Ultimate Guide: SIP plans for child education in India

Education has become very expensive in India. SIP plans for child education are the solution! Statistics show that educational inflation is around 11% in the country today, and the cost of education is expected to soar in the future.

A report by the National Sample Survey Office (NSSO) during the period of 2008-14 stated that the annual cost of education burgeoned by 2.75 times when compared to 2008, whereas the per-capita income had only increased by 2.49 times, indicating the mismatch in the income growth and the increase in the cost of education.

High tuition fees coupled with the difficulty of paying bills and staying independent cause highly qualified and bright minds to even refrain from applying to colleges.

Tuition rates are increasing all over the world and are rising faster than the growth in per capita income.

Looking at these expenses from an exchange rate perspective, rupee owners will always have a disadvantage in terms of the cost of overseas education due to our country’s current account balance, relative interest rates, and inflation which cause a weakening of the Rupee.

In the near future, the trend would continue hence ballooning the fees even further. Investing is a mantra that can be followed to rise above the tide of this soaring educational inflation.

A wealthy corpus is accumulated and the effects are more prominent when the investor starts saving at an earlier stage owing to the compounding effect.

- What is SIP?

- Reason to invest in Mutual Fund Scheme for child education

- 5 Benefits of SIP Plans for Child Education

- Tax benefits of Mutual Fund Scheme for a child’s future

- Top 10 SIP plans (mutual fund scheme) for child education

- Mistakes to avoid while investing in SIP plans

- Which mutual fund scheme should you choose?

- SIP calculator online for child education plans

- How to choose a mutual fund scheme for child education?

- How to invest in SIP plans for child education on the EduFund App?

What is SIP?

SIP is a Systematic Investment Plan. It is a facility offered by mutual funds to investors to invest in a fund properly. With a SIP facility, investors can invest a fixed amount of money in pre-defined intervals.

SIP is the perfect method of investment for newcomers and risk-averse investors – it allows you to participate in the market without timing it or worrying about its highs & lows.

Note that the fixed amount of money can be as low as INR 500. The SIP route to investment is necessary as it helps you to invest in a time-bound manner.

There is no need to worry about market dynamics when you are investing via SIPs.

Reason to invest in Mutual Fund Scheme for child education

1. Reduce the financial burden

This forms a habit of investment discipline by debiting a fixed amount from your bank account at every periodic interval. This also prevents a lump sum or a sudden outflow of money from your pocket, hence maintaining financial stability.

2. Start investing in small amounts

Most SIPs start at a minimal amount of Rs 500, which enables the investors to save for their child’s future – one penny at a time.

3. Rupee cost averaging

By investing through SIP, one can also benefit from rupee cost averaging – where the cost of purchasing a unit of the fund is averaged over the time horizon thus protecting its investors from volatile market conditions and price fluctuations.

4. Compounding effect

Investors also benefit from the compounding of returns, where the returns earned on the invested capital are re-invested into the fund.

Best SIP Mutual Funds

5 Benefits of SIP Plans for Child Education

1. Compounding can help you become financially stable

SIP helps everyone make the best of their savings and lets one make the most of compounding. Compounding is when the initial interest earned on your investment starts earning interest over the years.

It helps people with small sums of money generate a sizeable amount over the years.

Compounding is a great way to meet your financial goals and retire with a healthy sum of money in your pocket.

2. Make the most of rupee cost averaging

Staying invested for long and consistently have its benefits. This benefit is called rupee cost averaging when your overall investment is protected from market fluctuations.

3. A common’s man way of investing

SIP is a method that is suitable for every investor. Whether you are a seasoned or a new investor, you can start a SIP and invest in funds that can help you with your financial goals.

It is a common’s way of ensuring their future and helps them invest small sums of money.

4. SIP can help you stay financially disciplined

SIP makes investing easier and affordable for everyone. It is an EMI for your future funds and helps you consistently contribute to it.

You can set up an auto-debit from your account so that you continue to invest. SIPs can be paused and even stopped based on your needs.

It is a great way to contribute towards your financial goals without worrying yourself out.

5. SIP can be as little as Rs. 100

You can start a SIP for Rs. 100 or even Rs. 500. The choice is yours! Based on your needs and financial goals, your investment can be as little or as big as you want.

You can gradually increase your SIP investments. Some mutual funds offer a Step-up option above a certain investment amount which means that as your salary grows, you can increase your investments as well.

How does the SIP calculator work?

Tax benefits of Mutual Fund Scheme for a child’s future

There are certain benefits when you invest via SIP. Starting a SIP in a tax saving like ELSS. This tax-saving fund has certain tax benefits. It also has a lock-in period of three years.

SIP plans in an ELSS fund from April to March (financial year) are eligible for Section 80C benefits for that fiscal year up to Rs.1.50 lakhs.

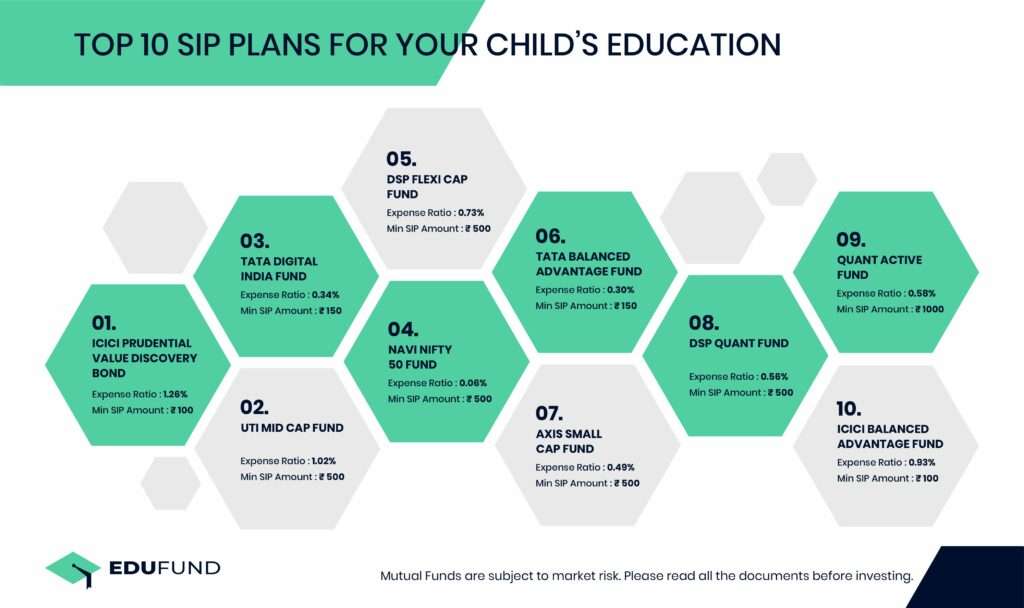

Top 10 SIP plans (mutual fund scheme) for child education

| Scheme Name | 1-Yr Return | AUM | Pros | Cons |

| Aditya Birla Sun Life Frontline Equity Fund Expense Ratio: 1.08% Min SIP Amount: Rs 100 | 14.85% | Rs 18,897.76 Cr | Lower expense ratio | Assets Under Management (AUM) of the fund are greater than Rs 15,000 Cr. When a fund crosses a certain AUM threshold, the returns from the fund tend to decrease or stagnate. The investors should monitor the performance |

| Axis Long Term Equity Fund Expense Ratio: 0.72% Min SIP Amount: Rs 500 | 14.85% | Rs 28,556.83 Cr | Fund has higher 3-year and 5-year returns as compared to the category average. ELSS fund – Tax haven for 80C | Assets Under Management (AUM) of the fund are greater than Rs 20,000 Cr. When a fund crosses a certain AUM threshold, the returns from the fund tend to decrease or stagnate. Investors should monitor their performance. |

| Parag Parikh Flexi Cap Fund Expense Ratio: 0.96% Min SIP Amount: Rs 1000 | 21.11% | Rs 8,701.65 Cr | Fund has higher 1-year, 3 years, and 5-year returns as compared to the category average. Low expense ratio. | None |

| SBI Equity Hybrid Fund Expense Ratio: 0.97% Min SIP Amount: Rs 500 | 12.20% | Rs 38,080.12 Cr | Fund has higher 1year, 3-year, and 5-year returns as compared to the category average. Low expense ratio. | Assets Under Management (AUM) of the fund is greater than Rs 20,000 Cr. When a fund crosses a certain AUM threshold, the returns from the fund tend to decrease or stagnate. Investors should monitor their performance. |

| SBI Focused Equity Fund Expense Ratio: 0.97% Min SIP Amount: Rs 500 | 13.08% | Rs 14,533.37 Cr | Fund has higher 3-year 5 year and 10-year returns as compared to the category average. The fund has been in the market for over 10 years. | High expense ratio |

| Axis Bluechip Fund Expense Ratio: 0.55% Min SIP Amount: Rs 500 | Rs 25,134.85 Cr | Fund has higher 1-year 3-year and 5-year returns as compared to the category average. The expense ratio is on the lower end and the fund has no lock-in period. | Assets Under Management (AUM) of the fund are greater than Rs 20,000 Cr. When a fund crosses a certain AUM threshold, the returns from the fund tend to decrease or stagnate. Investors should monitor their performance. | |

| L&T Midcap Fund Expense Ratio: 0.77% Min SIP Amount: Rs 500 | 67.18% ( 3 year = 7.25%) | Rs 6,258.04 Cr | Fund has higher 5-year returns as compared to the category average. The expense ratio is on the lower end. | Assets Under Management (AUM) of the fund are greater than Rs 5,000 Cr. When a fund crosses a certain AUM threshold, the returns from the fund tend to decrease or stagnate. Investors should monitor the performance. |

| HDFC Mid-Cap Opportunities Fund Expense Ratio: 1.04% Min SIP Amount: Rs 500 | 75.85% ( 3 year = 7.94%) | Rs 25,779 Cr | Fund has higher 5-year returns as compared to the category average. The expense ratio is on the lower end | Assets Under Management (AUM) of the fund are greater than Rs 5,000 Cr. When a fund crosses a certain AUM threshold, the returns from the fund tend to decrease or stagnate. Investors should monitor their performance. |

| Axis Small Cap Fund Expense Ratio: 0.38% Min SIP Amount: Rs 500 | 74.30% (3 year = 17.37%) | Rs 4,724.14 Cr | Fund has higher 3-year and 5-year returns as compared to the category average. The expense ratio is on the lower end | None |

| HDFC Small Cap Fund Expense Ratio: 0.95% Min SIP Amount: Rs 500 | 94.91% (3 year = 5.88%) | Rs 10,024.44 Cr | Fund has higher 3-year and 5-year returns as compared to the category average. The expense ratio is on the lower end. | Assets Under Management (AUM) of the fund are greater than Rs 5,000 Cr. When a fund crosses a certain AUM threshold, the returns from the fund tend to decrease or stagnate. Investors should monitor their performance. |

Mistakes to avoid while investing in SIP plans

Here are some SIP plan mistakes that you should avoid as a new investor:

1. Investing in the wrong fund

The most basic mistake in picking SIP plans is to invest in the wrong fund. This usually occurs when an investor is new and invests based on a friend’s advice or hearsay.

It’s important to do your own research, find out the fund house’s previous performance, and the companies listed in the fund, and study its overall progress before starting any SIP plans.

It’s best to consult a professional before starting on this journey.

2. Investing a huge amount

Many investors start strong but end up regretting it. Entering the market can be exciting and thrilling but you have to be careful where you are investing your hard-earned money towards.

When picking up SIP plans, it is important to choose an amount you are comfortable spending and can consistently pay over the next couple of years to get the best returns possible.

3. Only for small investors or new investors

This is a huge mistake while investing in SIP plans. Anyone can invest in SIP plans.

Whether you are a financial advisor or a risk-averse investor, you can start a SIP for any amount and invest regularly. That is the beauty of SIP, it allows you to stay invested for a long at your own terms.

4. It is considered a short-term Investment

SIP is not a short-term investment or a purely long-term investment method.

It acts as both, the investor can decide how long they wish to stay invested, increase or decrease their SIP amount and even aim for big financial goals like a child’s education or retirement via SIP plans.

5. Not using the step-up SIP option

Many investors do not increase their SIP amount and continue to invest at the same pace for a long duration. This is a huge mistake when selecting SIP plans and investing in them.

As your income increases, it is important to increase your investments and SIP plan amount so that your financial goals are met in time and smoothly.

Which mutual fund scheme should you choose?

Selecting the funds that are tailored to your investment requirement time horizon, income, target corpus, and risk appetite is the first critical step that you should take as a parent investing in your child’s education.

One could start by investing in one fund and then diversifying to 2 or 3 funds by proportionately investing across the schemes.

You should ideally aim for a smaller proportion of investments in small and mid-cap funds which bring in high returns (along with high volatility) and balance them with large-cap funds that have stable returns (lower than small and mid-cap).

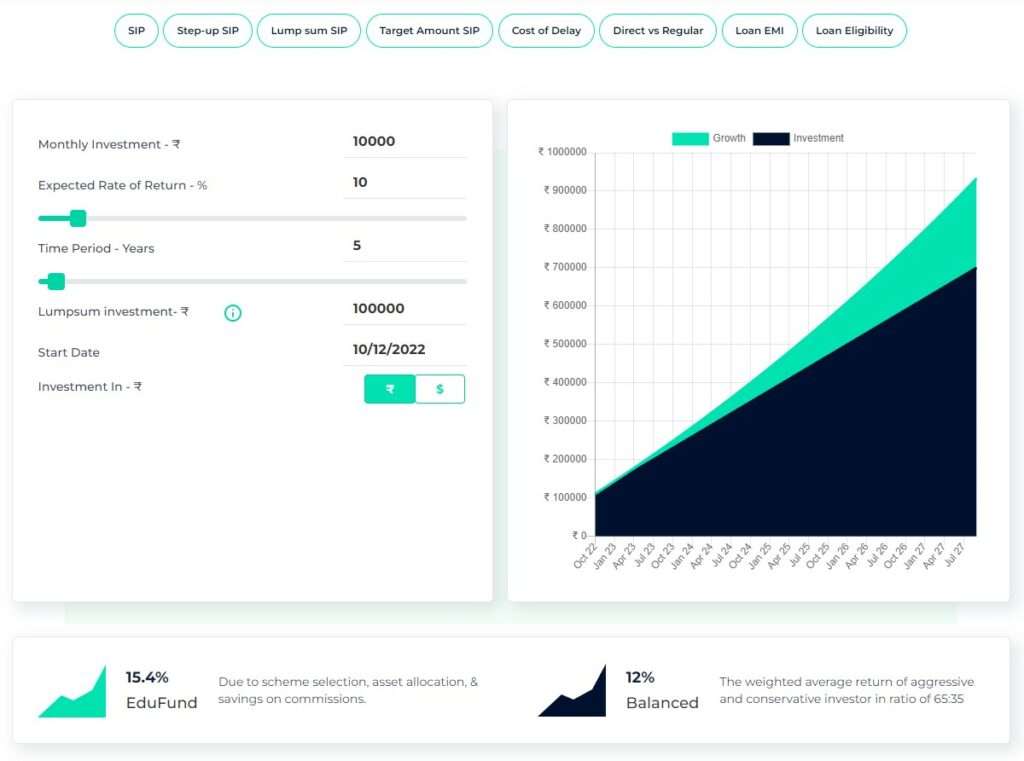

SIP calculator online for child education plans

SIP calculator allows users to calculate and plan for child education. Users can calculate SIP over a period of time even before they start the investment process. SIP interest is based on compound interest.

Just enter the amount you wish to invest and calculate your SIP.

How to choose a mutual fund scheme for child education?

Choosing SIP plans depends on your financial goals. Ask yourself certain questions:

- What are your long-term goals?

- What are your short-term goals?

- How much money do you wish to save for your retirement?

- How much money can you save monthly and invest?

You can also consult a financial advisor who can help you create a financial plan to save for multiple goals and that can help you meet your daily wants and needs.

How to invest in SIP plans for child education on the EduFund App?

Step 1: Download and Sign up with EduFund

Go online with SIP plans with EduFund. Download the application and sign up with personal details. The whole signup process takes just 3 seconds.

Step 2: Identify your financial goals

The application provides a gamut of options for your child’s education. Evaluate the goal.

You can save for short-term or long-term goals such as saving for school fees and saving for higher education in India or overseas.

You can save for both simultaneously as well!

Step 3: Calculate the total cost with a FREE calculator

After identifying the goals, calculate the total costs of higher education for undergraduate or postgraduate studies.

You could calculate basing National or International academic education expectations. Select the specialization and the country you are seeking higher education.

Step 4: Get your investment map and invest

Soon after filing the details, you will get how much you could get after investing for the respective number of years. You will get a number of SIP plan suggestions that you could compare with yours.

You could increase or decrease the sum to invest monthly as per financials.

We provide an overview of your savings transitioning into returns until you get the investment sum. You could go for a lump sum payment if you are an entrepreneur with unstable finances.

Place the order as a secured investment through UPI or other methods. You could start with just ₹100 in Edufund SIP investments.

Step 5: Track, revisit and reset goals anytime

Once you set up a SIP plan, you can edit goals according to the revised economic situation. Edufund captures the sensitivity that comes with finances.

Revisit the plan and modify it as per goals and finances. You will get a new investment plan with new goals. Plan your savings accordingly.

Conclusion

A financial strategy for your child’s education is an absolute necessity, given the high educational inflation that is prevailing in the world today.

The strategy should factor in your income, target corpus, investment horizon, and risk appetite.

Starting early in terms of investments lowers the financial burden in the future and helps you pave the path for your child’s dream career.

There is no appropriate or right time to start investing in your child’s education because the right time is now.

Note – The past track record of a fund is no guarantee of its future performance.

FAQs

Is SIP good for child education?

A SIP is a great way to save for your child’s education.

You have the flexibility to select the amount and invest regularly in your chosen funds. You can also redraw the money when you need it or pause the SIP if you wish to do so.

SIP is a systematic and disciplined way to save for your child’s future education.

Which mutual fund is best for child education?

Here are the top mutual funds that offer SIP for your child’s education:

- Aditya Birla Sun Life Frontline Equity Fund

- Axis Long-Term Equity Fund

- Parag Parikh Flexi Cap Fund

- SBI Equity Hybrid Fund

- SBI Focused Equity Fund

Can I open a SIP for my child?

Yes, you can start a SIP for your child. Download the EduFund App and select the funds you like and start investing.

How can invest in SIP for kids?

Explore several saving options on the EduFund app to save for your child’s future. Select the funds that suit your risk appetite and your goals. Invest an amount you are comfortable with and start saving!

Which SIP is best for kids?

Here are some mutual funds that offer SIP investments starting at Rs. 100 or Rs. 500:

- Aditya Birla Sun Life Frontline Equity Fund

- Axis Long-Term Equity Fund

- Parag Parikh Flexi Cap Fund

- SBI Equity Hybrid Fund

- SBI Focused Equity Fund

Is a long-term SIP risky?

Investing in SIP for the long term is highly effective and has lesser risk compared to making a lumpsum investment in mutual funds.

What is the best age to start a SIP?

There is no right age to start a SIP. A systematic investment plan is a great tool to save for your child’s education. As many experts suggest, it is always beneficial when you have a long investment horizon, as it reduces the SIP amount needed to reach your goal. You need to invest early to have a long investment tenure. Investing early also may increase your returns on investment.

Disclaimer

Mutual fund investments are subject to market risks and EduFund does not endorse any fund over another in this blog.

recommended reading