higher than the other investment options with tax benefits. Historical returns show 12%-15% p.a. Higher returns will also help beat inflation.

- Flexibility – There are two ways to invest in ELSS funds – SIP & Lumpsum. If you cannot invest in Lumpsum, then you can consider going with the SIP option.

Comparison between ELSS vs PPF vs Tax Saver FD vs NPS

| Investment | ELSS | PPF | NSC | Tax Saver FD |

| Lock-in | 3 Years | 15 Years | 5 years | 5 Years |

| Annual Returns | Market-linked, historical returns show 12%-15% | 7.10% | 6.80% | 6.00% |

| Risk | Market-related risk | Low risk | Low risk | Low risk |

| Minimum Investment | ₹ 500 | ₹ 500 | ₹ 1,000 | ₹ 100 |

| Tax Benefit | Yes | Yes | Yes | Yes |

| Maximum Deduction | ₹ 1,50,000 | ₹ 1,50,000 | ₹ 1,50,000 | ₹ 1,50,000 |

| Premature/Partial Withdrawal | Not Allowed | Allowed only after 5th Year | Under only special circumstances | Not Allowed |

| Taxation on Returns | LTCG Applicable | Tax-Free | Tax Applicable | TDS Applicable |

ELSS of the Month 2023: Mirae Asset Tax Saver Direct Plan-Growth

Objective

The investment objective of the scheme is to generate long-term capital appreciation from a diversified portfolio of predominantly equity and equity-related instruments. The scheme does not guarantee or assure any returns.

Performance

| Trailing Returns % | Fund | Benchmark | Category |

| 3 Years Annualized | 26.71 | 20.15 | 18.29 |

| 5 Years Annualized | 24.01 | 18.18 | 16.61 |

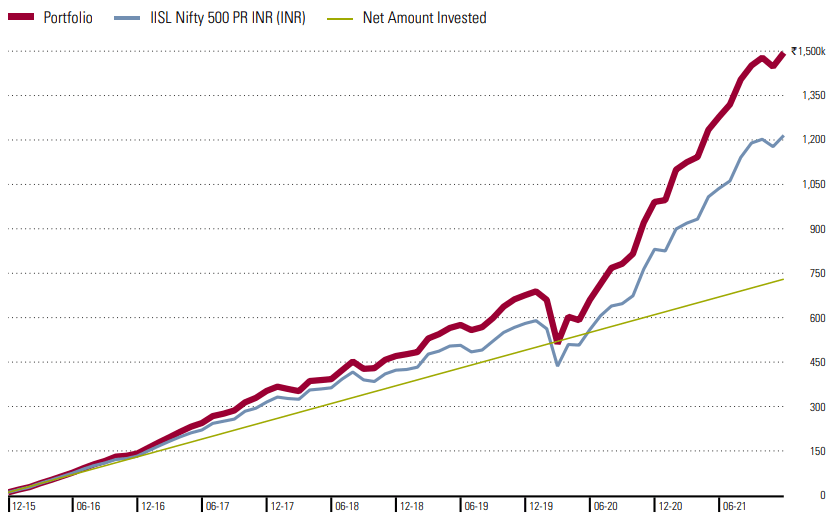

| Invested | Returns | Accumulated | Annualized Return (XIRR) | Cumulative Return |

| ₹ 7,30,000 | ₹ 7,64,439 | ₹ 14,94,439 | 23.99% | 264.48% |

Note: Considering investing 10,000/month from Dec’15 to Dec’22

Suitability – For any investor looking to save tax on income through investment in the mutual fund.

Risk – High risk, as returns are totally dependent upon market risk. Returns are not guaranteed.

FAQs

Why should you invest?

Financial Security – In the first place, people want to be financially secure so that they can protect themselves from unanticipated financial hardship.

Financial Independence – Your investments allow you to have financial independence as you reach retirement.

Building Wealth – People invest to create wealth from the process of saving and then investing the savings.

Attaining Any Specific Goal – Some people invest to achieve specific goals like child education.

Why should you invest in ELSS?

ELSS fund is an effective way to create wealth and to save tax at the same time under one roof. ELSS funds are professionally managed funds.

ELSS funds invest in equity and equity-related securities. ELSS is the only mutual fund class that is eligible for a tax deduction.

Which is the best ELSS fund for 2023?

ELSS of the Month 2023: Mirae Asset Tax Saver Direct Plan-Growth

Conclusion

When we have the best investment vehicle available to save tax then, why do we need to run for conventional tools to save tax?

Every investor has a different risk appetite, but if anyone is ready to hold their investment for 15 years in an instrument like PPF then, he/she should consider investing in the ELSS funds that tend to give greater returns in the long term.

Disclaimer

Mutual fund investments are subject to market risks. The previous performance of any fund is no guarantee of similar future performance. Please read the offer document carefully before investing.

recommended reading

10 Reasons Why You Should Study in the USA

4 essential tips on investing in your child's education

4 W’s of Balanced Advantage Funds

5 financial things to consider before child planning.

5 investment plans every parent should have

5 reasons why SIP is the best investment choice?

5 tips to know before investing in US stocks

5 top investments for risk-averse investors