![]() Fall 2024 Scholarship: Get Up to $10K for Your Master's Abroad!

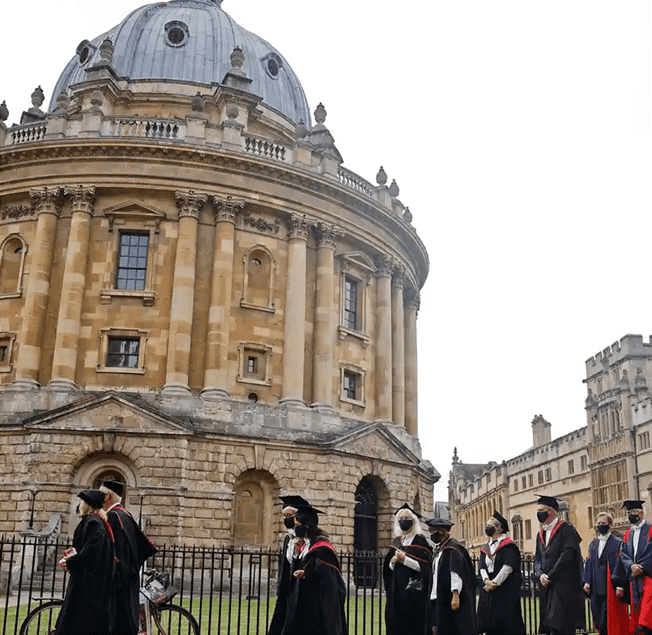

Fall 2024 Scholarship: Get Up to $10K for Your Master's Abroad!

![]() Fall 2024 Scholarship: Get Up to $10K for Your Master's Abroad!

Fall 2024 Scholarship: Get Up to $10K for Your Master's Abroad!

A degree that costs Rs.40 lakhs today, can cost approximately

Rs.80-90 lakhs in the future.

Find out exactly how much you will pay for college.

after Year

| Year | Amount Invested | Education savings |

|---|---|---|

| 2022 | ₹60,000 | ₹24,18,000 |

| 2023 | ₹60,000 | ₹32,59,000 |

| 2024 | ₹60,000 | ₹40,71,000 |

| 2025 | ₹60,000 | ₹52,98,000 |

| 2026 | ₹60,000 | ₹64,18,000 |

| Amount Invested | ₹36,84,360 | |

| Total Investments | ₹80,00,000 | |

Calculate

college

education cost

Start early

investments

Talk to Education

counsellors

Get quick

education loans

Graduate from

dream college

Find out much you need for college

Learn more

Financial plan to achieve this goal

Learn more

Get help with college applications

Learn more

Get low-interest education loans with top banks

Learn moreUse smart savings plans to invest in your child's future

Grow your savings, save on taxes, opt for low risk & create wealth

Learn more

Save in rupees to get dollar returns

Learn more

Buy and sell 24k Digital Gold of 99.9% purity at live market rates

Learn more

Grow your savings with advice from qualified advisors

Learn more

No hidden costs and zero commission to help you save on unnecessary fees

Invest smart and save up to 1% more with direct plans.

SEBI-registered investment advisors to help you invest easily & smartly

The best thing about the EduFund app is that it allows me to plan and save financially, and it also offers a counselling feature. With a customized investing strategy, I’m confident that I can secure my little one’s future!

What we needed is expert advice and guidance. Thankfully, we came across a unique app called EduFund. For my daughter’s future, they offered a personalized financial plan. Plus, it’s so simple to set up an education fund.

This app is a game-changer! Seamless investing experience with EduFund. The level of detail and focusgiven is excellent. I’d highly recommend this to Indian parents.

What sets edufund apart from others is it focuses mainly on every new parent's confusion on investing and saving for their kid's future. Not only is the app user friendly and detailed but they have a very friendly and informative staff to support and follow up. I have grown my knowledge and interest in investing

Education has become so expensive. I wanted to be prepared for my children's college fees when the time comes. EduFund has helped me in planning for both my kid's college.

Our Investment Packs:

17.64%

Above Average Risk

By EduFund Advisory Team

11.97%

Average Risk

By DSP Advisory Team

Get a low-interest education loan with our partners-

Axis and ICICI

Get a low-interest education loan with our partners - Axis and ICICI